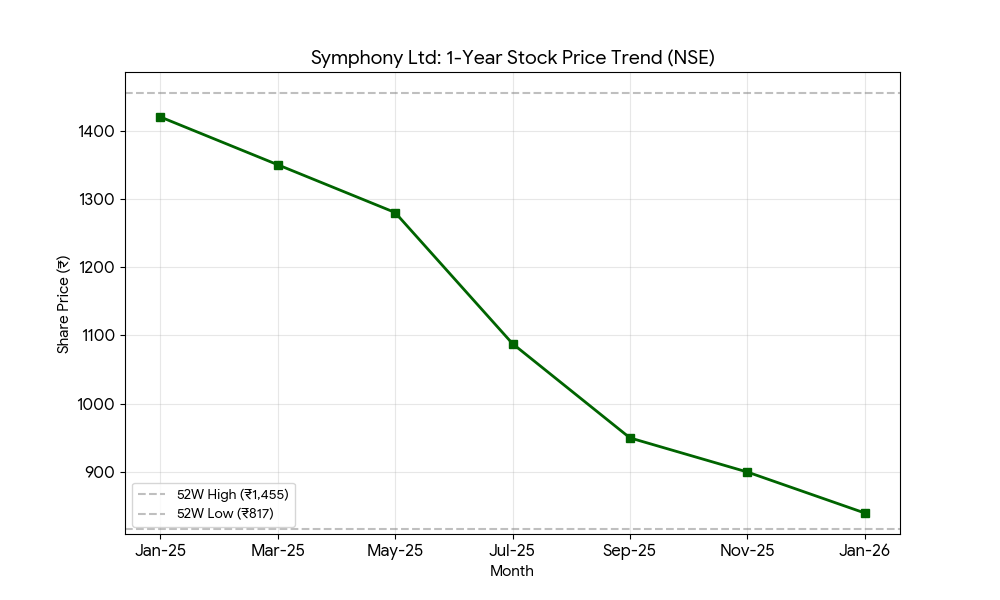

Symphony Ltd (NSE: SYMPHONY; BSE: 517385) shares traded at INR 839.80 at the market close on January 29, 2026, representing an intraday move of 1.45%. The stock performance follows the company’s release of its third-quarter financial results for the period ended December 31, 2025.

Market Capitalization

As of January 29, 2026, Symphony Ltd holds a market capitalization of INR 57.67 billion (approximately USD 690 million).

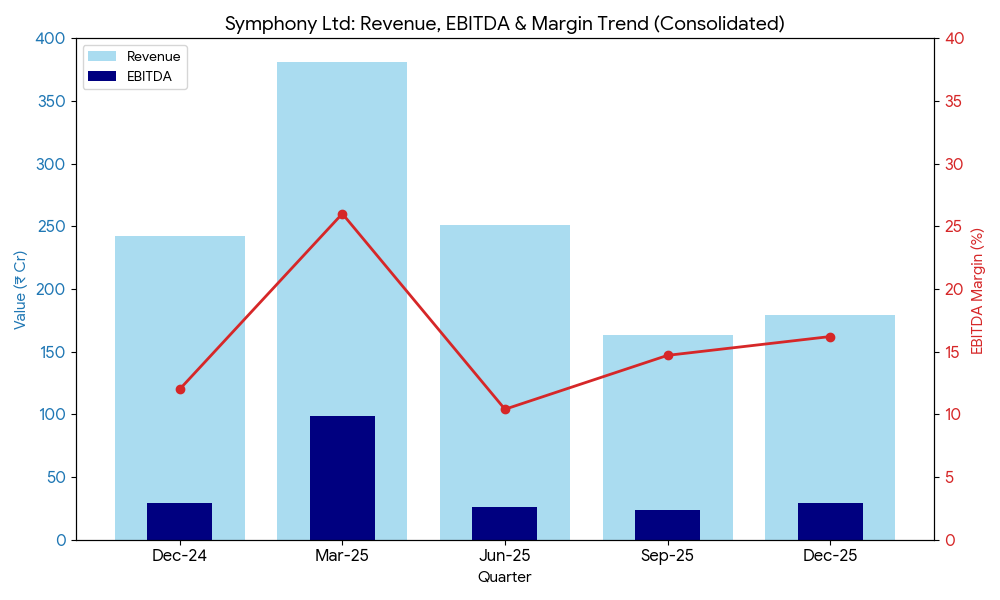

Latest Quarterly Results

For the third quarter (Q3 FY26), Symphony reported consolidated revenue from operations of INR 1.79 billion, a decline of 7.25% compared to INR 1.93 billion in the corresponding quarter of the previous year.

Consolidated net profit for the quarter stood at INR 200 million, down 85.07% from INR 1.34 billion reported in Q3 FY25. Earnings per share (EPS) for the period were INR 3.00, compared to INR 19.50 a year earlier.

Segment Highlights:

- India: Revenue from operations reached INR 1.59 billion.

- Rest of the World: Revenue contributed INR 200 million.

Nine-Month View

For the nine-month period ended December 31, 2025, Symphony reported total revenue of INR 5.93 billion, down from INR 8.75 billion in the prior year. Net profit for the same period stood at INR 810 million, reflecting a contraction from INR 1.34 billion in the nine-month period of FY25.

Business & Operations Update

The company recognized an incremental liability of INR 14 million during the quarter due to the implementation of New Labor Codes, effective November 21, 2025. Additionally, the company reported an exceptional recovery of INR 40 million from Pathways Retail Pvt Ltd. In management changes, Mr. Amit Kumar resigned as Executive Director and Group Chief Executive Officer; Chairman Achal Bakeri will assume these responsibilities during the transition.

M&A or Strategic Moves

The Board of Directors has formally rolled back the divestment process for its wholly owned subsidiaries, Climate Holdings Pty Ltd (Australia) and IMPCO S. de R.L. de C.V. (Mexico). The process, initiated in April 2025, was terminated as proposals did not align with the company’s valuation expectations and strategic requirements.

Equity Analyst Commentary

Institutional coverage following the results remains cautious. HDFC Securities maintain an “Add” rating with a price target of INR 1,150, while Anand Rathi maintains a “Buy” rating with a target of INR 1,194. Analysts highlighted the divergence between improved sequential margins and persistent year-on-year revenue declines as a primary area of focus.

Guidance & Outlook

The Board declared a third interim dividend of INR 2 per equity share for FY26, with a record date of February 3, 2026. Management has indicated that market conditions remain challenging, with industry-wide inventory overhangs in the air cooler segment. Regulatory shifts regarding labor codes and geopolitical factors influencing international subsidiaries are cited as key factors to watch.

Performance Summary

Symphony stock closed 1.45% higher at INR 839.80 today. The company reported a 7.25% decline in quarterly revenue to INR 1.79 billion and an 85.07% drop in net profit. The domestic India segment remains the primary revenue driver, contributing 89% of quarterly sales.