LTTS is an engineering services provider incorporated in 2012, offers engineering,, research and development (ER&D) and digitalization solutions to companies in the areas such as Transportation, Industrial Products, Telecom and Hi-Tech, Medical Devices and Plant Engineering. LTTS’ customer base includes 69 Fortune 500 companies and 53 of the world’s top ER&D companies. The business also provides digital engineering advisory services. The company went public on September 23, 2016. LTTS has 296 global clients in 25+ countries. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

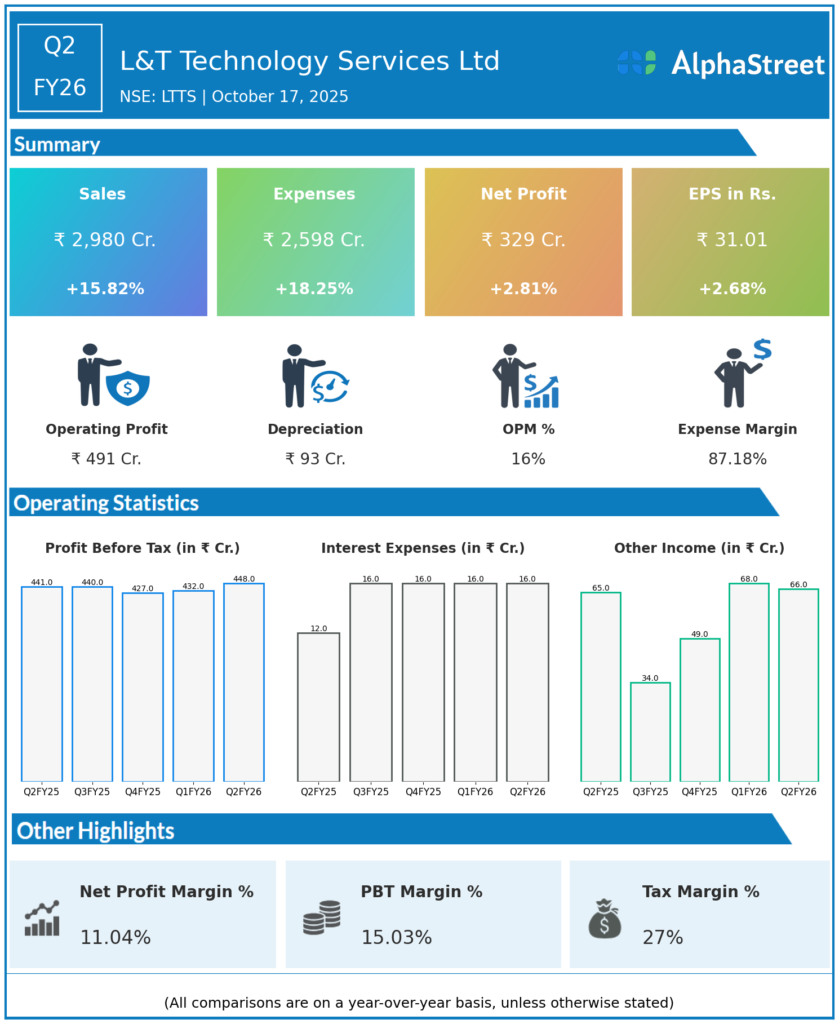

Revenue from Operations: ₹2,980 crore, up 15.8% YoY from ₹2,572.9 crore and up 4% QoQ from ₹2,866 crore.

EBIT: ₹398 crore, with an EBIT margin of 13.4%.

Profit Before Tax (PBT): ₹442 crore, up 3.8% QoQ.

Profit After Tax (PAT): ₹328.7 crore, up 2.85% YoY from ₹319.6 crore and up 4.1% QoQ from ₹315.7 crore.

PAT Margin: 11%, compared to 12.4% YoY.

USD Revenue: $337 million, up 10.4% in constant currency terms.

Employee Count: 24,090 as of Q2 FY26.

Total Contract Value (TCV): Record high near $300 million, the strongest ever for LTTS.

Interim Dividend: ₹18 per share; record date set as October 27, 2025.

Management Commentary & Strategic Highlights

Amit Chadha, CEO & Managing Director, stated:

“We delivered another quarter of strong revenue growth, driven by broad-based traction across segments. Our record TCV of $300 million and double-digit growth reaffirm our trajectory towards crossing USD 2 billion in annual revenue.”

Key operational and strategic priorities during Q2 FY26:

-

Large multi-year deal wins:

-

$100 million in the Sustainability (semiconductors) segment with a major U.S. equipment manufacturer.

-

$60 million in the Tech segment with a North American telecom firm.

-

Additional contracts in Transportation and MedTech verticals contributed to broad-based growth.

-

-

AI & Digital Engineering: Expanded proprietary platform development in PLxAI and Digital Twin ecosystems.

-

Leadership Expansion: Appointed new Chief Operating Officer to strengthen delivery transformation.

-

Geographic Mix: North America led growth (+14.4% YoY), with Europe showing resilience despite macro softness.

-

Outlook: Management reiterated FY26 target of crossing USD 2 billion revenue, buoyed by strong pipeline momentum and controlled cost base.

Q1 FY26 Earnings Results

Revenue from Operations: ₹2,866 crore, up 16.4% YoY from ₹2,464 crore.

EBIT Margin: 13.3%.

Profit After Tax (PAT): ₹315.7 crore, up 0.7% YoY.

USD Revenue: $335.3 million, up 13.6% YoY.

Employee Count: 23,626.

Patents Filed: 1,550 patents, including 952 co-authored with clients.

Large Deals:

-

1 deal worth $50 million,

-

3 deals between $20–30 million,

-

6 deals of over $10 million each.

Growth Drivers: Strong traction in Mobility and Sustainability segments.

AI Investments: Launch of PLxAI proprietary framework to accelerate the product development lifecycle through AI integration.

New Design Center: Opened in Plano, Texas for cybersecurity and AI-led engineering services.

Amit Chadha (CEO) emphasized that AI-driven design and digital manufacturing competencies are becoming core differentiators, while multi-vertical diversification continues to provide resilience amid cyclical demand shifts

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.