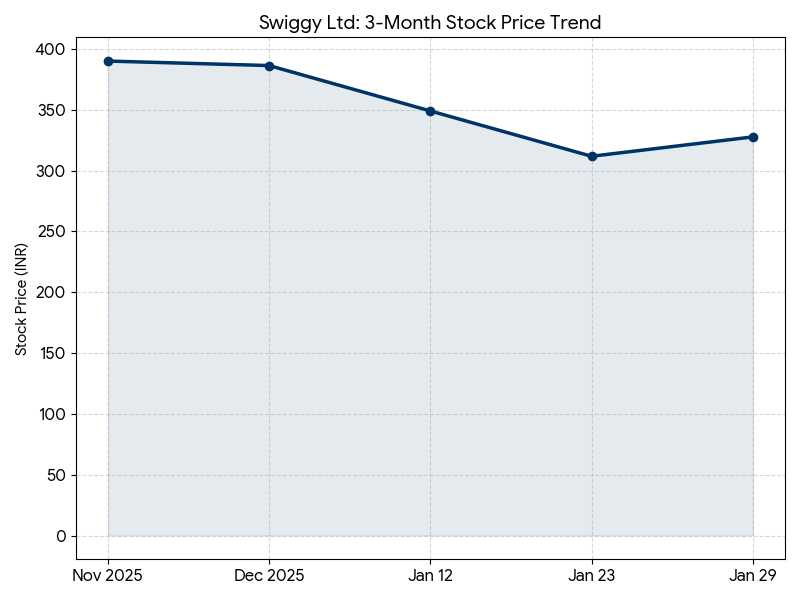

Swiggy Ltd (SWIGGY) shares traded at INR 324.05 on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) during today’s session, representing a 0.17% increase from the previous close of INR 323.50. The stock reached an intraday high of INR 330.50 and a low of INR 321.65. Total traded volume stood at 6,541,452 shares with a total traded value of INR 213.49 Crore.

Market Capitalization

As of today’s market close, the total market capitalization of Swiggy Ltd is approximately INR 89,392 Crore.

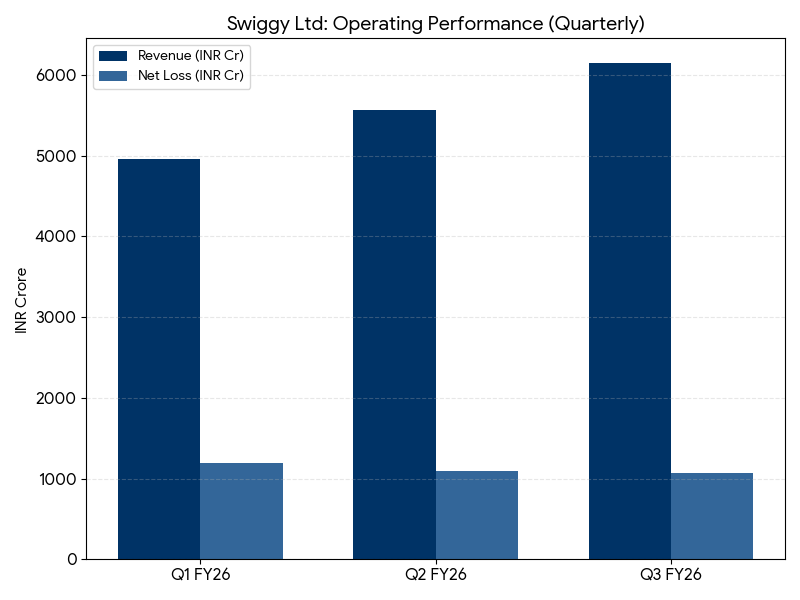

Latest Quarterly Results

For the third quarter ended December 31, 2025 (Q3 FY26), Swiggy reported consolidated revenue from operations of INR 6,148 Crore. This reflects a 54% increase compared to INR 3,993 Crore in the same period last year. The consolidated net loss for the quarter widened to INR 1,065 Crore, compared to a net loss of INR 799 Crore in Q3 FY25.

Segment-wise performance:

- Food Delivery: Revenue reached INR 2,041 Crore, a 24.67% year-over-year increase. Gross Order Value (GOV) grew by 20.5%.

- Quick Commerce (Instamart): Revenue stood at INR 1,016 Crore, up 76% year-over-year. The dark store network expanded to 1,136 locations.

- Supply Chain and Distribution: Revenue contributed INR 2,981 Crore, reflecting a 76% year-over-year growth.

- Out-of-Home Consumption: Revenue grew 56% to INR 103 Crore.

Financial Trends

Full-Year Results Context

For the preceding full fiscal year ended March 31, 2025, Swiggy reported a consolidated revenue of INR 11,247 Crore. The annual net loss was recorded at INR 3,117 Crore. Directional trends show rising revenue scale alongside consistent capital expenditure in the quick commerce segment.

Business & Operations Update

Swiggy added 34 dark stores during the quarter, bringing the total active area to 4.8 million square feet. The company noted that average order value (AOV) in quick commerce grew 40% year-over-year to INR 746. Operationally, the company flagged “irrational” competition in the low-AOV segment, leading to a strategic decision to avoid incentive-led volume gains.

M&A or Strategic Moves

The company reported a proforma cash base of INR 15,900 Crore as of December 31, 2025. This includes INR 9,931 Crore from a recent Qualified Institutional Placement (QIP) and INR 2,400 Crore accrued from the sale of its stake in Rapido.

Equity Analyst Commentary

Institutional analysts indicate that while food delivery margins are improving, the quick commerce segment continues to face a trade-off between growth and profitability. Analysts noted that food delivery adjusted EBITDA reached INR 272 Crore (3% of GOV), the highest in two years, while Instamart losses increased to INR 908 Crore.

Guidance & Outlook

The company stated its intent to navigate toward profitability by focusing on differentiated assortment propositions rather than participating in aggressive pricing wars. Management expects competitive intensity in quick commerce to remain a headwind to short-term volume growth.

Performance Summary

Swiggy Ltd shares closed at INR 324.05, up 0.17%. Q3 FY26 revenue rose 54% to INR 6,148 Crore while net loss widened to INR 1,065 Crore. Food delivery GOV growth reached a three-year high of 20.5%. Market capitalization stands at INR 89,392 Crore.