Swaraj Engines was established in 1989 it manufactures diesel engines specifically for tractors in the range of 22 HP to above 65 HP and hi-tech engine components.

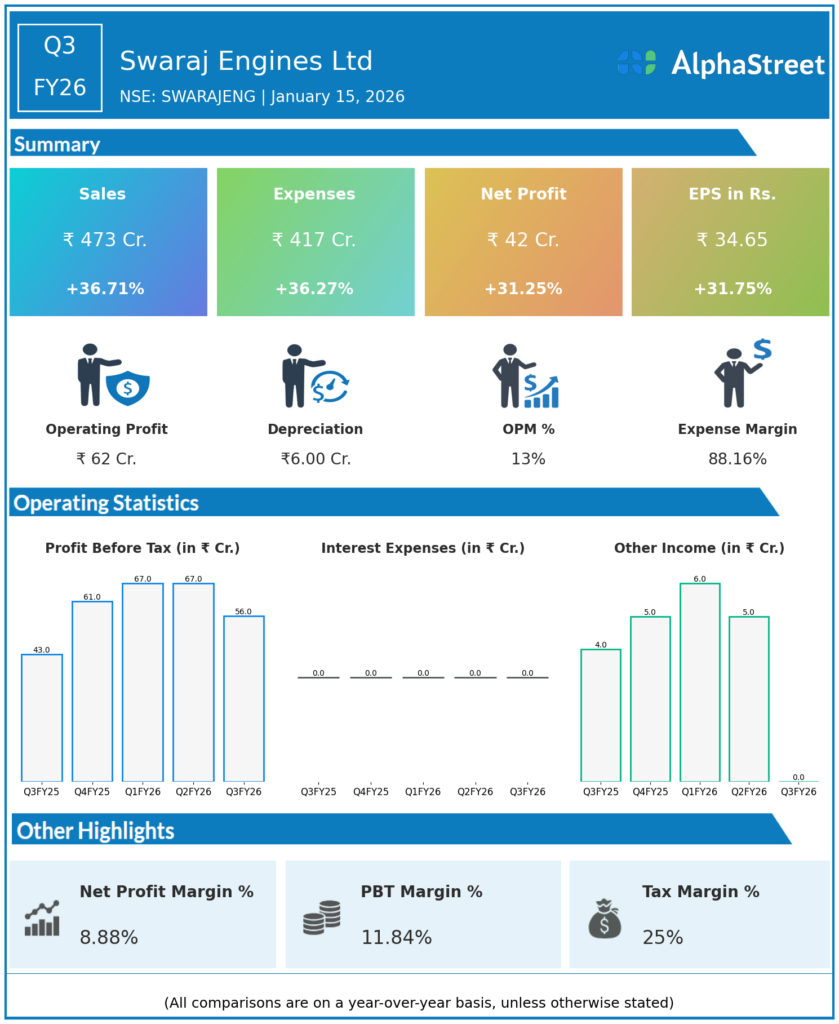

Q3 FY26 Earnings Results

- Revenue from Operations: ₹473.2 crore, up 37% YoY from ₹345.5 crore in Q3 FY25; highest‑ever quarterly revenue for the company.

- EBITDA: ₹61.95 crore, up ~40% YoY from ~₹44 crore in Q3 FY25; EBITDA margin at ~13.1%, improving from ~12.8% YoY.

- Profit Before Tax (PBT): ₹59.87 crore, up ~40% YoY from ₹42.82 crore in Q3 FY25.

- Profit After Tax (PAT): ₹42.10 crore, up ~31.6% YoY from ₹31.9 crore in Q3 FY25.

- Operating margin: OPM at 13.1% vs 12.8% last year, indicating margin expansion on strong operating leverage.

- Volumes: Engine sales at 47,563 units, up ~38% YoY from 34,415 units; highest‑ever Q3 engine sales volume.

- 9M FY26 snapshot:

- Engine sales: 147,767 units vs 123,226 units in 9M FY25.

- Net operating revenue: ₹1,461 crore vs ₹1,228 crore.

- PBT (before exceptional items): ₹194 crore, up 19.7% YoY; PBT (after exceptional items): ₹190.39 crore.

Management Commentary & Strategic Decisions (Q3 FY26)

- Management highlighted that robust and sustained engine demand from Mahindra’s Swaraj tractor franchise drove record Q3 volumes and the highest‑ever nine‑month sales and profits.

- Margin improvement was attributed to operating leverage on higher volumes and disciplined cost control, even as input and employee costs remained under check.

- Strategically, the company continues to:

- Focus on capacity utilisation and debottlenecking to support higher demand from the tractor OEM.

- Maintain a lean cost structure and strong quality standards to preserve double‑digit margins through cycles.

- Leverage healthy rural demand and farm mechanisation trends to sustain volume growth over the medium term.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹504.04 crore, up 8.6% YoY from ~₹464 crore in Q2 FY25 and up ~4.1% QoQ from ~₹484 crore in Q1 FY26.

- Profit Before Tax (PBT): ₹66.75 crore, up ~9.5% YoY from ₹60.98 crore in Q2 FY25; broadly stable QoQ.

- Profit After Tax (PAT): ₹49.68 crore, up 9.4% YoY from ₹45.42 crore; marginally down ~0.6–1% QoQ vs ~₹49.97 crore in Q1 FY26.

- EPS: ₹40.89 vs ₹37.39 in Q2 FY25.

- Engine Sales: 51,164 units, up 9% YoY and 4.3% QoQ, a record quarterly sales performance at the time.

- Operating Profit: ₹68.03 crore, up ~8.3% YoY.

- Margin profile: Operating margin around 13.5%, slightly compressed QoQ due to higher raw material and employee costs but still healthy.

Management Commentary & Strategic Directions (Q2 FY26)

- Management noted that despite only moderate tractor industry growth, Swaraj Engines sustained strong revenue and profit growth via cost efficiencies, improved engine realisations and stable offtake from Mahindra’s tractor division.

- The company emphasised maintaining high utilisation and consistent quality to support OEM demand while managing input‑cost headwinds.

- Strategic focus remained on:

- Deepening collaboration with the OEM (Mahindra Swaraj) for new models and higher‑HP engines.

- Incremental capacity and process improvements rather than large, lumpy capex.

- Protecting margins through efficiency gains and disciplined overhead control as volumes scale.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.