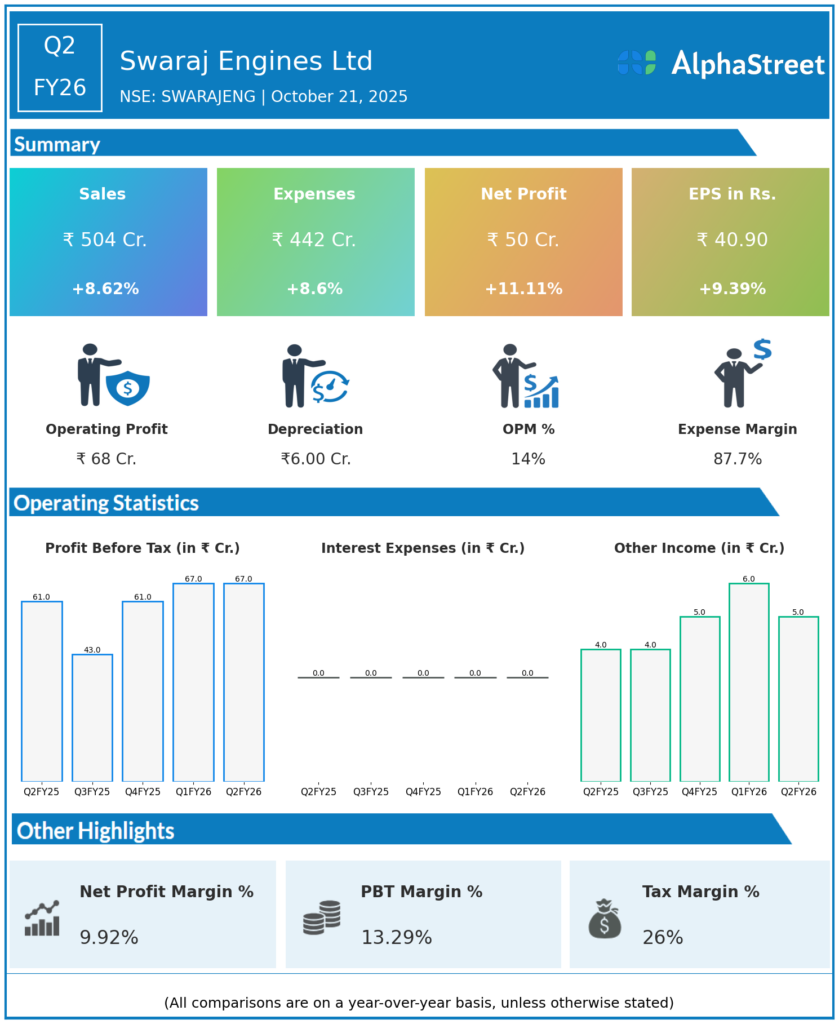

Swaraj Engines was established in 1989 it manufactures diesel engines specifically for tractors in the range of 22 HP to above 65 HP and hi-tech engine components. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹504.04 crore, up 8.57% YoY and 4.1% QoQ, driven by sustained tractor demand and higher sales volumes.

-

Profit Before Tax (PBT): ₹66.75 crore, up 9.5% YoY and stable QoQ, reflecting operational efficiencies amid cost challenges.

-

Profit After Tax (PAT): ₹49.68 crore, up 9.4% YoY and marginally down by 0.6% QoQ, maintaining consistent profitability.

-

EPS: ₹40.89 in Q2 FY26 vs ₹37.39 in Q2 FY25, reflecting solid earnings growth.

-

Engine Sales: 51,164 units, up 9% YoY and 4.3% QoQ, marking a record quarterly sales performance.

-

Operating Profit: ₹68.03 crore with an 8.3% YoY increase.

-

Margins: Operating profit margin slightly compressed marginally QoQ due to rising raw material and employee costs, but remains healthy at approximately 13.5%.

-

Employee Costs: Marginal sequential increase to ₹13.89 crore from ₹13.22 crore.

-

Capital Expenditure: ₹31.35 crore spent in H1 FY26, up from ₹20.3 crore in the previous year, supporting capacity expansion and operational improvements.

Management Commentary and Strategic Insights

-

The company highlighted continued strong rural demand driven by favourable agriculture outlook and improved monsoon across key markets.

-

Operational efficiencies and improved supply chain logistics mitigated inflationary pressures, maintaining healthy profitability.

-

Swaraj Engines expects volume growth to sustain in H2 FY26 amid new product launches and increased tractor adoption owing to government schemes.

-

Management emphasis remains on optimizing cost structures, expanding aftermarket services, and focusing on newer geographies to fuel future growth.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹484.10 crore, up 16% YoY.

-

PAT: ₹49.97 crore, up approximately 13% YoY, marginally higher than Q2 PAT.

-

Engine Sales: 49,040 units, showing steady growth QoQ and YoY.

-

Operating Profit: ₹67.10 crore with sustained operating margins.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.