Swan Energy Limited (SEL) was originally incorporated in 1909 as Swan Mills Ltd. (SML), a manufacturer and marketer of cotton and polyester textile products in India. Over the years, it diversified into Real estate and is developing a Floating Storage and Regasification Units -based liquid natural gas (LNG) import terminal at Jafrabad in Gujarat. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

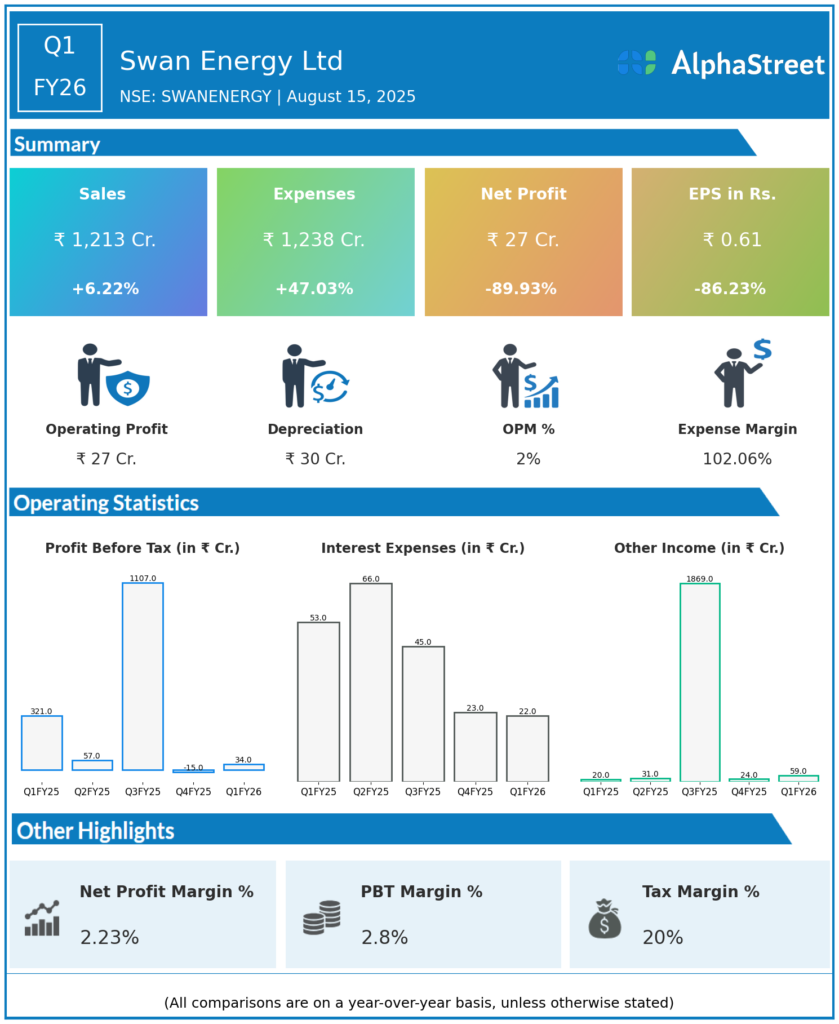

Revenue: ₹1,213 crore, up 6.2% year-over-year (YoY) from ₹1,142 crore and up 41.8% quarter-on-quarter (QoQ).

-

Net Profit (PAT): ₹27 crore, down 89.9% YoY (from ₹139 crore in Q1 FY25) but a recovery from a loss of ₹17.1 crore in Q4 FY25.

-

EBITDA: ₹26.7 crore, down 93% YoY (from ₹381 crore in Q1 FY25); EBITDA margin contracted sharply to 2.2% from 33.4% YoY.

-

EPS: ₹0.61 for Q1 FY26, compared with ₹4.43 a year earlier.

-

Expenses: Increased significantly versus prior periods, exerting pressure on overall margins.

Management Commentary & Strategic Highlights

-

Management acknowledged that Q1 FY26 profit and margin contraction was primarily due to a high base in Q1 FY25, one-off gains last year, and increased expenses that weighed on operational profit this quarter.

-

Revenue growth was supported by ongoing expansion across the company’s business verticals textiles, energy (including LNG and real estate), shipbuilding, and heavy industries.

-

Notable operational milestone: shipbuilding business saw steady order execution and the flagship real estate project in Bangalore progressed well with strong sales and occupancy.

-

Management maintains confidence in long-term prospects, pointing to continued ramp-up of LNG and defence-related operations, a ₹6,884 crore consolidated income and ₹874 crore PAT in FY25, and robust growth in new energy and infra projects.

-

Cost optimization, efficiency improvements, and debt reduction remain immediate focus areas to restore margins and return to sustained profitability.

-

The recent corporate name change to “Swan Corp Ltd” (effective July 29, 2025) signals the conglomerate’s diversification strategy and ambition.

Q4 FY25 Earnings Results

-

Revenue: ₹856 crore, down by 39 percent on the YoY basis.

-

Net Profit/Loss: –₹22 crore (net loss), down by more than a 100 percent during the same period last year.

-

EBITDA: ₹14 crore.

-

Previous quarters were marked by higher volatility; Q4’s loss contrasted with the positive YoY trend in FY25.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.