Suzlon is one of the leading global renewable energy solutions providers. It is a vertically integrated WTG manufacturer. It also undertakes installation and O&M of all WTG sales. Operations include design development and manufacturing of all major components, including rotor blades, tubular towers, generators, control equipment, gears and nacelles. Apart from manufacturing, it offers a full gamut of wind project planning and execution services, including wind resource assessment, infrastructure and power evacuation, technical planning and execution of wind power projects. It also offers O&M services in India and overseas countries. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

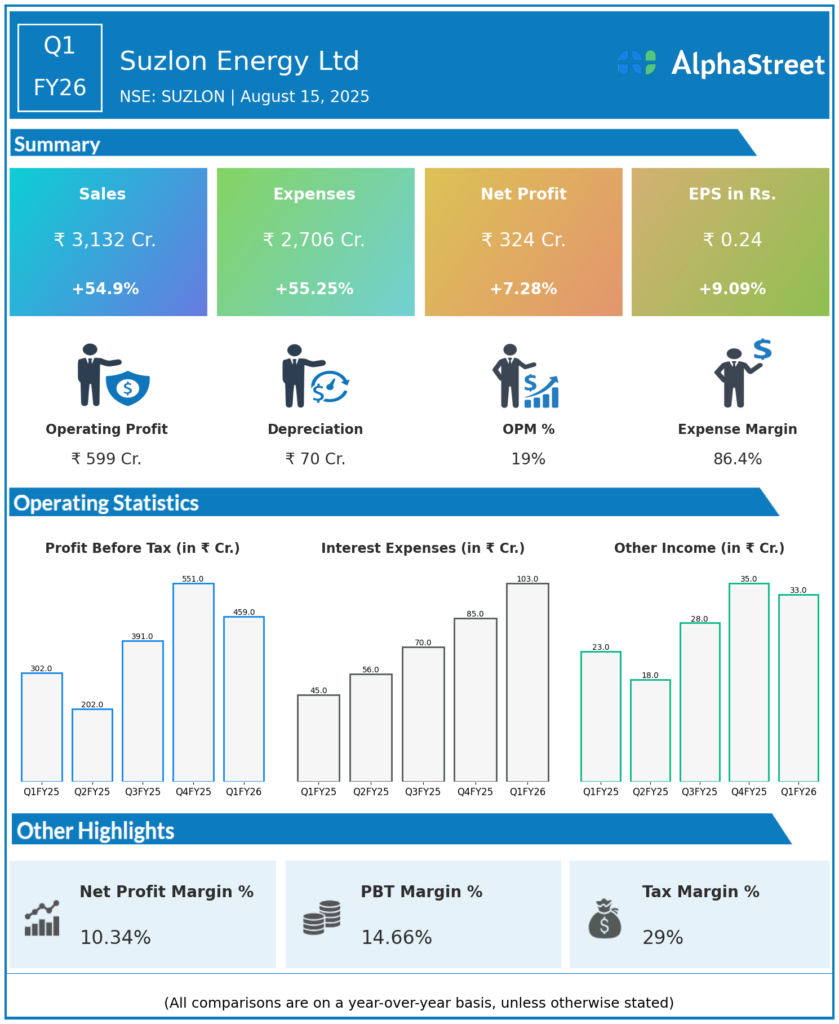

Revenue from Operations: ₹3,132 crore, up 55% year-over-year (YoY) from ₹2,016 crore.

-

Net Profit (PAT): ₹324 crore, a 7% increase YoY from ₹302 crore.

-

EBITDA: ₹599 crore, up 62% YoY from ₹370 crore; EBITDA margin improved to 19.2% from 18.4%.

-

Net Volumes: 444 MW for the quarter, up from 274 MW in Q1 FY25. Record deliveries for a Q1.

-

Order Book: 5.7 GW, with 75% from Commercial & Industrial (C&I) and PSU orders.

-

Finance Cost: ₹70 crore, up from ₹22 crore last year.

-

EPS: ₹0.24, a growth of 9% over the last year.

Management Commentary & Strategic Highlights

-

Suzlon highlights structural transformation in India’s energy sector, focusing on wind-dominant hybrid projects, RTC (Round The Clock), and FDRE (Firm, Dispatchable Renewable Energy) solutions.

-

Strong growth driven by large PSU-led auctions and increasing demand from commercial and industrial customers for reliable, cost-effective clean power.

-

Operational efficiency, execution capabilities, and a robust domestic manufacturing base (4.5 GW annual capacity) support the company’s leadership in renewable energy.

-

Suzlon CEO JP Chalasani emphasized alignment with MNRE’s revised guidelines fostering a domestic manufacturing ecosystem.

-

Founder Tulsi Tanti honored with the Lifetime Achievement Award by GWEC for visionary contributions to wind energy.

Q4 FY25 Earnings Results

-

Revenue: ₹3,790 crore, up by 73 percent on the YoY basis.

-

Net Profit: The net profit was ₹1,181 crore which was an exceptionally high seasonal performance. It was up by more than a 100 percent on the YoY basis

-

EBITDA: ₹693 crore, margin 18.4%.

-

Reflects strong finish for FY25 with high order inflow and execution momentum.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.