Suven Pharma is in the business of Contract development & manufacturing organisation (CDMO), catering to the needs of global Pharma Industry. SPL engages in NCE molecule development and supply of intermediates. This is a high-value-add, high-margin business. SPL supplies intermediates for four molecules addressing rheumatoid arthritis, diabetes, depression and women’s health. This segment makes up 78% of revenues. The company has a strong order book with new clients being consistently added. Most clients are the Big Pharma companies in Europe and the US. The company is looking to shift from Intermediate to API manufacturing and is in discussion with clients regarding this. The company has stated that it has the facilities for API manufacturing.

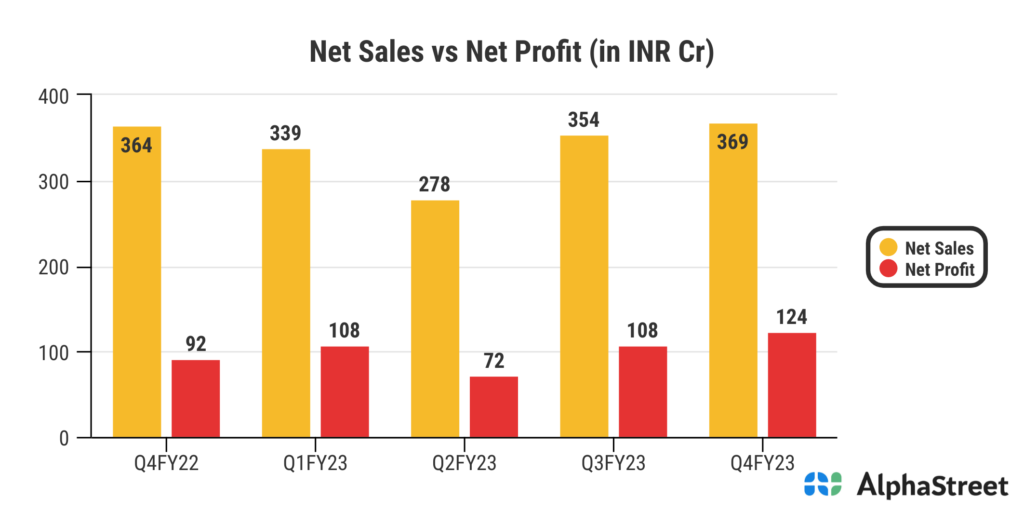

- Suven Pharmaceuticals Ltd reported Total revenue for Q4 FY23 of ₹369 Crore, up from ₹364 Crore year on year depicting a growth of 1.3%.

- Total Expenses for Q4 FY23 of ₹215 Crore down, from ₹219 Crore year on year, a decline of 2%.

- Consolidated Net Profit of ₹124 Crore, up 35% from ₹92 Crore in the same quarter of the previous year.

- The Earnings per Share is ₹4.87, up 35% from ₹3.6 in the same quarter of the previous year.