Supreme Industries Limited is India’s leading plastics product manufacturer, offering a wide and comprehensive range of plastic products in India. The company operates in various product categories viz. Plastic Piping System, Cross Laminated Films & Products, Protective Packaging Products, Industrial Moulded Components, Moulded Furniture, Storage & Material Handling Products, Performance

Packaging Films and Composite LPG Cylinders.

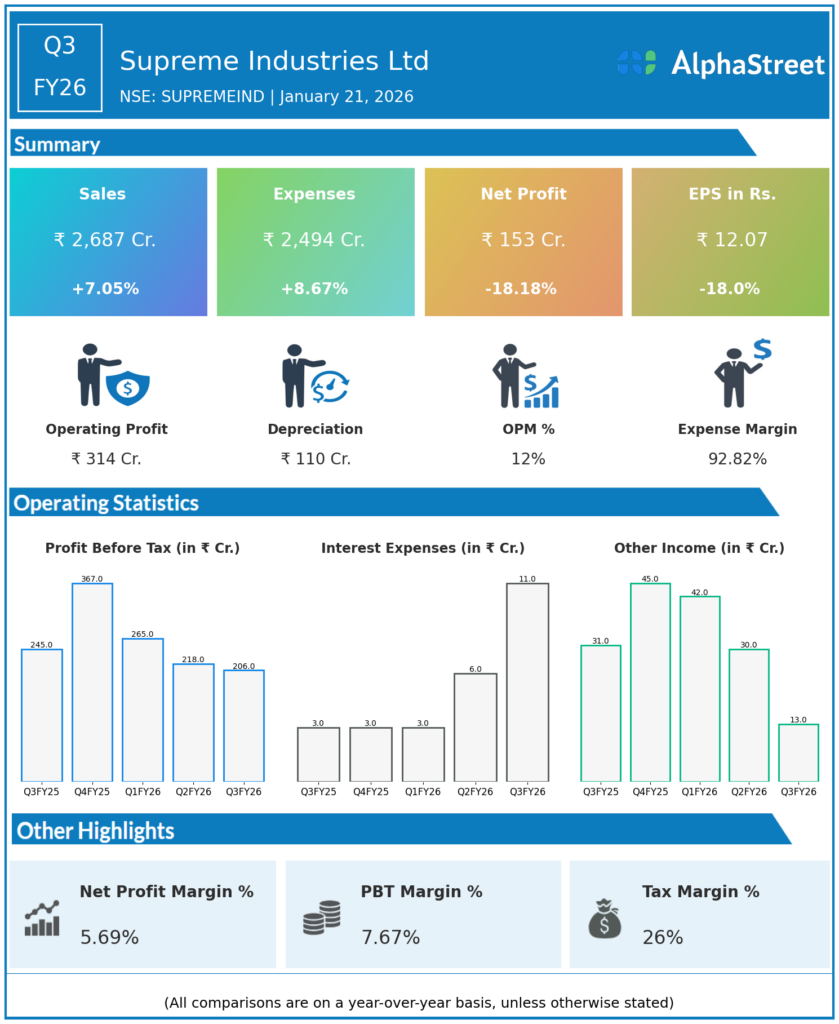

Q3 FY26 Earnings Results

- Revenue from Operations: ₹2,687 crore, up 7.0% YoY from ₹2,510 crore in Q3 FY25; up 11.8% QoQ from ₹2,409 crore in Q2 FY26.

- Sales Volume: 183,794 MT, up 13% YoY from 161,500 MT.

- EBITDA: ₹314 crore, up 1.5% YoY from ₹309 crore; EBITDA margin 11.7%, down 60 bps YoY from 12.3%.

- Operating Profit: ₹313.84 crore, down 2.3% YoY from ₹321 crore; OPM 12.0% vs 12.8% in Q3 FY25.

- Profit After Tax (PAT): ₹158.5 crore, down 18.6% YoY from ₹194.7 crore.

- Value‑Added Products Turnover: ₹1,118 crore, up 16% YoY from ₹961 crore.

- 9M FY26:

- Revenue from Operations: ₹7,690 crore, up 4% YoY from ₹7,419 crore.

- Sales Volume: 522,018 MT, up 10% YoY.

- EBITDA: ₹930 crore.

- PAT: ₹520.4 crore, down from ₹667 crore in 9M FY25.

Management Commentary & Strategic Decisions – Q3 FY26

- Management highlighted 7% revenue growth and 13% volume growth despite challenging market conditions, driven by strong demand for value‑added products (16% turnover growth) and continued market share gains in piping and insulation segments.

- Margin compression was attributed to elevated raw material costs, investments in brand building, and unfavourable product mix; capex guidance maintained at ₹1,200 crore for FY26 to support capacity expansion.

- Strategic focus:

- Scaling value‑added products to 45% of total turnover (currently ~42%), targeting higher margins and market leadership in premium segments.

- Aggressive capacity expansion across pipes, fittings, insulation and new verticals like appliance components.

- Strengthening exports and institutional sales while maintaining pricing discipline amid input cost volatility.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹2,409 crore, down 8.3% QoQ from ₹2,626 crore in Q1 FY26, up 5.3% YoY from ₹2,288 crore in Q2 FY25.

- Total Expenses: ₹2,207 crore, down 7.5% QoQ, up 7.8% YoY.

- Profit Before Tax (PBT): ₹202.8 crore, down 15.5% QoQ, down 16.1% YoY from ₹241.7 crore.

- Profit After Tax (PAT): ₹164.7 crore, down 18.6% QoQ from ₹202.3 crore, down 20.3% YoY from ₹206.6 crore.

- EPS: ₹12.97, down 18.6% QoQ and 20.2% YoY.

- H1 FY26: Revenue ₹4,935 crore, up 5.3% YoY; PAT ₹367 crore, down 19.5% YoY.

Management Commentary & Strategic Directions – Q2 FY26

- Management noted modest YoY revenue growth amid seasonal factors and input cost pressures, but highlighted continued value‑added product traction and market share gains.

- Strategic emphasis on capacity expansion, premium product mix and export growth to drive sustainable profitability.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.