Supreme Industries Limited is India’s leading plastics product manufacturer, offering a wide and comprehensive range of plastic products in India. The company operates in various product categories viz. Plastic Piping System, Cross Laminated Films & Products, Protective Packaging Products, Industrial Moulded Components, Moulded Furniture, Storage & Material Handling Products, Performance

Packaging Films and Composite LPG Cylinders.

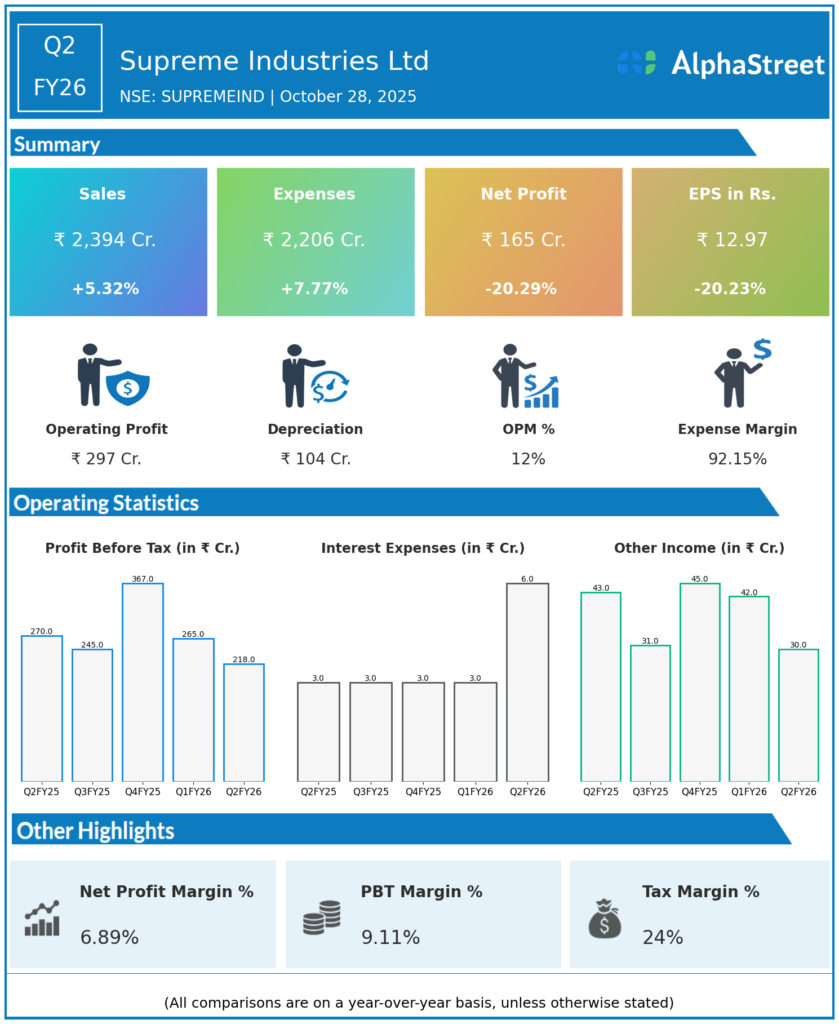

Q2 FY26 Earnings Results

Revenue from Operations: ₹2,393.87 crore, up 5.3% YoY from ₹2,272.95 crore.

Sales Volume: 1,54,431 MT, up 11.8% YoY from 1,38,077 MT.

EBITDA: ₹297.41 crore, down 6.9% YoY.

EBITDA Margin: 12.4% (down 163 bps YoY, versus 14.1% in Q2 FY25).

Profit Before Tax (PBT): ₹246.2 crore, down 12.8% YoY.

Profit After Tax (PAT): ₹165 crore, down 20.2% YoY from ₹202.39 crore.

PAT Margin: 8.1%.

Segmental Growth: Plastic piping sales volumes up 11.4% YoY; strong performance in value-added products.

Dividend: Interim dividend of ₹11/share (550%) declared, record date Nov 8, 2025.

Management Commentary & Strategic Directions

-

Management cited robust volume growth in core plastic piping segments as a key positive, but margin pressure from higher raw material (polymer) prices, inventory losses, and competitive intensity impacted profits.

-

The company finalized the acquisition of Wavin’s plastic pipe business for ₹302 crore and signed a technology partnership with Wavin B.V. Netherlands; this will drive technological upgrading and market expansion.

-

Supreme Industries forecasts 12–14% annual volume growth, underpinned by healthy demand from housing and irrigation segments and enhanced manufacturing capacity.

-

Focus remains on premiumization, value-added products, and judicious cost control amid industry price volatility.

-

The company continues to invest in capacity expansion, targeting 1 million tons of plastic piping capacity by March 2026, and maintains a net cash position.

Q1 FY26 Earnings Results

Revenue: ₹2,609.13 crore, down 1.02% YoY from ₹2,657.79 crore.

Sales Volume: 1,83,793 MT, up 6% YoY.

EBITDA: ₹318.88 crore, down 5.1% YoY.

Profit Before Tax (PBT): ₹240.00 crore, down 24.9% YoY.

Profit After Tax (PAT): ₹202.3 crore, down 26% YoY from ₹273.4 crore.

Value-Added Products Revenue: ₹933 crore.

PAT Margin: 7.8%.

Capex: Investment of ₹1,350 crore planned for fiscal expansion and new product launches.

Management highlighted that inventory losses due to declining PVC prices, early monsoon impact on agriculture segment, and low polymer procurement prices weighed on Q1 profitability, but near-term outlook remains volume positive.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.