Supreme Industries Limited is India’s leading plastics product manufacturer, offering a wide and comprehensive range of plastic products in India. The company operates in various product categories viz. Plastic Piping System, Cross Laminated Films & Products, Protective Packaging Products, Industrial Moulded Components, Moulded Furniture, Storage & Material Handling Products, Performance

Packaging Films and Composite LPG Cylinders. Presenting below are its Q1 FY26 earnings results.

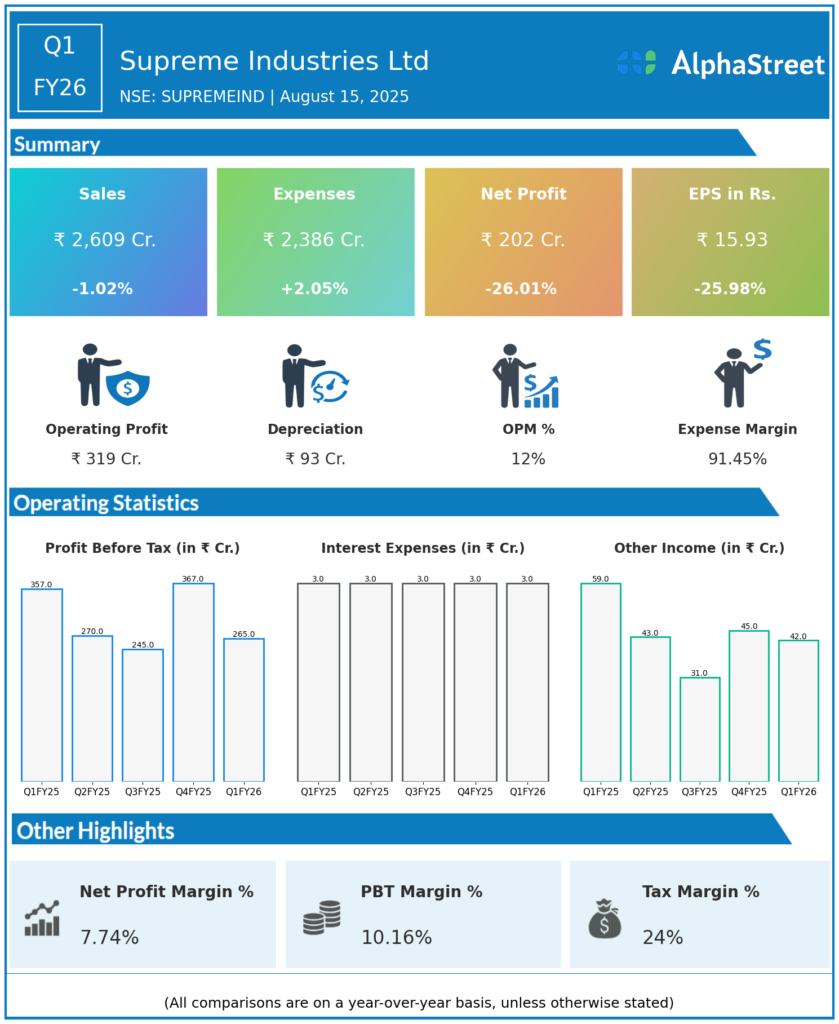

Q1 FY26 Earnings Results

-

Revenue: ₹2,609 crore, down 1.02% year-over-year (YoY) and 13.2% quarter-on-quarter (QoQ).

-

Net Profit (PAT): ₹202.3 crore, down 26% YoY and 43% QoQ.

-

EBITDA: ₹344 crore; EBITDA margin contracted to 13.1% from 15.99% YoY.

-

Volume Growth: Plastic goods volume grew 5.7% YoY, driven by 6.1% volume growth in the plastic pipe segment (but below management’s estimates).

-

EPS: ₹15.93, down from ₹21.50 in Q1 FY25 and ₹27.90 in Q4 FY25.

-

Expenses: ₹2,386 crore, up 2% YoY.

-

Operating Profit: ₹319 crore, down 19% YoY; PAT margin at 7.7% (down from 10.3% YoY).

Management Commentary & Strategic Highlights

-

Q1 was affected by early monsoon (impacting pipe volumes, particularly in agriculture), inventory losses (falling PVC prices), and delayed anti-dumping duty enforcement.

-

Management expects Q1 inventory losses of ₹50–60 crore to be non-recurring and forecasts EBITDA margin recovery to 14.5–15.5% for FY26 as business conditions normalize.

-

The guidance for full-year volume growth in Plastics Piping has been raised to 15–17%, overall volume growth to 14–15% (including ~30,000 tonnes volume from the soon-to-close Wavin acquisition).

-

Wavin acquisition (₹310 crore) adds new product lines and tech for Indian/SAARC markets, and exclusive licensing for seven years; expected to close July 2025, capex funded via internal accruals.

-

Focus remains on value-added product sales, brand-building, and new plant expansions.

-

Despite margin weakness in Q1, management is optimistic about strong housing demand and expects agriculture demand to recover as government fund flows resume.

Q4 FY25 Earnings Results

-

Revenue: ₹3,027 crore, up 11% YoY.

-

Net Profit (PAT): ₹294 crore, up 20.8% YoY.

-

EBITDA: ₹416 crore, margin at 15.99%.

-

Q4 saw higher sales and profitability, providing a strong base for the year even as Q1 saw a seasonal and price-led margin dip.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.