Sunteck Realty Limited is a Mumbai-based real estate developer focused on developing premium residential and commercial properties across Mumbai Metropolitan Region (MMR). Presenting below are its Q2 FY26 earnings results.

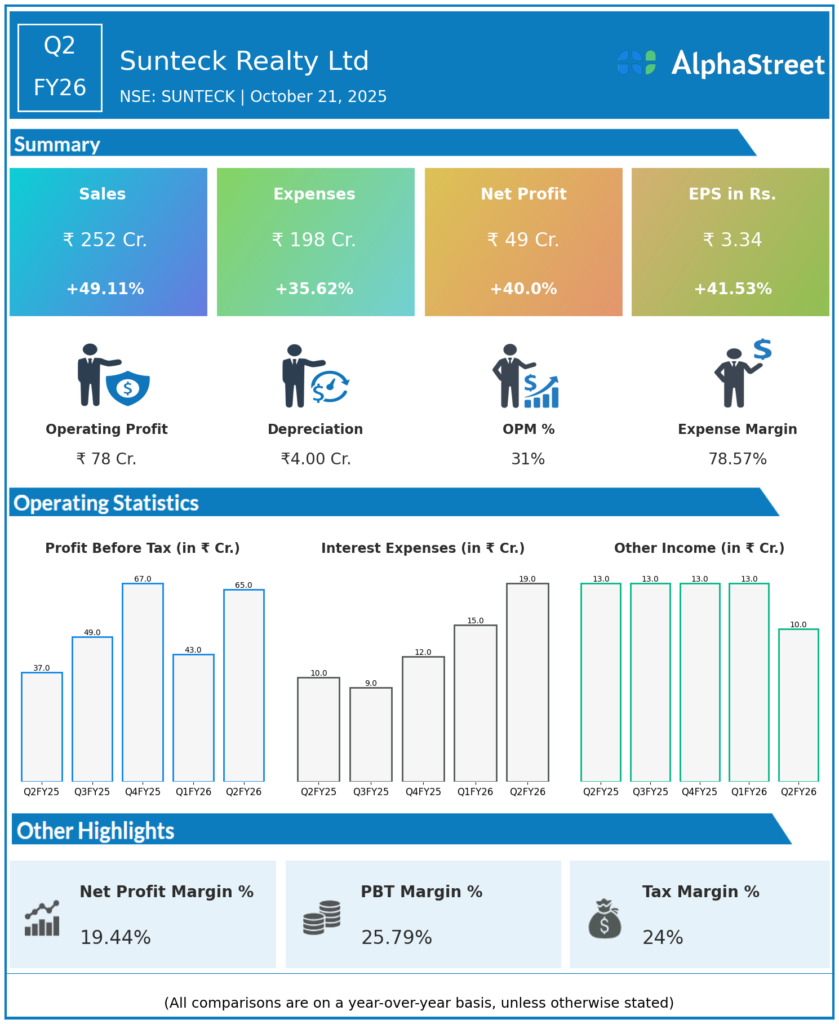

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹252.37 crore, up 49.3% YoY from ₹169.05 crore in Q2 FY25, and up significantly QoQ.

-

Net Profit (PAT): ₹48.97 crore, up 41.4% YoY from ₹34.63 crore, reflecting strong bottom-line growth.

-

EBITDA: ₹87.63 crore, up 73.9% YoY from ₹50.39 crore; EBITDA margin improved substantially to 31% from 22.3% YoY, indicating enhanced operating efficiency.

-

Pre-sales: ₹702 crore, up 34% YoY, driven by robust demand for residential projects in Mumbai and NCR markets.

-

Collections: ₹331 crore, up 24% YoY, showing strong cash flow discipline and customer confidence.

-

Net Debt-to-Equity Ratio: 0.04x, maintaining a strong balance sheet.

Management Commentary and Strategic Insights

-

Sunteck Realty emphasized strong operational execution and delivery, leading to higher handovers and collections impacting cash flow positively.

-

The company highlights demand recovery in premium residential segments, especially in Mumbai and NCR, with careful launch strategies avoiding aggressive discounting.

-

Focus remains on sustainable growth and profitability, with plans for selected project launches and expansion in key markets through FY26.

-

The company also formed a joint investment platform with IFC-World Bank Group to unlock ₹750 crore for future projects, enhancing financial flexibility.

-

Emphasis on ESG initiatives and community engagement continues to drive corporate social responsibility efforts, potentially enhancing brand trust and stakeholder value.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹201.53 crore, up 30% YoY.

-

Net Profit (PAT): ₹33.43 crore, increased 46% YoY.

-

EBITDA: ₹57.51 crore, with margin expanding significantly from previous year.

-

Pre-sales: Around ₹657 crore with steady collections.

-

The first quarter showed similar momentum as part of a strong H1 FY26, setting the stage for continued growth.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.