Sundram Fasteners Limited (NSE: SUNDRMFAST), a leading Indian auto-components manufacturer and a key entity within the TVS Group, reported its third quarter results for the financial year 2025-26, revealing a nuanced blend of robust domestic demand, margin pressures, and the evolving footprint of its global operations. The latest financials, for the quarter ended December 31, 2025, underscore solid top-line growth but highlight persistent challenges in export markets and cost dynamics.

Top-Line Acceleration with Divergent Market Trends

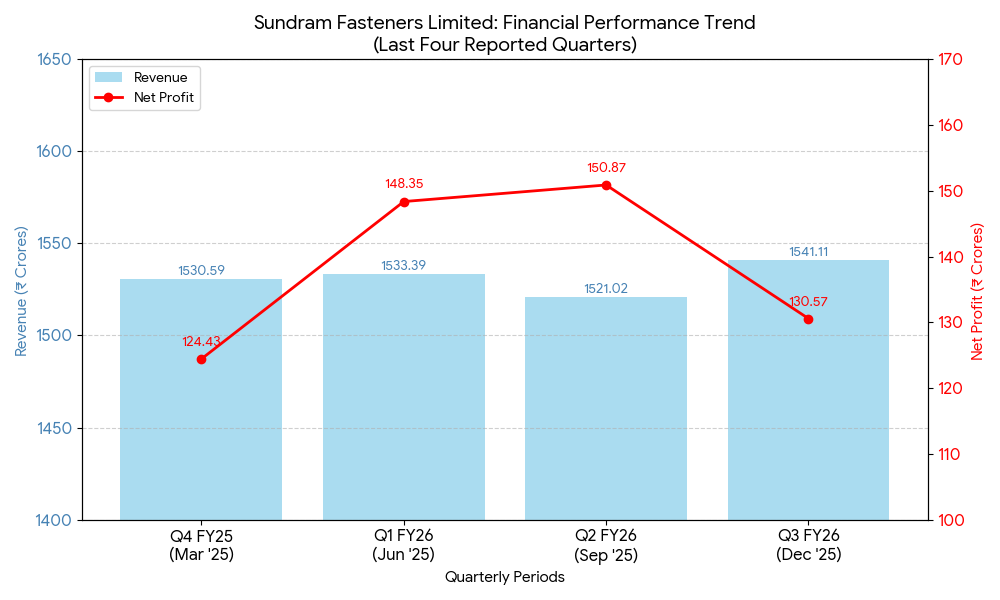

For Q3 FY26, Sundram Fasteners recorded a consolidated revenue from operations of ₹1,541.11 crore, representing an approximate 6.9% year-on-year increase compared with the same quarter last year. The company’s standalone operations also demonstrated resilience, with revenue at ₹1,351.47 crore, up from ₹1,256.58 crore in Q3 FY25. These gains were powered chiefly by stronger domestic sales, which climbed sharply by around 18% year-on-year to ₹994.97 crore, reflecting sustained demand in India’s automotive and ancillary industries.

However, export sales declined, with the quarterly figure at ₹308.41 crore, down from ₹362.79 crore in the prior year. This contraction highlights ongoing headwinds in international markets, likely linked to slower global auto production and competitive pressures.

Profitability: Flattish Quarter Amid One-off and Cost Pressures

Despite the revenue uptick, net profitability remained largely flat. On a consolidated basis, net profit stood at ₹130.80 crore, marginally above ₹130.36-130.73 crore in Q3 FY25. Standalone net profit for the period, after adjusting for a one-time employee benefits provision linked to new labour code compliance, was reported at ₹121.88 crore.

The modest improvement in earnings occurred against the backdrop of exceptional costs and margin pressures. The company recognised a one-time increase of approximately ₹11-13 crore for employee benefit provisions arising from India’s updated labour regulations, which impacted comparable profit metrics. These cost headwinds, alongside export contraction, underscore challenges in translating revenue growth into commensurate expansion in bottom-line performance.

Nine-Month Performance and Capital Deployment

Across the nine-month period ending December 31, 2025, Sundram Fasteners reported consolidated net profit of ₹431.49 crore, up from ₹417.26 crore a year earlier, while total income for this period rose to approximately ₹4,648.32 crore. The company also continued its capital investment programme, with capital expenditure of ₹217.92 crore, aligned with strategic capacity enhancement and diversification efforts.

Strategic Continuity and Leadership Strength

In tandem with its financial results, the company’s board approved the re-appointment of key directors, including Sri Suresh Krishna as Non-Executive Director and Ms Arathi Krishna as Managing Director, subject to shareholder approval. Additionally, Sundram Fasteners appointed a Senior General Manager for Information Technology, reflecting a continued emphasis on governance stability and digital transformation.

Outlook Implications: Balanced Performance in a Transitional Phase

Sundram Fasteners’ Q3 FY26 performance illustrates a company navigating a dynamic industry environment with solid domestic market traction but tangible export challenges and transitional cost impacts. While revenue momentum remains intact, especially in the Indian market, the flat profit trajectory points to margin sensitivities that will be key to monitor in subsequent quarters as the global automotive cycle evolves.