“We have achieved a consolidated PAT of INR 500 crores, for the first time, and we also declared the highest payout in the history of the company. The dividend was INR 8.63 per share. The revenues have grown well from INR 4,198 crores to INR 4,949 crores, registering 18%. This growth has been broad-based across most of our divisions and also across all verticals, all segments, be it commercial vehicles, or passenger vehicles, or stationary engines, tractors, all have done well for us.”

– Mr. Dilip Kumar, CFO in Q4FY23 Concall

| Stock Data | |

| Ticker | SUNDRMFAST |

| Exchange | NSE |

| Industry | MANUFACTURING |

| Price Performance | |

| Last 5 Days | +0.04% |

| YTD | +18.25% |

| Last 12 Months | +54.17% |

*As of 08.06.2023

Company Description:

Sundram Fasteners Limited (SFL) is a leading Indian company engaged in the manufacturing and distribution of high-quality automotive and industrial fasteners. Established in 1966, the company has grown to become a significant player in the fasteners industry, both in India and globally.

Sundram Fasteners was founded as a joint venture between TVS Group, an Indian conglomerate, and CEFIM, a French company. The company began its operations with a focus on the domestic market, supplying fasteners to the automotive industry.

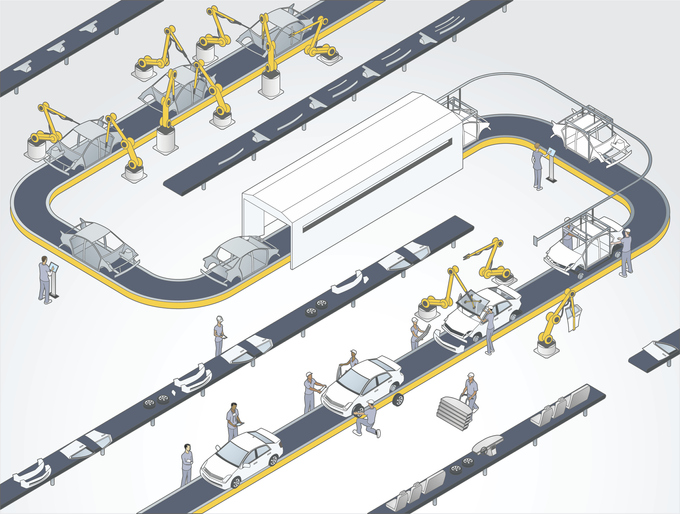

Business Operations: Sundram Fasteners operates through multiple divisions, including Automotive Components Division, Industrial Fasteners Division, and Other Products Division. The Automotive Components Division manufactures a wide range of fasteners and components for various automotive applications. The Industrial Fasteners Division caters to industries such as infrastructure, wind energy, aerospace, and railways. The Other Products Division focuses on products like radiator caps, gear shifters, and precision forgings.

Financial Performance:

Revenue: Revenues grew by 18% from INR 4,198 crores to INR 4,949 crores, with growth across most divisions and segments in the fiscal year 2023.

Profitability: The company has maintained a strong profitability track record. In FY23, Sundram Fasteners recorded a consolidated net profit of ₹ 500 crore while reaching ₹ 5,000 crores of consolidated turnover for the first time in its history.

Expansion and Investments: Sundram Fasteners has been investing in capacity expansion and technology upgradation to meet growing customer demands. The company has also been exploring strategic acquisitions and partnerships to enhance its product portfolio and market presence.

Market Position & Competitors:

Market Position: Sundram Fasteners has established a strong market position in India, driven by its focus on quality, customer-centric approach, and timely delivery. The company has also expanded its global footprint by exporting its products to over 60 countries.

Competitors: Sundram Fasteners faces competition from both domestic and international players in the fasteners industry. Some of its key competitors include UNBRAKO, Laxmi Fasteners, PSL Limited, and Pennar Industries.

Growth Prospects:

- Automotive Industry Growth: Sundram Fasteners is well-positioned to benefit from the anticipated growth in the Indian automotive industry. With the increasing demand for automobiles and government initiatives promoting electric vehicles, the company’s automotive components division is expected to witness robust growth.

- Infrastructure Development: The Indian government’s focus on infrastructure development, including projects such as highways, railways, and metro networks, presents opportunities for Sundram Fasteners’ industrial fasteners division.

- Global Expansion: Sundram Fasteners’ successful penetration of international markets provides a foundation for further global expansion. The company can leverage its existing customer base and reputation to explore new markets and diversify its revenue streams.

Risks and Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of raw materials, such as steel and aluminum, can impact Sundram Fasteners’ profitability. The company’s ability to manage and mitigate these risks through effective procurement strategies and hedging mechanisms is crucial.

- Intense Competition: The fasteners industry is highly competitive, and Sundram Fasteners must continually innovate and maintain product quality to stay ahead of its competitors. Failure to do so may lead to market share erosion.

- Economic Factors: Macroeconomic factors, such as changes in interest rates, currency exchange rates, and overall economic conditions, can affect Sundram Fasteners’ business performance. The company needs to monitor and adapt to such changes to minimize the impact on its operations.

Conclusion:

Sundram Fasteners has established itself as a leading player in the fasteners industry, leveraging its strong reputation, product quality, and customer-centric approach. With a diversified product portfolio, robust financial performance, and growth prospects driven by the automotive industry and infrastructure development, the company is well-positioned for future success. However, it must navigate challenges such as raw material price volatility, intense competition, and economic factors to sustain its growth trajectory. Overall, Sundram Fasteners is a promising Indian company with the potential for further expansion and value creation.