Sun Pharmaceutical Industries Ltd is engaged in the business of manufacturing, developing and marketing a wide range of branded and generic formulations and Active Pharma Ingredients (APIs). The company and its subsidiaries has various manufacturing facilities spread across the world with trading and other incidental and related activities extending to global market. It is the largest pharmaceutical company in India.

Q3 FY26 Earnings Results

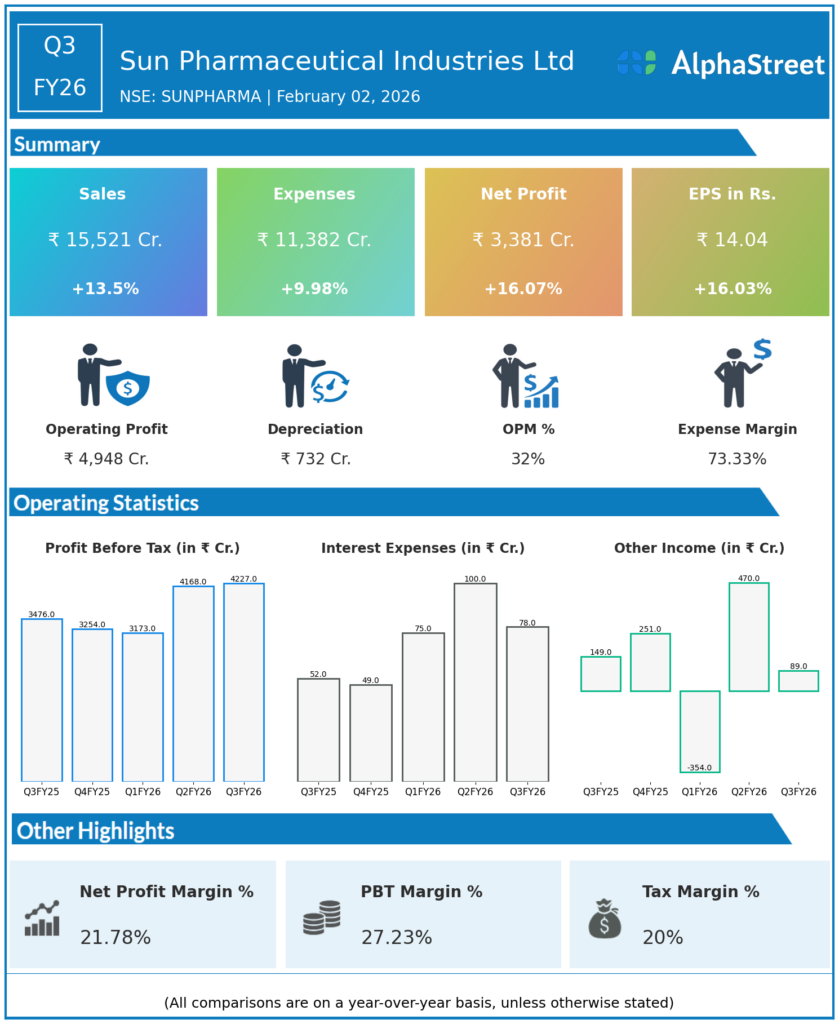

- Revenue from Operations: ₹15,520 cr, +13.5% YoY (₹13,675 cr in Q3 FY25).

- EBITDA: ~₹4,948 cr, EBITDA margin ~31.9% (up ~260 bps YoY).

- PAT: ₹3,369 cr, +16.0% YoY (₹2,903 cr in Q3 FY25).

- Other Key Metrics: PBT ₹4,227 cr, +21.6% YoY; India Formulations sales ₹4,998 cr, +16.2% YoY; Emerging Markets/up 21.6% YoY; Global Innovative Medicines sales US$423 mn.

Management Commentary & Strategic Decisions

- MD Kirti Ganorkar highlighted “well-rounded growth across all businesses, led by branded India, emerging markets and global innovative medicines.”

- Dividend: Interim dividend of ₹11 per equity share for FY26 approved; record date Feb 5 2026.

- Strategic Moves: Company maintaining focus on specialty and innovative products with broad geographic performance, underpinning medium-term growth; large greenfield facility capex (~₹3,000 cr) previously approved via subsidiary to expand manufacturing capacity.

Q2 FY26 Earnings Results

- Revenue from Operations: ₹14,478 cr, +8.6% to +8.9% YoY.

- EBITDA: ₹4,527 cr, +14.9% YoY; EBITDA margin 31.3%.

- PAT: ₹3,118.95 cr, +2.6% YoY.

- Other Key Metrics: India formulations +11% YoY, Emerging markets +10.9% YoY; U.S. sales declined 4.1% in generic segment; R&D spend 5.4% of sales.

Management Commentary Q2

- Q2 commentary highlighted broad-based sales growth across India, Emerging & RoW markets, and rising contribution from global innovative medicines.

- U.S. innovative drugs sales outpaced generics but U.S. generics fell slightly; structural shift in portfolio mix noted.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.