Sun Pharmaceutical Industries Ltd is engaged in the business of manufacturing, developing and marketing a wide range of branded and generic formulations and Active Pharma Ingredients (APIs). The company and its subsidiaries has various manufacturing facilities spread across the world with trading and other incidental and related activities extending to global market. It is the largest pharmaceutical company in India.

Q2 FY26 Earnings Results:

-

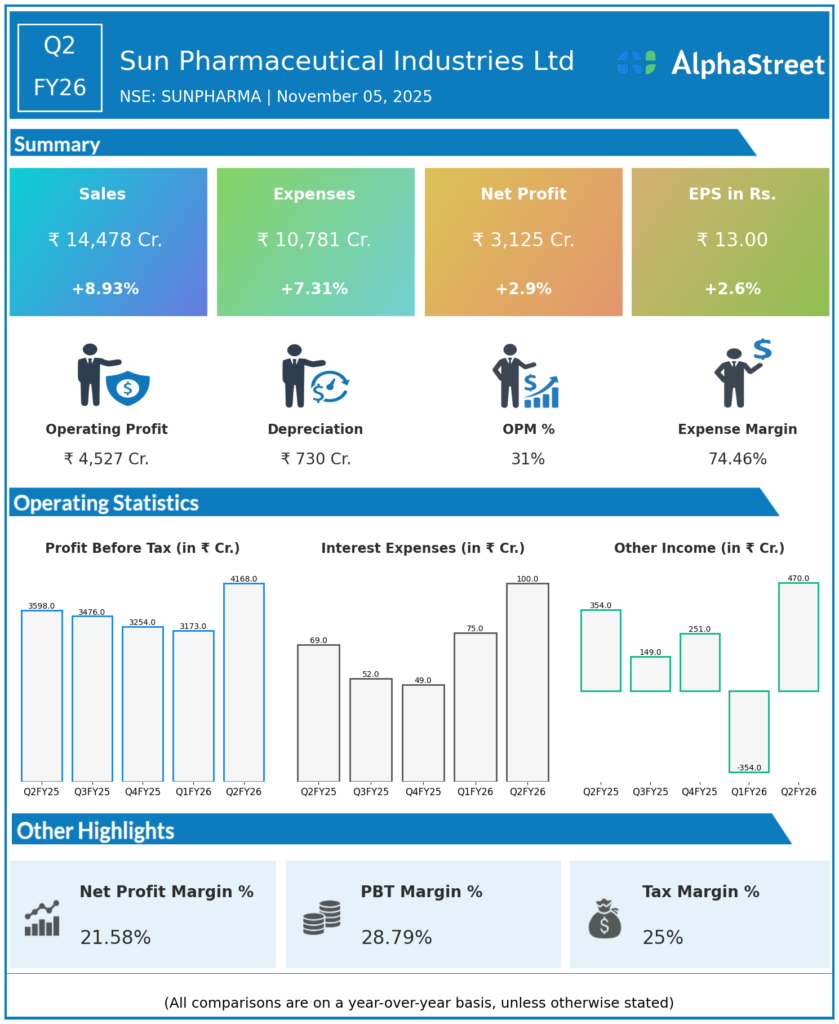

Revenue from Operations: ₹14,478 crore, up 8.9% YoY from ₹13,264 crore in Q2 FY25.

-

Net Profit After Tax (PAT): ₹3,125 crore, up 2.9% YoY from ₹3,040 crore.

-

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): ₹4,527 crore, a 14.9% increase YoY.

-

EBITDA Margin: Expanded 167 basis points YoY to 31.3%.

-

Profit Before Exceptional Items and Tax rose 15.8% YoY to ₹4,168 crore.

-

Sales from Global Innovative Medicines grew 16.4% YoY to $333 million, accounting for 20.2% of total revenue.

-

US Innovative medicine sales surpassed generics for the first time.

-

Research & Development investment at ₹783 crore (5.4% of sales).

-

Strong growth seen in India, emerging markets, and rest of world.

Management Commentary and Strategic Insights:

-

MD Kirti Ganorkar highlighted robust growth led by India, emerging markets, and Rest of World regions.

-

Focus on strengthening innovative drug portfolio in dermatology, oncology, and obesity therapy.

-

Launch of LEQSELVI in US treating severe alopecia areata received good initial market response.

-

US business declined by 4.1% YoY due to pricing pressures.

-

Confidence in sustaining mid-to-high single-digit revenue growth guidance for FY26.

Q1 FY26 Earnings Results:

-

Revenue: ₹13,851 crore, up 9.5% YoY.

-

PAT: ₹2,279 crore, down 20% YoY mainly due to exceptional charges.

-

EBITDA grew 19.2% YoY to ₹4,302 crore; margin improved to 31%.

-

Adjusted net profit excluding exceptional items rose 5.7% YoY to ₹3,000 crore.

-

Strong sales across India, US, and international markets.

-

Increased R&D to 6.5% of sales supporting long-term growth.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.