Sumitomo Chemical India Ltd. (SCIL) is one of the leading players in the industry which has a balanced portfolio of technical as well as formulation products along with backward integration for some products. The Company is known for domestic marketing of proprietary products of its Japanese parent -Sumitomo Chemical Company Limited in agrochemicals, animal nutrition, and environmental health business segments. With the integration of Excel Crop Care Limited, the Company now has a strong portfolio of generics in addition to specialty products and a strong combined marketing network. With this integration, the Company has moved up several notches in the pecking order of the Indian crop protection industry. SCIL has also marked its presence in Africa and several other geographies of the world.

Q3 FY26 Earnings Results (Standalone)

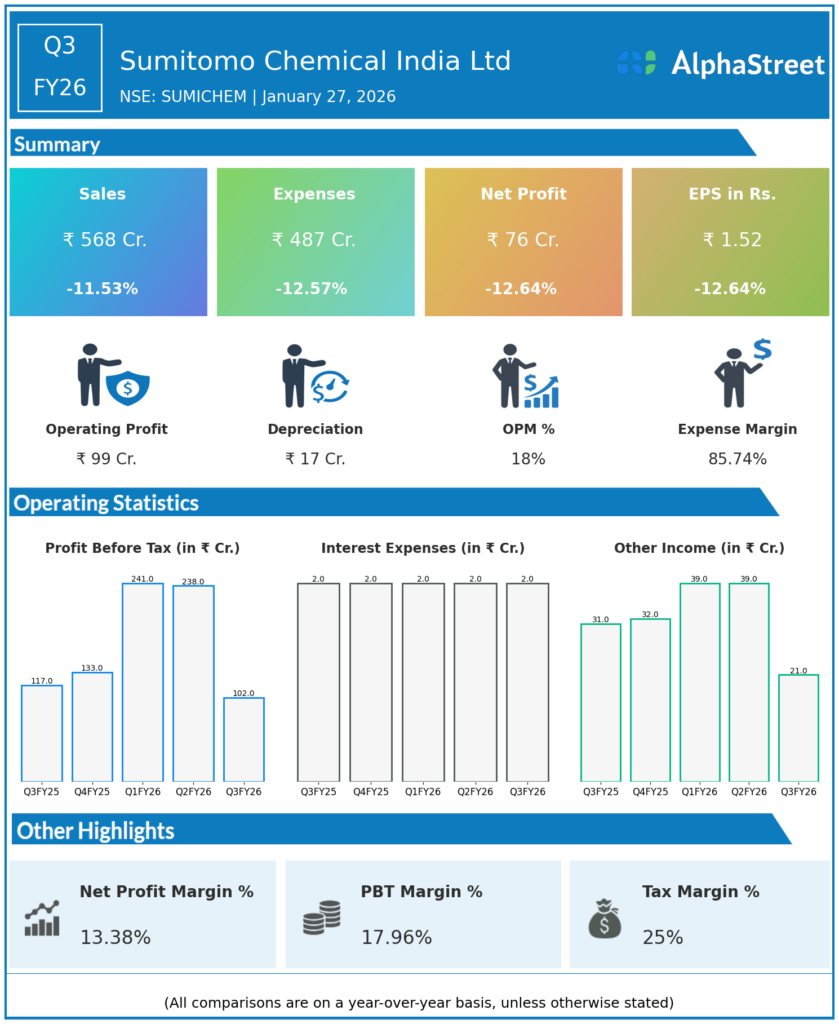

Revenue from Operations / Net Sales: ₹551.76 cr, down 11.4% YoY versus ₹622.43 cr in Q3 FY25, down ~QoQ from Q2 FY26 (est. based on H1 ₹1,986 cr), reflecting challenging market conditions in agrochemicals amid pricing pressures and seasonal demand softness.

Total Income: ₹588.57 cr, down 10.0% YoY from ₹653.70 cr in Q3 FY25.

Profit Before Tax (PBT): ₹99.76 cr, down YoY (implied from PAT drop).

Profit After Tax (PAT): ₹74.83 cr, down 11.2% YoY from ₹84.31 cr in Q3 FY25, impacted by ₹15.19 cr exceptional items related to new Labour Code implementation; PAT margin 13.6% versus 13.5% YoY.

Basic EPS: ₹1.50, down 11.2% YoY from ₹1.69.

9M YTD Performance: Revenue ₹2,514.27 cr, up 3.7% YoY; PAT ₹432.53 cr, up 7.2% YoY, showcasing resilience despite quarterly volatility; Basic EPS ₹8.67 (+7.3% YoY).

Management Commentary & Strategic Decisions

- Quarterly results reflect softer volumes and pricing in agrochemicals segment amid competitive pressures and regulatory costs (Labour Codes), partially offset by cost discipline; 9M growth underscores balanced portfolio strength in crop protection and public health insecticides.

- Strategic moves: No dividends or specific guidance declared; focus on leveraging parent Sumitomo Chemical’s technical expertise, expanding bio-pesticides via Valent Biosciences tie-up, and indigenous R&D for new formulations to counter pricing headwinds.

Q3 FY26 Earnings Results (Consolidated)

Revenue from Operations: ₹567.98 cr, down 11.5% YoY from ₹641.92 cr, down QoQ.

Total Income: ₹604.94 cr.

Profit Before Tax (PBT): ₹101.57 cr.

Profit After Tax (PAT): ₹75.63 cr (attributable to owners), down 13.5% YoY from ₹87.43 cr; Basic EPS ₹1.52.

9M YTD Consolidated: Revenue ₹2,554.57 cr (+YoY), PAT ₹431.73 cr (+YoY).

Management Commentary Q2

- Consolidated trends mirror standalone with minor subsidiary contributions; Q2 FY26 standalone revenue ₹914 cr (-5.9% YoY), PAT ₹177.77 cr (-7.7% YoY), EBITDA ₹256.84 cr (27.6% margin, -36 bps YoY) on revenue ₹914 cr (-5.9% YoY); H1 revenue ₹1,986 cr (+8.7% YoY), PAT ₹356 cr (+11.5% YoY).

- Commentary notes margin pressure from mix shifts but strong H1 growth; strategic emphasis on technical/formulation balance, pest control expansion, and feed additives amid volatile commodity cycles.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.