Sumitomo Chemical India Ltd. (SCIL) is one of the leading players in the industry which has a balanced portfolio of technical as well as formulation products along with backward integration for some products. The Company is known for domestic marketing of proprietary products of its Japanese parent -Sumitomo Chemical Company Limited in agrochemicals, animal nutrition, and environmental health business segments. With the integration of Excel Crop Care Limited, the Company now has a strong portfolio of generics in addition to specialty products and a strong combined marketing network. With this integration, the Company has moved up several notches in the pecking order of the Indian crop protection industry. SCIL has also marked its presence in Africa and several other geographies of the world. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

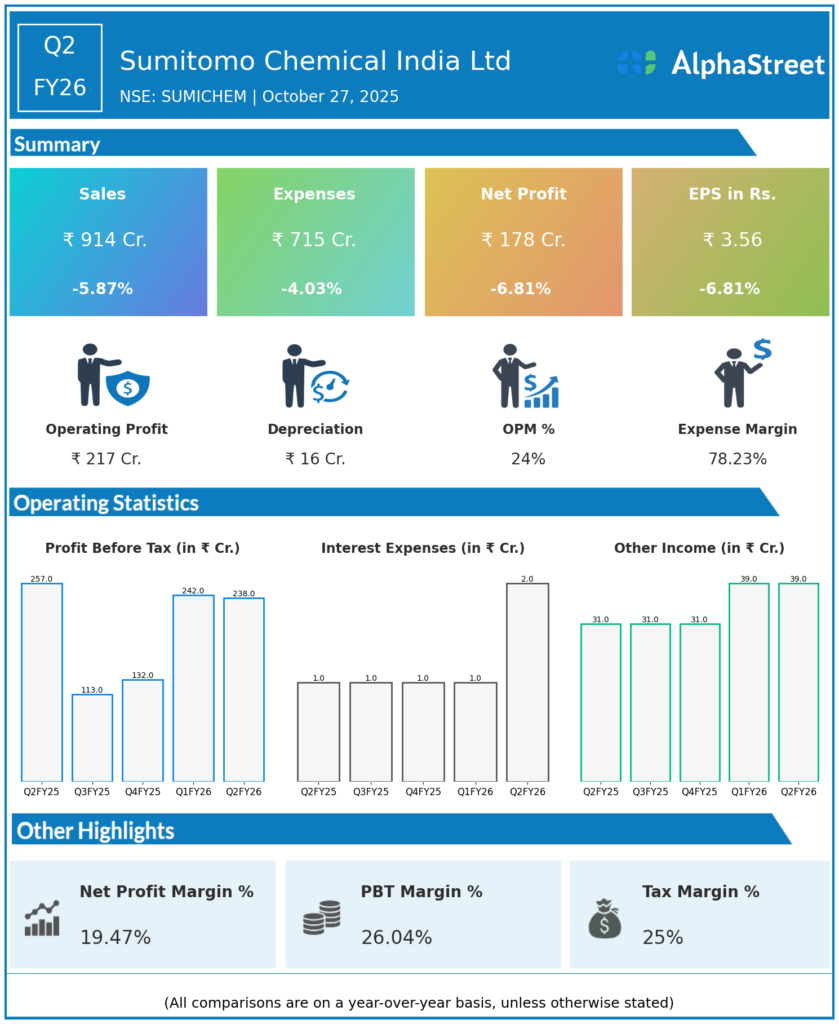

Revenue from Operations: ₹914 crore, down 5.9% YoY from ₹988.30 crore, and down 12.01% QoQ from Q1 FY26.

EBITDA: ₹256.84 crore, down 7.1% YoY from ₹276.51 crore.

EBITDA Margin: 27.62%, down 36 bps YoY.

Profit After Tax (PAT): ₹177.77 crore, down 7.7% YoY from ₹192.29 crore.

PAT Margin: 19.13%.

Half-Year Performance:

-

H1 FY26 revenue: ₹1,985.69 crore (up 8.7% YoY).

-

H1 net profit: ₹355.85 crore (up 11.5% YoY).

Management Commentary & Strategic Decisions

-

Management attributed the YoY and QoQ decline in Q2 results to challenging market conditions, regulatory hurdles, and muted farm sentiment following patchy monsoon.

-

Pressure from glyphosate regulatory challenges affected product demand and operational execution.

-

Discontinued animal nutrition products distribution business in India to focus on core crop protection and specialty solutions.

-

Management reaffirms commitment to portfolio rationalization, cost optimization, and accelerating penetration of high-value, innovative crop chemistries.

-

Company plans to accelerate R&D driven launches, digital advisory initiatives, and selective expansion in Southeast Asia and Africa for export growth.

-

Expressed confidence in recovery momentum in H2 FY26 on the back of increased sowing, new launches, and stable input prices.

Q1 FY26 Earnings Results

Revenue from Operations: ₹1,048.07 crore, up 26% YoY from ₹831.78 crore.

EBITDA: ₹220.04 crore, up from ₹161.38 crore (prior year); margin improved to 20.74%.

Profit After Tax (PAT): ₹178.10 crore, up 40.78% YoY from ₹126.69 crore.

PAT Margin: 17%.

EPS: ₹3.60, up 44% YoY.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.