Sumitomo Chemical India Ltd. (SCIL) is one of the leading players in the industry which has a balanced portfolio of technical as well as formulation products along with backward integration for some products. The Company is known for domestic marketing of proprietary products of its Japanese parent Sumitomo Chemical Company Limited in agrochemicals, animal nutrition, and environmental health business segments. With the integration of Excel Crop Care Limited, the Company now has a strong portfolio of generics in addition to specialty products and a strong combined marketing network. With this integration, the Company has moved up several notches in the pecking order of the Indian crop protection industry. SCIL has also marked its presence in Africa and several other geographies of the world. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Results

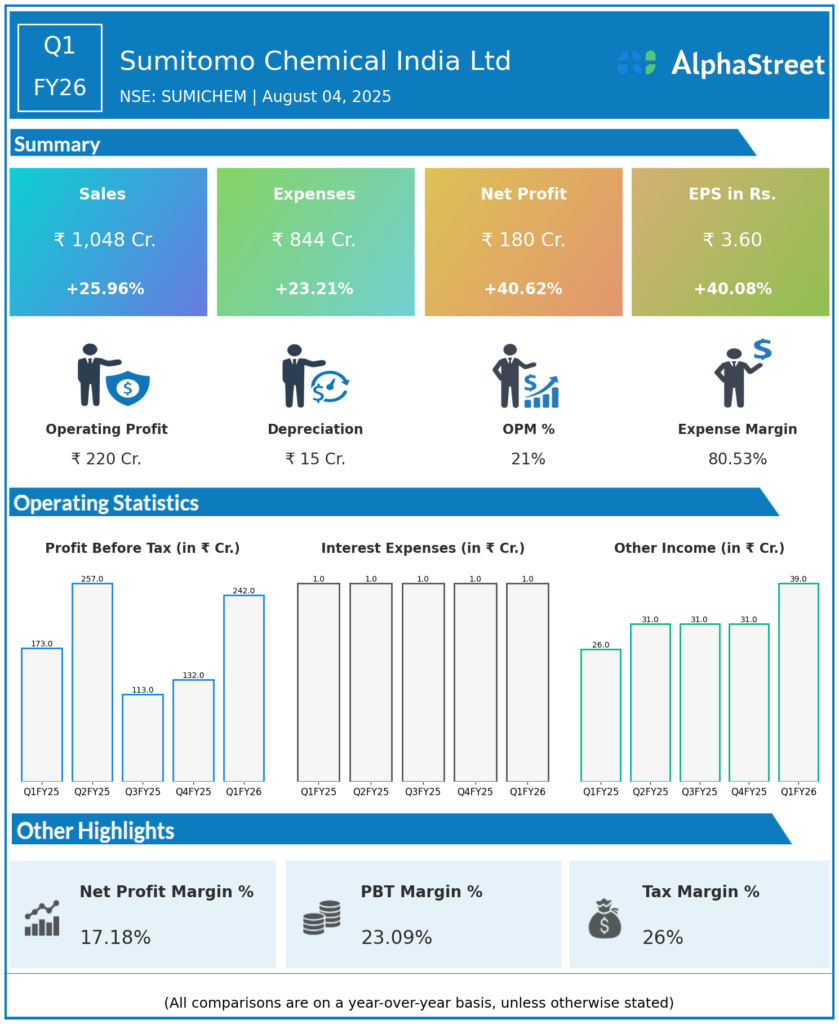

- Sumitomo Chemical India Ltd reported Revenues for Q1FY26 of ₹1,048.00 Crores up from ₹832.00 Crore year on year, a rise of 25.96%.

- Total Expenses for Q1FY26 of ₹844.00 Crores up from ₹685.00 Crores year on year, a rise of 23.21%.

- Consolidated Net Profit of ₹180.00 Crores up 40.62% from ₹128.00 Crores in the same quarter of the previous year.

- The Earnings per Share is ₹3.60, up 40.08% from ₹2.57 in the same quarter of the previous year.

-

Performance Drivers: Growth driven by stable revenues in crop protection, specialty chemicals, and polymer products, supported by efficient cost management and strong market positioning.

Key Management Commentary & Strategic Highlights

-

Management highlighted steady growth and margin expansion, pointing to the company’s successful cost control initiatives amid raw material price volatility.

-

The company continues to strengthen its product portfolio and expand market share across agrochemicals and specialty chemicals.

-

Emphasis on sustainability, innovation, and digital initiatives to enhance operational efficiency.

-

Outlook remains positive, backed by steady demand in core segments and ongoing investments in R&D and capacity enhancement.

Q4 FY25 Earnings Results:

-

Total Revenue: ₹665 crore.

-

Total Expenses: ₹548 crore.

-

EBIT: ₹117 crore.

-

PAT: ₹98 crore.

-

EBIT Margin: Approximately 18%.

-

Performance: Margins exhibited slight improvement quarter-over-quarter, with steady revenue contributing to sustained profitability.

To view the company’s previous earnings: Please Click Here