Strides Pharma Science Ltd is in the business of development and manufacturing of pharmaceutical products. The company’s pharmaceutical products are sold in over 100 countries. The company has always followed an inorganic growth strategy over the years that resulted in foray into new markets, addition of new business segments, therapy segments and manufacturing infrastructure.

Q1 FY26 Earnings Summary

-

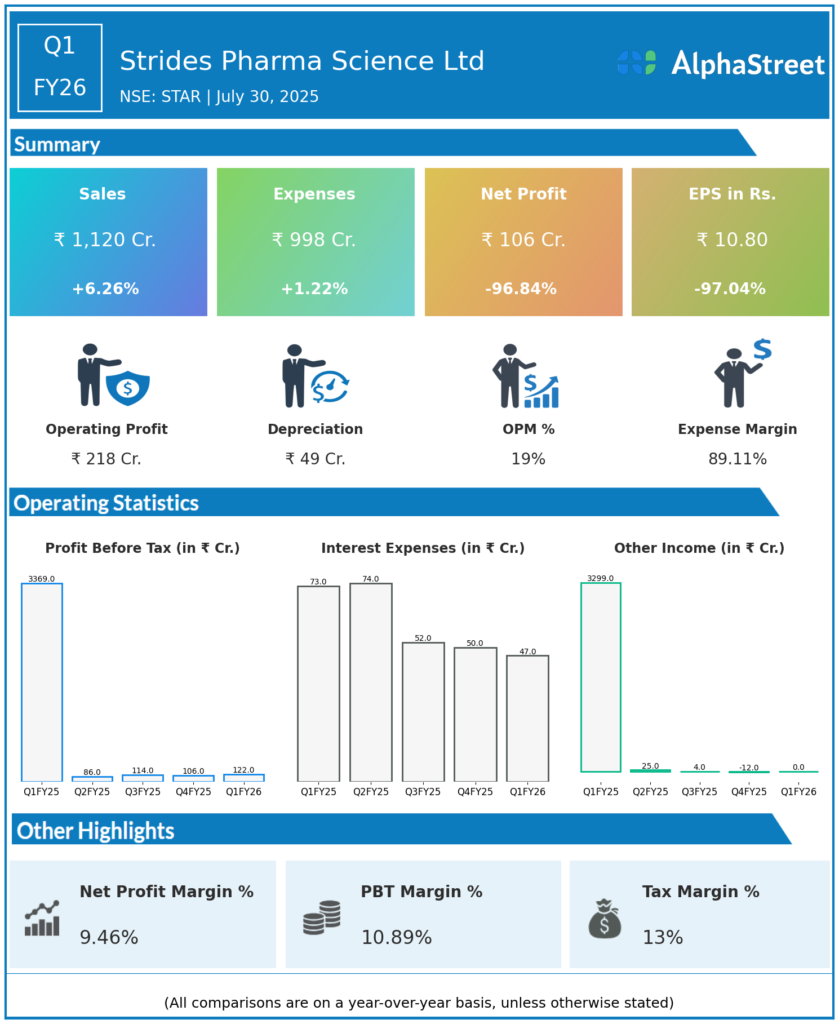

Revenue: ₹1,119.7 crore, up 6.2% year-over-year (YoY) from ₹1,054.3 crore in Q1 FY25 but down 5.9% quarter-over-quarter (QoQ) from ₹1,190.4 crore in Q4 FY25.

-

Gross Margin: ₹675.5 crore, increased 11.7% YoY; gross margin percentage improved by 300 basis points YoY to 60.3%.

-

EBITDA: ₹218.1 crore, up 14.8% YoY; EBITDA margin expanded by 150 basis points to 19.5%.

-

Operational Profit After Tax (PAT): ₹114 crore, a strong 80.6% increase YoY (Q1 FY25: ₹63.1 crore).

-

Reported PAT: ₹105.6 crore, up 97% on YOY basis.

-

Operational EPS: ₹12.4, up significantly from ₹6.9 in Q1 FY25.

-

US Revenue: $71 million, up 7% YoY, driven by base business growth, with 70 commercialized products and continued strong market share.

-

Product Approvals: Received 1 product approval and launched 1 product in the US in Q1 FY26; discontinued 4 low-margin products.

-

Other Markets: Growth markets (including Africa, LATAM, MENA, APAC) posted ₹140.2 crore ($16.4 million) revenue, up 32.2% YoY. Access markets declined sharply due to donor funding challenges.

-

Operating Costs: Personnel cost at ₹225.5 crore; other operating expenses at ₹231.9 crore.

Key Management Commentary & Strategic Highlights

-

Management emphasized strong margin expansion and improved profitability due to disciplined cost control and execution.

-

Focus on portfolio maximization and channel expansion in growth markets.

-

Despite challenges in access markets due to reduced donor funding, the company is investing in regulatory filings and market development to stabilize growth over the next two years.

-

Reiterated US business revenue target of ~$400 million by FY27-28, supported by over 230 ANDA filings and 215+ approvals, with 60 dormant ANDAs in process for relaunch.

-

Invested in “Beyond Generics” segments including control substances, nasal sprays to diversify growth streams.

-

Continues to lead in several generic markets with top 3 position in 37 products.

-

Operational discipline and cost rationalization remain key priorities.

Q4 FY25 Earnings Summary

-

Revenue: ₹1,190.4 crore, up 17.0% year-over-year (YoY).

-

Gross Margin: ₹691.4 crore, increased 18.1% YoY, with a margin around 58.1%.

-

EBITDA: ₹217.9 crore, up 22.0% YoY; EBITDA margin expanded to 18.3%, up 75 basis points YoY.

-

US Revenue: $77 million, up 23.2% YoY.

-

Operational Profit After Tax (PAT): ₹113 crore, a 5-fold increase YoY.

-

Operational EPS: ₹12.3, up 5 times YoY.

-

Net Debt: Reduced by ₹512.8 crore leading to an improved net debt-to-EBITDA ratio of 1.9x.

-

Dividend: The Board recommended a dividend of ₹4 per share for FY25.