Stove Kraft Limited (NSE: STOVEKRAFT) reported weaker quarterly profitability for the three months ended December 31, 2025, amid softer revenues and margin compression.

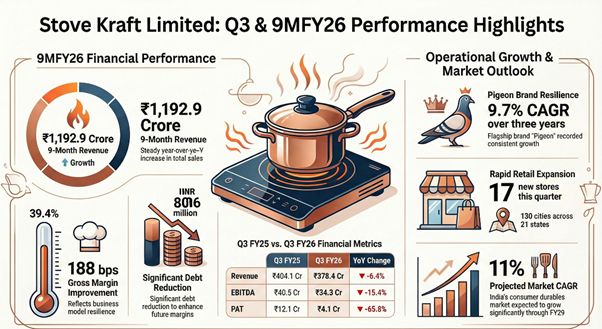

Revenue from operations declined 6.4% year-on-year to ₹378.4 crore in Q3 FY26, compared with ₹404.1 crore a year earlier. Sequentially, revenue fell 20.2% from ₹474.4 crore in Q2 FY26.

Gross profit stood at ₹149.2 crore, down 1.7% year-on-year. Gross margin improved to 39.4% from 37.6% in Q3 FY25, reflecting a favorable product mix and pricing discipline. EBITDA declined 15.4% year-on-year to ₹34.3 crore, with EBITDA margin contracting to 9.1% from 10.0%.

Adjusted profit after tax fell sharply to ₹5.2 crore from ₹12.1 crore a year earlier. Reported PAT declined 65.8% year-on-year to ₹4.1 crore, impacted by one-time forex losses of ₹2.7 crore and additional labor code-related expenses during the quarter.

SWOT Analysis

Strengths:

Established brands with long market presence, backward-integrated manufacturing facilities, and a growing exclusive retail network.

Weaknesses:

Declining quarterly profitability, sensitivity to ForEx movements, and margin pressure during demand slowdowns.

Opportunities:

Expansion of exclusive brand stores, deeper penetration across Indian states, and diversified product portfolio across value and premium segments.

Threats:

Demand volatility in consumer durables, regulatory cost increases, competitive intensity, and export-related risks.

Segment & Category Trends

During Q3 FY26, gas cooktops recorded 10.1% value growth despite a 20.4% volume decline. Pressure cookers posted 4.0% value growth with 9.6% volume expansion. Induction cooktops and small appliances reported value declines of 2.8% and 6.0%, respectively, while non-stick cookware saw a 27.0% value decline, partly due to lower exports. Pressure cookers and small appliances together contributed about 30% of revenue, while cooktops, hobs, and chimneys accounted for around 20%.

Retail Footprint

The company reduced working capital days to 43 during the quarter. Its exclusive retail network expanded to 313 stores across 21 states and 138 cities, with 17 new stores added in Q3. Average monthly sales per store stood at about ₹4.27 lakh. Management reiterated progress toward scaling the exclusive retail network to 500 stores by calendar year 2027 and stated that execution efficiency remains a key operational focus.

What Investors Are Watching

Investors are monitoring demand trends in core kitchen appliance categories, margin sensitivity to input costs and ForEx movements, and the pace of retail store expansion. Working capital discipline and the normalization of one-time expenses remain key variables.