SIKA Interplant Systems Ltd (BSE:523606) is an Indian engineering company that was incorporated in 1985. The company operates through the engineering products and services segment, with a primary focus on manufacturing and rendering engineering products, projects, and designs. Its products include handling equipment, engineering projects, and engineering services, design engineering and supply, and engineering services.

The company’s Motion Control Products range from servo motors, brush and brushless motors, stepper motors, frameless and housed motors, and linear motors to generators, amplifiers, controllers, actuators, feedback sensors, tachometers, resolvers, potentiometers, gear heads, brakes and clutches, and slip rings. The company’s Motion Control Systems include pedestals, rotary tables, and positioning systems. Its Hydraulic Products include solenoid valves, air intake particle separators, and pressure switches.

SIKA Interplant Systems Ltd has subsidiaries such as M/s. Sikka n Sikka Engineers Pvt Ltd, M/s. EMSAC Engineering Pvt Ltd, and M/s. SIKA UK Ltd. The company was awarded for ‘Excellence in Aerospace Indigenisation‘ at the Society of Indian Aerospace Technologies & Industries’ biennial awards ceremony in February 2022, in recognition of its contribution to the indigenous design, development, manufacture, integration, supply, and lifecycle support for a high-precision aerospace and defence (A&D) system.

The last decade has seen India emerge as one of the most attractive A&D markets in the world, with the Ministry of Defence’s (MoD) continued emphasis on modernisation of the armed forces, expected to result in capital expenditure of about USD 250 billion over the next 10 years. The company is well positioned to meet the requirements of both potential international partners and domestic projects.

Within the automotive sector, SIKA Interplant Systems Ltd continues to undertake projects to supply critical capital equipment to a significant number of the major automobile manufacturers across the country. The Indian manufacturing sector growth looks encouraging, and if an expectation of a global economic slowdown results in a fall in commodity prices, Indian import bills will also come down, which may improve India’s current as well as fiscal accounts.

The company is primarily engaged in the business of manufacturing and rendering services in engineering products, engineering projects/systems, and services. Over the years, the management has evaluated proposals for engaging in other businesses not necessarily being an extension of the Core Business. To enable focused growth of its Core Business, the Company has been evaluating the segregation of its Non-Core.

Most of the threats to the domestic A&D industry are rooted on the policy front, such as lengthy procurement and evaluation processes, controversies related to corruption, and disputes over shortlisting in competitive bids. These will serve to delay acquisition plans of the armed forces and impact the timing of execution of already long-dated projects. Further, given the nature of the A&D business, the products and systems involved are typically of complex advanced technologies, often resulting in the approval and certification cycle extending for materially longer than originally planned. This can result in delays in production orders and consequent deliveries, affecting the timing of revenues.

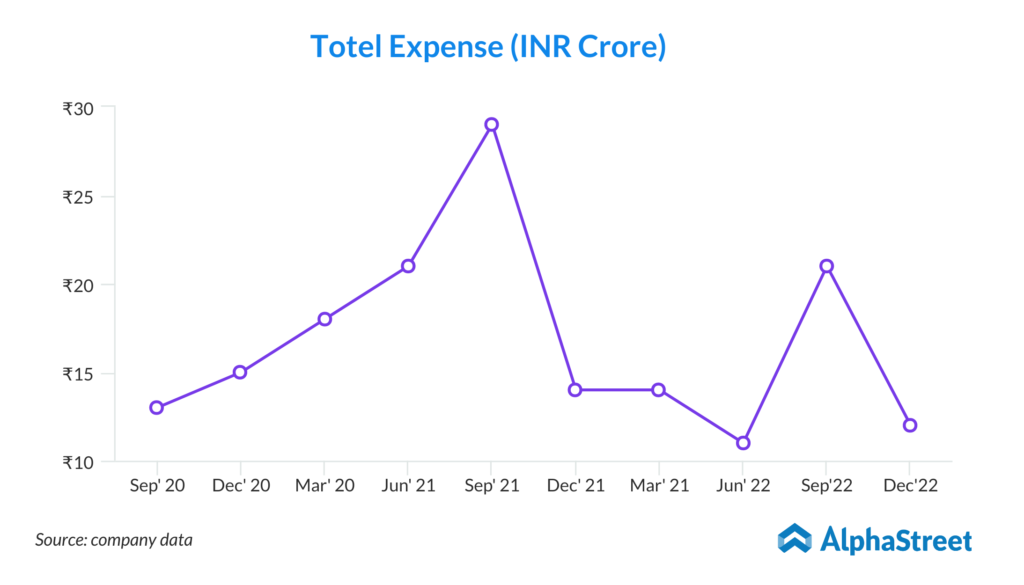

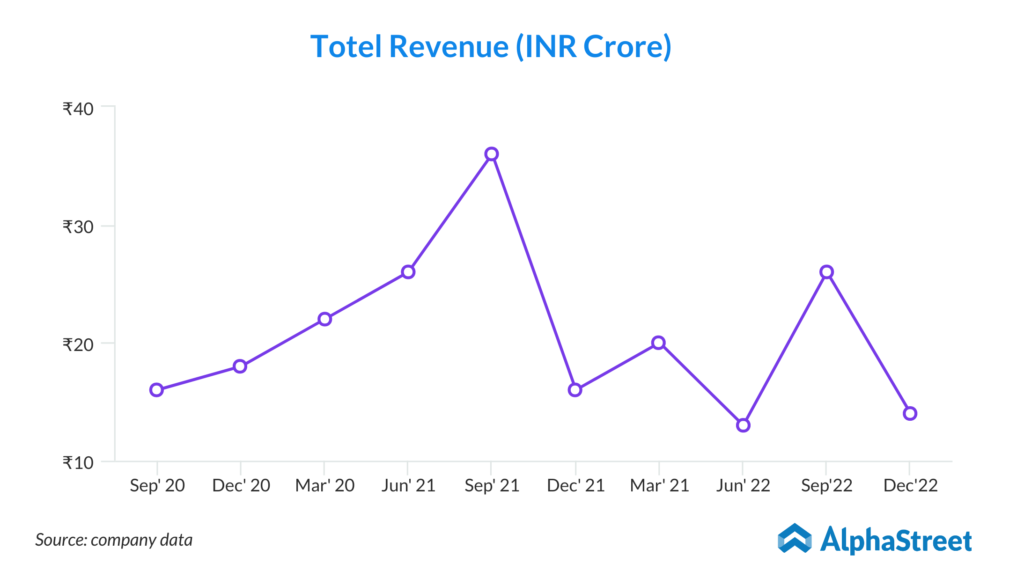

In the 3-month period ended December 31, 2022, the company reported a total income of Rs. 15.3 crore, which is a significant decrease of about 45.5% from the previous quarter’s total income of Rs. 28.0 crore. Similarly, the net profit for the same period decreased from Rs. 5.0 crore to Rs. 2.2 crore, representing a decline of about 56.6%. The company’s EPS also decreased by about 56.6%, from Rs. 11.95 to Rs. 5.19. In comparison to the corresponding period in the previous year, the company’s total income for the 3-month period ended December 31, 2022, decreased by 10.1%, from Rs. 17.0 crore to Rs. 15.3 crore. Similarly, the net profit for the same period decreased from Rs. 7 crore to Rs. 2.2 crore, representing a decline of about 68.5%. The company’s EPS also declined by about 68.5%, from Rs. 16.49 to Rs. 5.19. During the 9-month period ended December 31, 2022, the company reported a total income of Rs. 43.3 crore, which is a decrease of about 46.6% from the corresponding period in the previous year when the total income was Rs. 81 crore. Similarly, the net profit for the same period decreased from Rs. 12.2 crore to Rs. 6.7 crore, representing a decline of about 44.6%. The company’s EPS also declined by about 44.8%, from Rs. 28.82 to Rs. 15.90.

Sika Interplant Systems Ltd. has experienced a decline in its financial performance in the 3-month period ended December 31, 2022, as well as the 9-month period ended December 31, 2022, compared to the corresponding periods in the previous year. The company’s total income, net profit, and earnings per share (EPS) all declined during these periods. This suggests that the company may be facing some challenges in its operations, and it will need to take appropriate measures to address these challenges in order to improve its financial performance in the future.