Info Edge (India) Ltd. (NSE:NAUKRI) is a leading internet technology company in India, with a diverse portfolio of businesses operating in online recruitment, real estate, matrimony, and other sectors. The company’s primary business is in online recruitment, with its flagship brand Naukri.com holding a dominant market share of over 80%.

In addition to Naukri.com, Info Edge operates in the real estate and matrimony markets through its subsidiaries 99acres.com and Jeevansathi.com, respectively. These businesses provide online platforms for users to search for and list properties and to find potential marriage partners.

Naukri.com, the company’s flagship brand, is the leader in the online recruitment industry in India, and its revenue growth is closely tied to the country’s GDP growth. The cash generated by Naukri.com supports the company’s other businesses, including 99acres and Jeevansathi.com, as well as its investments in start-ups.

99acres, the company’s online real estate platform, is well-positioned to benefit from the increasing adoption of digital tools by real estate developers and brokers. As more people turn to online platforms to search for properties and brokers, 99acres is likely to see strong growth in its business.

The company also holds stakes in a number of other businesses, including Zomato and Policybazaar.com. Zomato is a leading online food delivery and restaurant discovery platform, while Policybazaar.com is an online insurance marketplace.

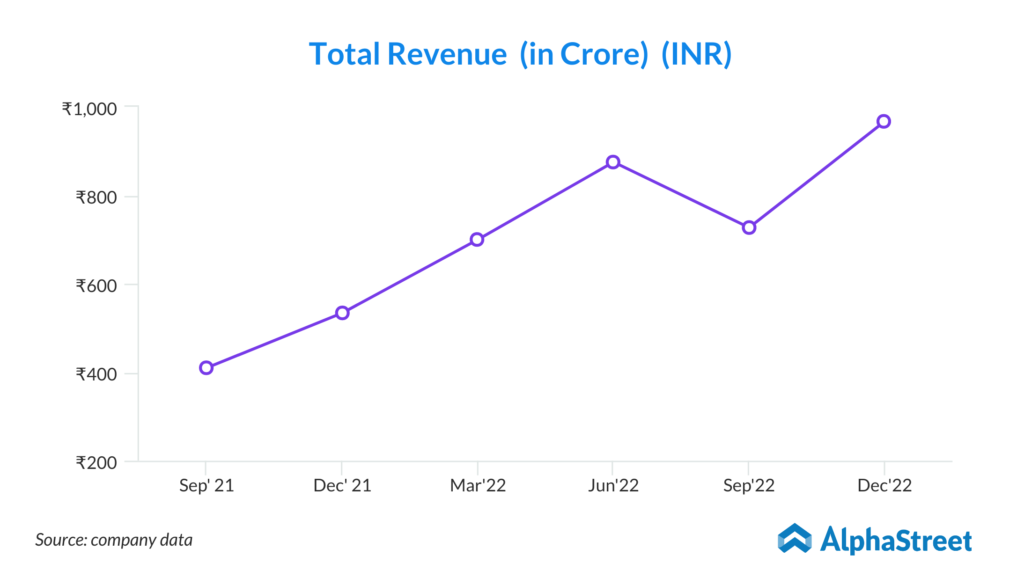

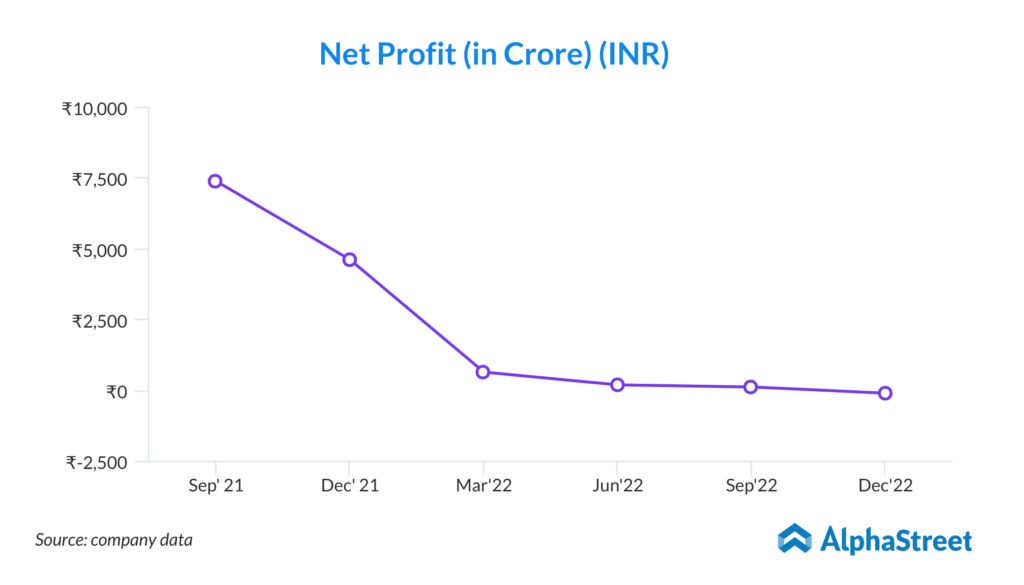

Info Edge’s Q3FY23 results were in line with expectations, with revenues growing 33.4% YoY and 4.4% QoQ to Rs. 555.2 crore. The growth was primarily driven by Recruitment Solutions and 99acres, which saw YoY growth of 40.3% and 24%, respectively. EBITDA margins also improved significantly, increasing by 1,000 bps YoY and 450 bps QoQ to 39.1%, beating estimates by ~400 bps. Adjusted net profit stood at Rs. 191.7 crore, up 61.7% YoY.

However, the company reported a loss of Rs. 84.2 crore due to the write-off of the entire investment of Rs. 276 crore in Proptech start-up 4B Network Ltd. The management cited longer sales cycles and spend optimization, especially for IT, during the quarter. The management also noted that while IT hiring was muted, non-IT hiring in sectors such as insurance, hospitality, retail, and banking posted robust growth.

Despite these challenges, Info Edge’s leadership position in recruitment and real estate verticals is expected to sustain in the long term, and the company’s investments in start-ups such as Zomato and Policybazaar could create additional value. The management commentary suggests that Info Edge faced some challenges during the quarter, particularly in the IT hiring segment, which experienced a slowdown. However, the non-IT customer base sectors such as insurance, hospitality, retail, and banking posted robust growth. The company is seeing higher demand for commercial space from non-IT and retail users.

The management reiterated that Naukri.com remains the number one priority, and the company will continue to invest in the core platform to defend its market share. They also mentioned that 99acres remains an important vertical, and they have set an internal billing target of Rs. 100 crore for Q4. Shiksha has been growing at a reasonable rate and has turned marginally positive.

Regarding the write-off of the entire investment in Proptech startup 4B Networks, the management expressed uncertainty regarding the overall funding environment but allayed apprehensions with respect to real estate and 99acres. Overall, the management seems positive about the company’s prospects and is focused on defending its market share in its core businesses while investing in growth opportunities.

While the company has several growth opportunities, it also faces several risks that investors should be aware of. One of the key risks is the entry of large internet players with aggressive expansion plans into the recruitment business, which could affect Info Edge’s growth trajectory and margins. Additionally, any slower-than-expected economic recovery could also impact the company’s growth prospects.

Another risk is the emergence of new technologies that could disrupt Info Edge’s core businesses. As technology evolves rapidly, the company needs to stay ahead of the curve and continue to innovate to remain competitive. Furthermore, the real estate segment is highly competitive, and there is a risk that Info Edge’s losses could widen if it fails to gain traction in this market.

In the food delivery segment, there is also high competition for attracting talent, which could increase Info Edge’s cash burn rates. Finally, the company’s investments in other businesses also carry a risk of increasing losses.

Despite these risks, Info Edge has several growth opportunities in its various online businesses. Investors should be aware of these risks and monitor the company’s performance closely to ensure that it continues to execute its strategy effectively and deliver sustainable growth over the long term.

The outlook for Info Edge appears positive, given the expected acceleration in the internet economy in India. As more people come online and shift towards digital platforms for recruitment, real estate, and other services, Info Edge is well-positioned to benefit from these trends.

In particular, the company’s recruitment business is likely to see strong growth as GDP growth picks up in India. This business is expected to benefit disproportionately from the shift towards digital recruitment platforms, as print ads become less popular and more companies turn to online solutions.

Additionally, the long-term outlook for 99acres.com, the company’s online real estate platform, appears positive, given the expected growth in the Indian real estate classifieds market. This market is expected to be worth Rs. 60 billion by 2030, with a 21% CAGR over the period from 2018 to 2030.

Overall, the outlook for Info Edge is positive, and the company’s strong market position in its core businesses, as well as its investments in promising start-ups, position it well to benefit from the growth of the digital economy in India. However, as with any investment, investors should carefully consider the company’s valuation and growth prospects before making any investment decisions.