Sterling and Wilson Solar Ltd is one of the leading end-to-end solar engineering, procurement and construction (EPC) solutions provider globally and is also engaged in the operation and maintenance (O&M) of solar power projects. The company is backed by strong parentage of the Reliance Industries. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

-

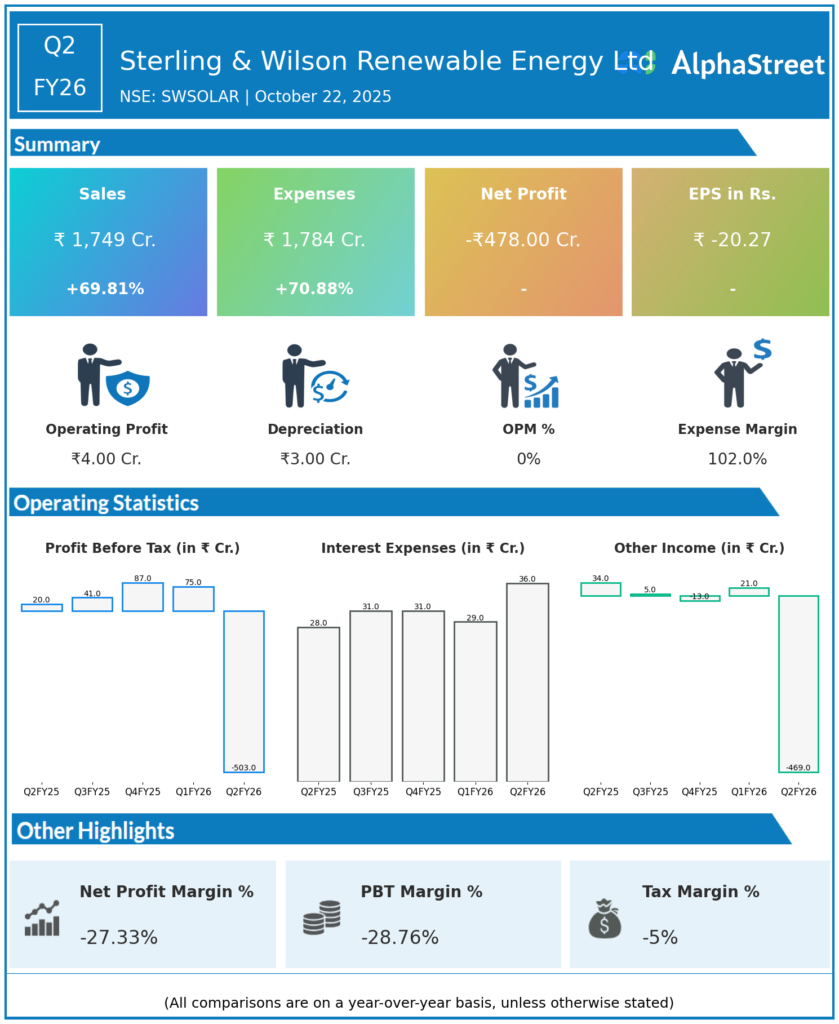

Revenue from Operations: ₹1,749 crore, a 70% YoY increase over ₹1,030 crore in Q2 FY25, supported by stronger domestic and international project execution.

-

Total Income: ₹1,859.65 crore, up 75% YoY from ₹1,064.45 crore in Q2 FY25.

-

Gross Profit: ₹156 crore, with a gross margin of 8.9%, stable YoY driven by higher execution efficiency.

-

Operational EBITDA: ₹62 crore compared to ₹23 crore in Q2 FY25, reflecting improved cost efficiencies and stronger operational discipline.

-

Reported EBITDA: Affected by one-time exceptional write-off of ₹637 crore due to an adverse U.S. arbitration ruling involving a terminated subcontractor; this resulted in a consolidated net loss of ₹477.6 crore for Q2 FY26 vs a profit of ₹8.6 crore in Q1 FY26 and ₹9 crore in Q2 FY25.

-

EBITDA Margin (Operational): 3.5%, compared to 2.2% YoY.

-

EPS: Negative ₹20.27 due to exceptional non-cash provision linked to arbitration.

Order Book and Business Highlights

-

New Order Inflows (FY26 YTD): ₹3,775 crore as of September 30, 2025, driven by large-scale grid and EPC projects in India, Africa, and Southeast Asia.

-

Unexecuted Order Book: ₹9,287 crore, providing visibility over the next 18–24 months.

-

Projects Won in Q2 FY26:

-

363 MWp in Rajasthan.

-

580 MWp in Uttar Pradesh.

-

115 MWp in South Africa.

-

Total contract value approximately ₹1,772 crore (USD 120 million).

-

-

Global Portfolio: Total installed capacity now exceeds 24.4 GWp across 28 countries, consolidating SWREL’s position as one of the largest India-based solar EPC players.

-

Capex: Focused on strengthening asset-light digital design and centralized procurement systems to support international scalability.

Management Commentary and Strategic Insights

C.K. Thakur, Global CEO of Sterling and Wilson Renewable Energy Group, stated:

“Despite geopolitical and arbitration-related setbacks, our Q2 performance reflects encouraging operational momentum. We achieved strong revenue growth and maintained project efficiency in both domestic and global markets. The exceptional charge is non-recurring, and we continue to focus on execution excellence, cash flow improvement, and expanding our clean energy portfolio across growth markets.”.

-

Management reaffirmed focus on diversification beyond EPC, with engagements in energy storage, hybrid solar-wind systems, and collaborations in green hydrogen feasibility projects.

-

Ongoing implementation of risk assessment frameworks aims to mitigate arbitration-related exposure and contract delays seen in legacy global projects.

-

Upcoming quarters expected to deliver consistent operating profits, supported by higher-margin domestic orders and strengthening of international partnerships with global utilities.

Q1 FY26 Earnings Results

-

Revenue: ₹1,762 crore, up 61% YoY, maintaining strong execution momentum from Q4 FY25.

-

Net Profit (PAT): ₹38.7 crore, driven by favorable execution and lower finance costs before Q2 arbitration impact.

-

EBITDA: ₹79 crore, with margin at 4.5%.

-

Order Book: ₹8,750 crore as of June 2025, prior to new inflows in Q2.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.