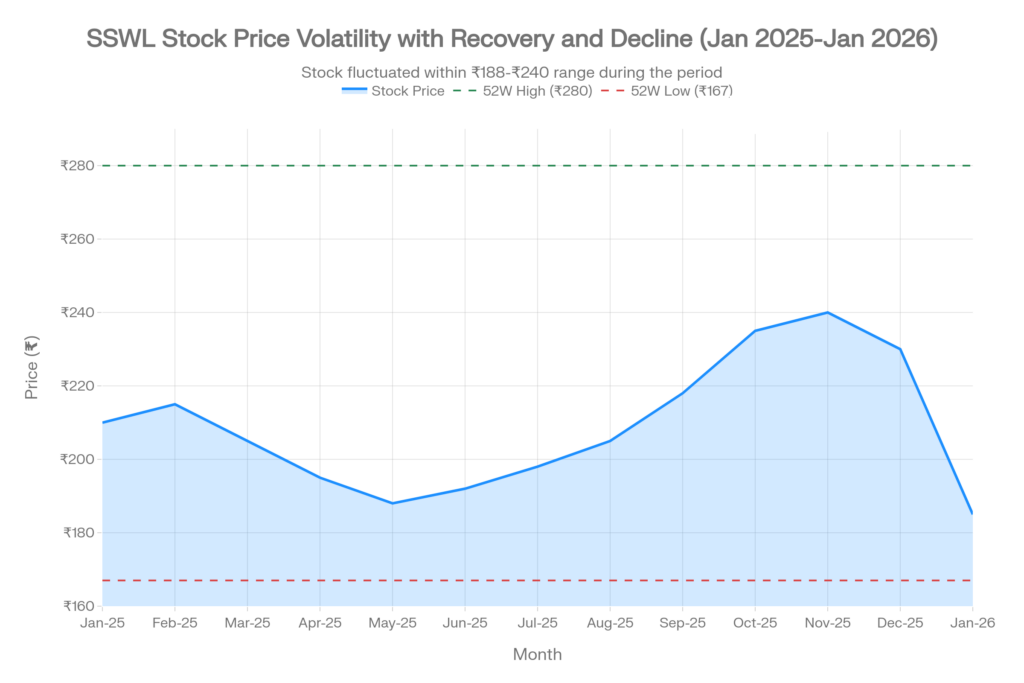

Steel Strips Wheels Ltd. (SSWL, NSE/BSE), India’s leading automotive wheel manufacturer, reported its strongest quarterly revenue on record while stock declined to ₹185.04, down 1% from the previous close. Market capitalization stands at approximately ₹2,918 crore as of today’s close.

Q3 FY26 Quarterly Results

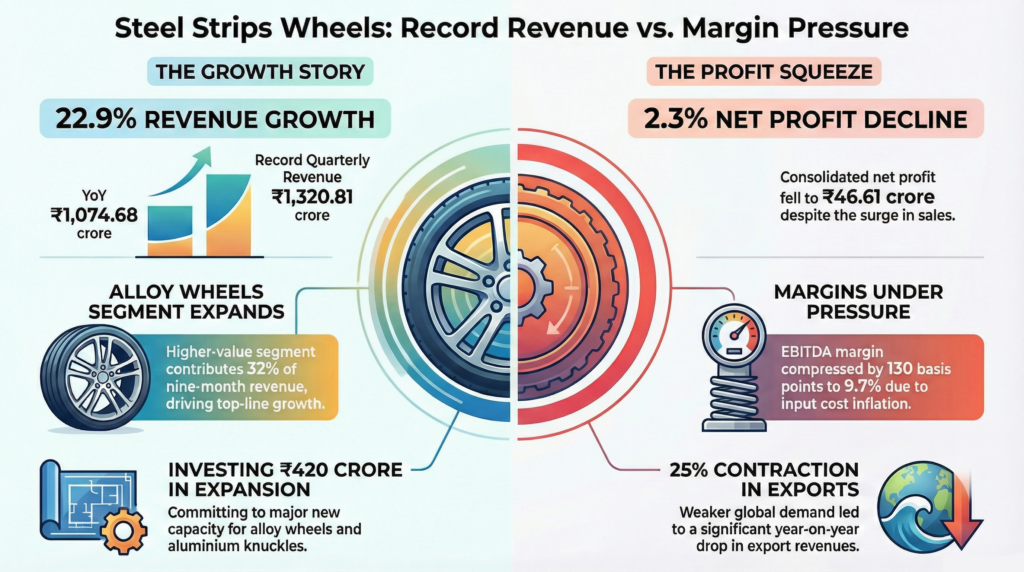

Steel Strips Wheels Ltd. (SSWL) reported record quarterly revenue of ₹1,320.81 crore for Q3 FY26, a 22.9% year-on-year increase from ₹1,074.68 crore. Consolidated net profit for the period was ₹46.61 crore, representing a 2.31% decline from ₹47.71 crore in Q3 FY25. Earnings before interest, tax, depreciation, and amortization (EBITDA) rose 8.5% to ₹127.8 crore, though the EBITDA margin compressed 130 basis points to 9.7%. The profit-after-tax margin fell to 3.5% from 4.4% in the prior-year quarter. Profit before tax stood at ₹61.65 crore, a 4.19% decrease. Sequentially, revenue grew 10% and net profit increased 31.2% compared to Q2 FY26.

FY2025 Annual Performance Context

For the nine-month period ending December 31, 2025, revenue reached ₹3,708.17 crore, up 16.1% year-on-year from ₹3,195.1 crore. Cumulative net profit declined 3.90% to ₹129.37 crore. Nine-month EBITDA reached ₹361.8 crore with a 9.8% margin, compared to 11.0% previously. The company has secured 83.7% of its total FY25 revenue target of ₹4,429 crore. These metrics track against a backdrop of domestic automotive demand recovery, though export markets remain subdued. Current capital efficiency shows a return on equity of 13.18% and return on capital employed of 14.04%, both trailing historical benchmarks.

Financial Snapshot

Stock Trend

Business and Operations Update

The alloy wheel segment contributed 32% of nine-month revenue, with its volume contribution rising to 20% from 7% in FY20. Aluminum knuckle production reached 3.5 lakh units in Q3. Export revenues contracted 25% year-on-year to ₹131 crore due to global demand volatility. SSWL integrated AMW Autocomponent Limited after a ₹138.15 crore acquisition, which included ₹5 crore in equity and ₹133.15 crore as an inter-corporate loan. Strategic partners Tata Steel and Nippon Steel hold stakes of 6.9% and 5.4%, respectively. Domestic market penetration remains significant, including 35% at Maruti Suzuki and 31% at Hyundai.

Forward Outlook

SSWL is executing a ₹420 crore capital expenditure plan. This includes ₹300 crore for a 7.2-million-unit alloy wheel facility in Gujarat and ₹120 crore for an aluminum steering knuckle unit. Both projects are expected to be operational by Q4 FY27, funded via debt and internal accruals. Management targets increasing aluminum knuckle production to 5.0 lakh units by the end of FY26 and 11.0 lakh units by FY27. Alloy wheel production is projected to reach 5.3 million units by FY26, with an expected 12% annual market growth rate and 4% for steel wheels.

Performance Summary

SSWL achieved record revenue of ₹1,320.81 crore in Q3 FY26, though margin compression of 130 basis points from inflation impacted profitability. Stock prices declined 1% to ₹185.04 with a market capitalization of ₹2,918 crore. Fiscal 2024 cash accruals of ₹487 crore provide liquidity for ongoing expansions. Future growth remains contingent on export stabilization and margin recovery in the final quarter. Company prioritizes product mix improvement to offset structural margin pressures. Operating margins excluding other income stood at 9.65% for this reported period