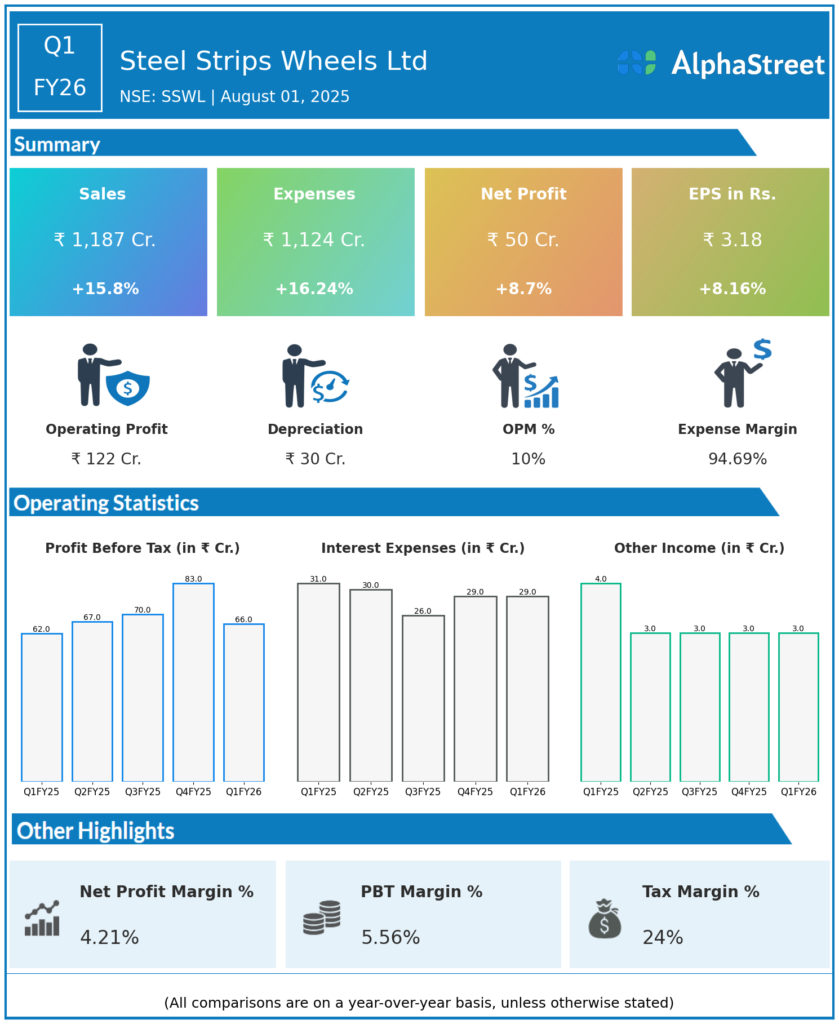

Steel Strips Wheels Ltd was incorporated in 1985 and started its operations in 1991. It designs, manufactures, and supplies Steel Wheel Rims and Alloy Wheels for a wide range of domestic and global automobile makers. It is Headquarter in Chandigarh. Presenting below are its Q1 FY26 earnings.

Q1 FY26 Earnings Summary

-

Standalone Revenue from Operations: Approximately ₹1,186.78 crore, up about 15.75% year-over-year (YoY).

-

Net Profit (Standalone PAT): Approximately ₹49.94 crore, up about 9% YoY from ₹46.2 crore in Q1 FY25.

-

EBITDA: About ₹125.15 crore for the quarter.

-

EBIT Margin: Around 8.7-9.1%, consistent with prior quarters.

-

Growth Drivers: Volume growth driven by improving demand in automotive sector and strong operational execution.

-

Segment Performance: Core wheel manufacturing and allied auto component operations showed steady growth; export revenues contributing positively.

Key Management Commentary & Strategic Highlights

-

Management highlighted steady growth in automotive OEM demand contributing to volume and revenue expansion.

-

Operational efficiencies and cost management efforts helped maintain stable margins despite inflationary pressures.

-

Focus on increasing capacity utilization and new client additions in domestic and export markets.

-

Emphasis on product quality, innovation, and compliance with new automotive standards driving competitive advantage.

-

Outlook remains cautiously optimistic based on improving industry demand, supply chain normalization, and new product launches.

Q4 FY25 Earnings Summary

-

Consolidated Total Income: Around ₹1,237 crore, with a growth of roughly 15% YoY.

-

Profit After Tax (PAT): Between ₹62 crore range across standalone and consolidated, consistent with sequential improvements.

-

EBITDA: Approximately ₹112 crore.

-

Margins: EBIT margin was near 8.9–9.1%.

-

Performance Drivers: Strong volumes in wheels and centrifugal components; favorable demand from key automotive customers.

-

Operational Notes: Cost controls and efficiency improvements aided profitability despite raw material price fluctuations.

To view its previous earnings, please click here