Star Health and Allied Insurance Co Ltd (BSE: 543412 / NSE: STARHEALTH) reported higher profitability in the quarter ended December 2025, supported by premium growth, improved loss ratios and stronger investment income, according to its Q3 FY26 disclosures.

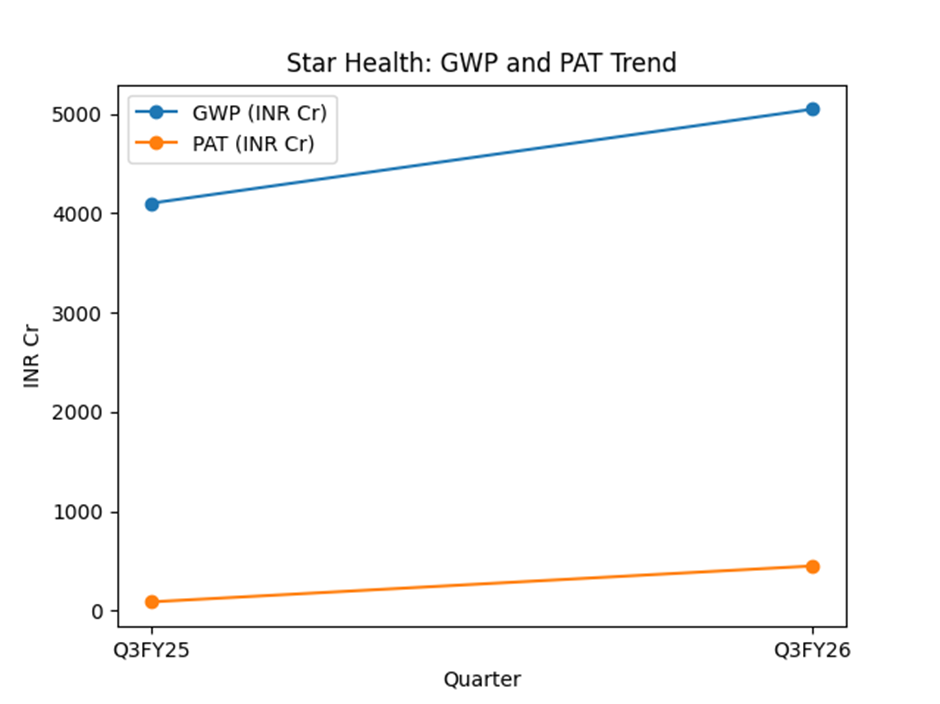

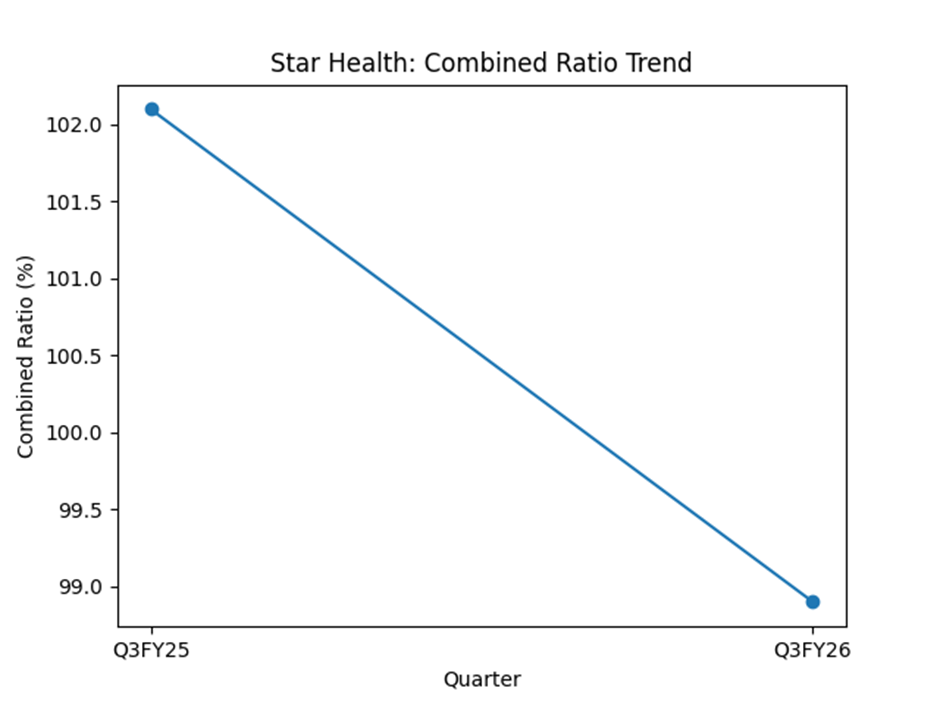

The company reported profit after tax (PAT) of ₹449 crore under Ind AS for Q3 FY26, up 414% year-on-year, while gross written premium (GWP) rose 23% to ₹5,047 crore. The combined ratio improved to 98.9% from 102.1% a year earlier.

Business overview

Star Health is a standalone health insurer offering health, personal accident and travel insurance products. The company operates a multi-channel distribution network with agents, bancassurance partners and digital platforms.

As of FY2025, the company reported a broad distribution footprint with over 8 lakh agents and 915 offices, supported by more than 14,500 network hospitals.

Financial performance

In Q3 FY26, gross written premium increased to ₹5,047 crore from ₹4,099 crore in Q3 FY25. Net earned premiums rose 12% to ₹4,250 crore.

Profit before tax rose to ₹594 crore from ₹117 crore, while PAT increased to ₹449 crore from ₹87 crore. Investment income grew to ₹569 crore, compared with ₹206 crore a year earlier.

For the nine months ended December 2025, PAT rose 87% year-on-year to ₹966 crore, while GWP increased 16% to ₹13,857 crore.

Underwriting and operating metrics

The loss ratio improved to 68.8% from 71.8%, while the expense ratio declined marginally to 30.1% from 30.3%. The combined ratio improved by 317 basis points to 98.9%.

Retail gross written premium grew 27% year-on-year to ₹4,838 crore in Q3 FY26, driven by growth in fresh retail premiums. The company reported retail health market share of 31.3% for 9M FY26.

Customer and digital indicators

The company reported renewal persistency of 99.2% during 9M FY26 and improvement in net promoter score (NPS) to 64 from 55 a year earlier.

Digital channels accounted for 20% of fresh retail sales and 76% of premium collections, while the customer application recorded more than 13 million downloads by December 2025.

Key developments

Star Health highlighted portfolio recalibration, underwriting discipline and expense management as contributors to improved operating metrics. The company also reported an investment yield of 9.6%.

Risks and constraints

Disclosures indicate that profitability remains sensitive to claims trends, pricing discipline, regulatory changes, competitive intensity and investment income volatility.

Outlook and commentary

Management stated that improvements in loss ratio, expense efficiency and customer experience contributed to a stronger operating profile during the quarter.