Star Cements Ltd is engaged in manufacturing and selling of Cement Clinker & Cement. It sells its products across north-eastern and eastern states in India. It is the largest cement manufacturer in North-east India.

Q2 FY26 Earnings Results:

-

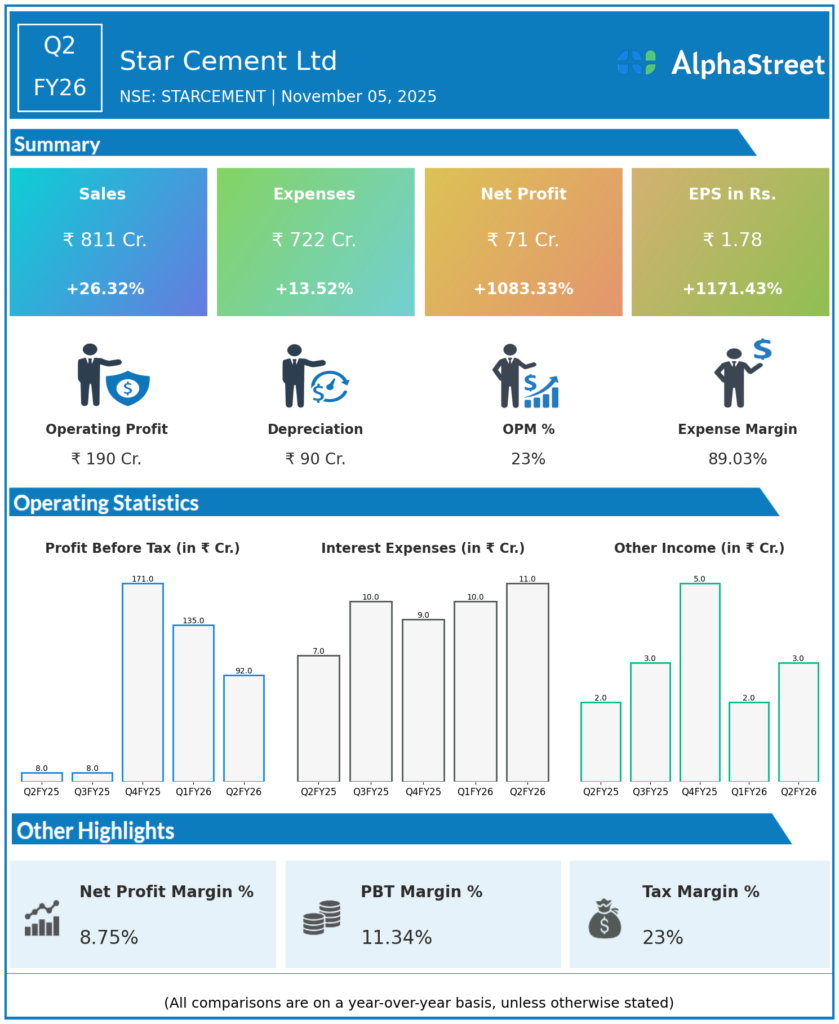

Revenue from Operations: ₹810.94 crore, up 26.4% YoY from ₹641.55 crore, but down 11.1% QoQ due to monsoon-related seasonality.

-

Net Profit After Tax (PAT): ₹71.95 crore, a massive 1,153.5% YoY jump due to a low base in Q2 FY25 (₹5.74 crore), but a 26.9% QoQ decline.

-

Operating Profit (PBDIT excl OI): ₹190.16 crore; margin at 23.45% (up from 14.90% YoY but down 158 bps sequentially).

-

PAT margin: 8.76% (vs 10.76% in Q1 FY26 and only 0.88% in Q2 FY25).

-

Consolidated revenue: ₹814.4 crore; consolidated PAT: ₹71.94 crore.

-

Employee costs: ₹71.49 crore, up due to wage inflation and expansion.

-

Interest expenses: ₹11.06 crore, up YoY.

-

Depreciation: ₹90.22 crore, reflecting capitalisation of a new grinding unit.

-

Board approved a fundraising plan of up to ₹1,500 crore to fund future expansion.

-

Non-current borrowings have increased due to capacity expansion.

-

Operating cash flow turned strongly positive in H1 FY26.

Management Commentary & Strategic Insights:

-

Management highlighted robust sales in North East India, price discipline, and ongoing demand from infrastructure.

-

Noted margin pressure sequentially due to rising energy/input costs and competitive market.

-

Emphasis on cost control, premiumization, and further expansion, with a strong pipeline for new projects and capacity increases.

-

Seasonality (monsoon) was a major factor in the sequential revenue and margin dip.

-

Continued focus on disciplined capital allocation, technology, and achieving volume guidance of 12-15% growth for FY26.

Q1 FY26 Earnings Results:

-

Revenue: ₹913.8 crore, up 21.5% YoY.

-

PAT: ₹98.16 crore, up 216.7% YoY and 12% QoQ.

-

Cement sales volume: 12.22 lakh tons, up 5.9% YoY.

-

EBITDA: ₹230 crore, margin above 25%.

-

EPS: ₹2.40 vs ₹0.80 YoY.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.