SRM Contractors Limited (NSE: SRM | BSE: 544158), a specialized engineering and construction firm focused on high-barrier infrastructure in India’s northern border regions, today released its investor presentation for the quarter and nine months ended December 31, 2025. The results underscore a period of transformative growth, highlighted by the strategic consolidation of its new subsidiary and a significant expansion in operational scale.

Financial Highlights: Exponential Growth Trajectory

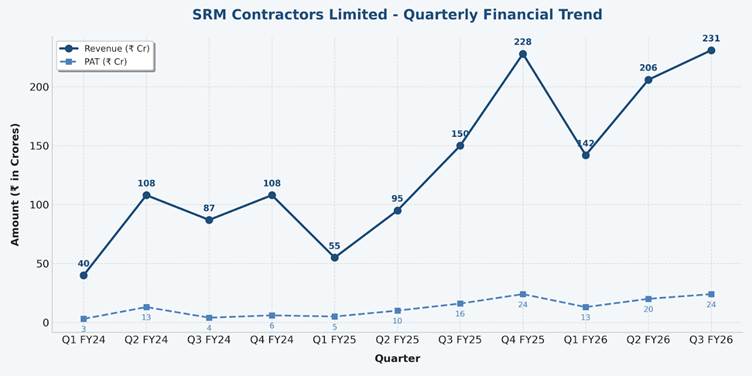

The company delivered a robust performance in Q3 FY26, benefitting from improved execution efficiency and the first-time consolidation of its geotechnical arm.

- Consolidated Revenue: Revenue from operations grew 53.7% year-on-year (YoY) to ₹231.21 crore, up from ₹150.44 crore in Q3 FY25.

- Profitability: Consolidated Profit After Tax (PAT) surged 50.6% YoY to ₹24.10 crore. For the nine-month period (9M FY26), net profit reached ₹57 crore, an 83% increase over the previous year.

- Margin Expansion: EBITDA margins improved to 19.3% in Q3 FY26 (vs. 17.2% in Q3 FY25), driven by a higher mix of specialized slope stabilization and tunnel projects.

- Earnings Per Share (EPS): Consolidated basic EPS for the quarter stood at ₹10.50, reflecting the company’s enhanced earning power post-IPO.

Operational Milestones and Strategic Integration

A key driver for this quarter’s results was the strategic integration of Maccaferri Infrastructure Private Limited (MIPL), in which SRM acquired a 51% stake.

- Maccaferri Consolidation: MIPL’s revenue was consolidated into SRM’s results for the first time in Q3. This partnership provides SRM with advanced geosynthetic technologies and a gateway to international markets in the GCC and Africa.

- Order Book Visibility: The company’s order book remains healthy at approximately ₹1,424 crore, representing roughly 2.7x its FY25 revenue.

- Project Diversification: While the core remains in Jammu & Kashmir and Ladakh (Roads: 66%, Slopes: 24%, Tunnels: 10%), SRM is successfully diversifying. Notable recent wins include a ₹155 crore road project in Maharashtra and a ₹110 crore pumped storage project.

- Leadership Update: Following the transition of CEO responsibilities to the Managing Director, Mr. Puneet Pal Singh now oversees all domestic operations, ensuring unified strategic execution.

Financial Strength and Market Valuation

The company has utilized its IPO proceeds to significantly deleverage, positioning it for capital-intensive growth.

- Deleveraging: The debt-to-equity ratio has improved to 0.16x, earning the company a credit rating upgrade to ‘CARE A-‘ from CARE Edge Ratings.

- Capex Execution: Out of the planned ₹70 crore capex for FY26, the company has already completed investments of over ₹48 crore in specialized high-altitude machinery.

- Valuation Metrics: At the current market price of ₹425.90, SRM trades at a trailing P/E of approximately 13x, significantly lower than the engineering-construction industry median of 17x.

Management Outlook

SRM management maintains an optimistic outlook for the remainder of the fiscal year, guiding for FY26 consolidated revenues between ₹1,100 crore and ₹1,200 crore. The company plans to aggressively pursue Hybrid Annuity Model (HAM) projects and further expand its footprint into the Northeast in collaboration with the Border Roads Organization (BRO).