Incorporated in 1970, SRF Ltd manufactures and sells technical textiles, chemicals, packaging films, aluminum foils, and other polymers.

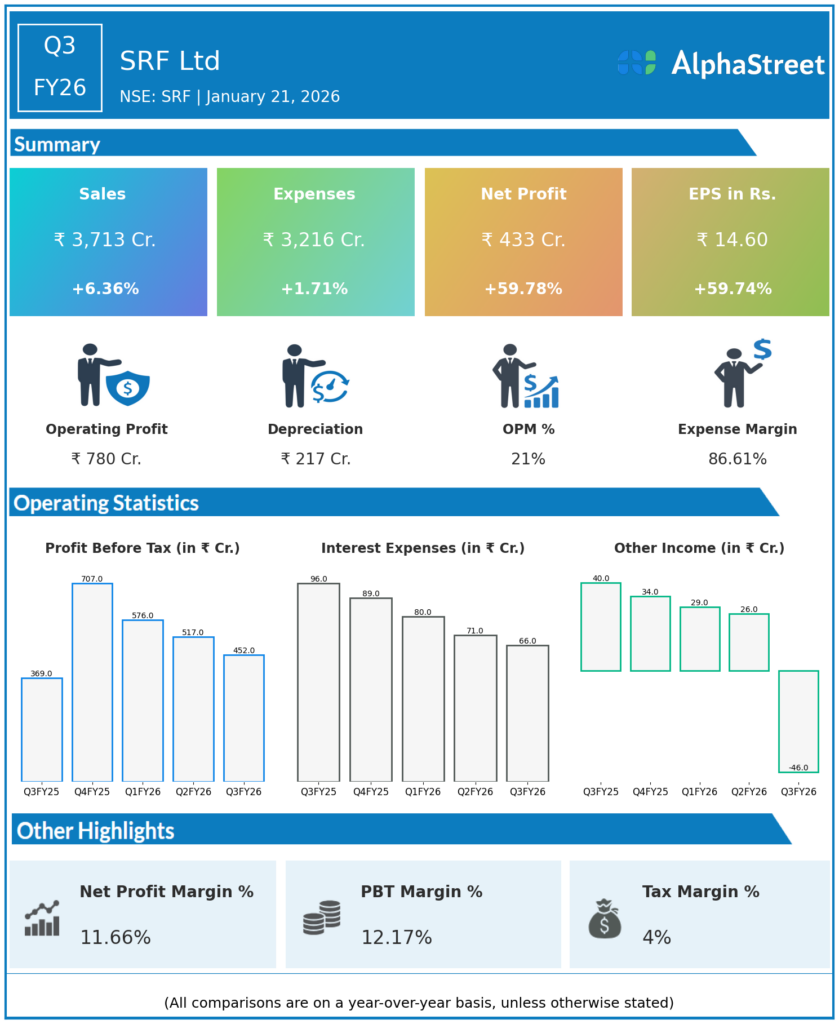

Q3 FY26 Earnings Results

- Gross Operating Revenue: ₹3,712.5 crore, up 6.3% YoY from ₹3,491.3 crore in Q3 FY25; up 1.99% QoQ from ~₹3,640 crore in Q2 FY26.

- Revenue from Operations: ₹3,712.53 crore, up 6.35% YoY.

- EBIDTA: ₹847.5 crore, up 22.2% YoY from ₹693.4 crore; EBIDTA margin 22.8%.

- EBIT: ₹653 crore, up 23% YoY from ₹529 crore.

- Profit Before Tax (PBT): ₹451.7 crore, up 22.5% YoY from ₹368.7 crore.

- Profit After Tax (PAT): ₹432.7 crore, up 59.6% YoY from ₹271.1 crore.

- 9M FY26 performance:

- Gross Operating Revenue: ₹11,171.3 crore, up 7.6% YoY from ₹10,379.7 crore.

- EBIDTA: ₹2,528.3 crore, up 30.8% YoY.

- PAT: ₹1,253.2 crore, up 72.9% YoY from ₹724.7 crore.

Business Segments – Q3 FY26

- Chemicals Business:

- Revenue: ₹1,824.8 crore, up 22.0% YoY.

- EBIT: ₹496.0 crore, up 36.4% YoY.

- Packaging Films Business:

- Revenue: 9M FY26 ₹4,168.6 crore, up 0.7% YoY.

- EBIT: 9M FY26 ₹353.9 crore, up 36.2% YoY.

- Others (Coated & Laminated Fabrics):

- Revenue: ₹91.9 crore, down 9.1% YoY.

- EBIT: ₹17.0 crore, up 8.3% YoY.

Management Commentary & Strategic Decisions – Q3 FY26

- Management attributed strong profitability growth to robust chemicals business momentum, with revenue up 22% and EBIT up 36% YoY, while packaging films showed resilience despite volume and pricing challenges from imports.

- PAT growth of 60% YoY was supported by operating leverage, cost efficiencies and favourable mix, even amid global headwinds in select segments.

- Strategic focus areas:

- Continued investment in chemicals capacity expansion and specialty products to capitalise on demand from EV, refrigeration and pharma intermediates.

- Operational optimisation in packaging films to counter import competition and improve competitiveness in BOPET/BOPP.

- Sustaining R&D and innovation to drive higher‑margin, sustainable products across the portfolio.

Q2 FY26 Earnings Results

- Gross Operating Revenue: ₹3,640 crore, up 6% YoY from ₹3,424 crore in Q2 FY25.

- EBIT: ₹650 crore, up 56% YoY from ₹417 crore.

- Profit After Tax (PAT): ₹388 crore, up 93% YoY from ₹201 crore.

- H1 FY26: Revenue ₹7,051 crore, up 6% YoY; PAT ₹750 crore, up 87% YoY.

Management Commentary & Strategic Directions – Q2 FY26

- Management highlighted strong H1 performance with double‑digit PAT growth driven by chemicals and operational efficiencies, despite packaging films facing pricing pressures.

- Strategic emphasis on capacity expansion in high‑growth chemicals and cost discipline to sustain profitability momentum.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.