Incorporated in 1970, SRF Ltd manufactures and sells technical textiles, chemicals, packaging films, aluminum foils, and other polymers. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

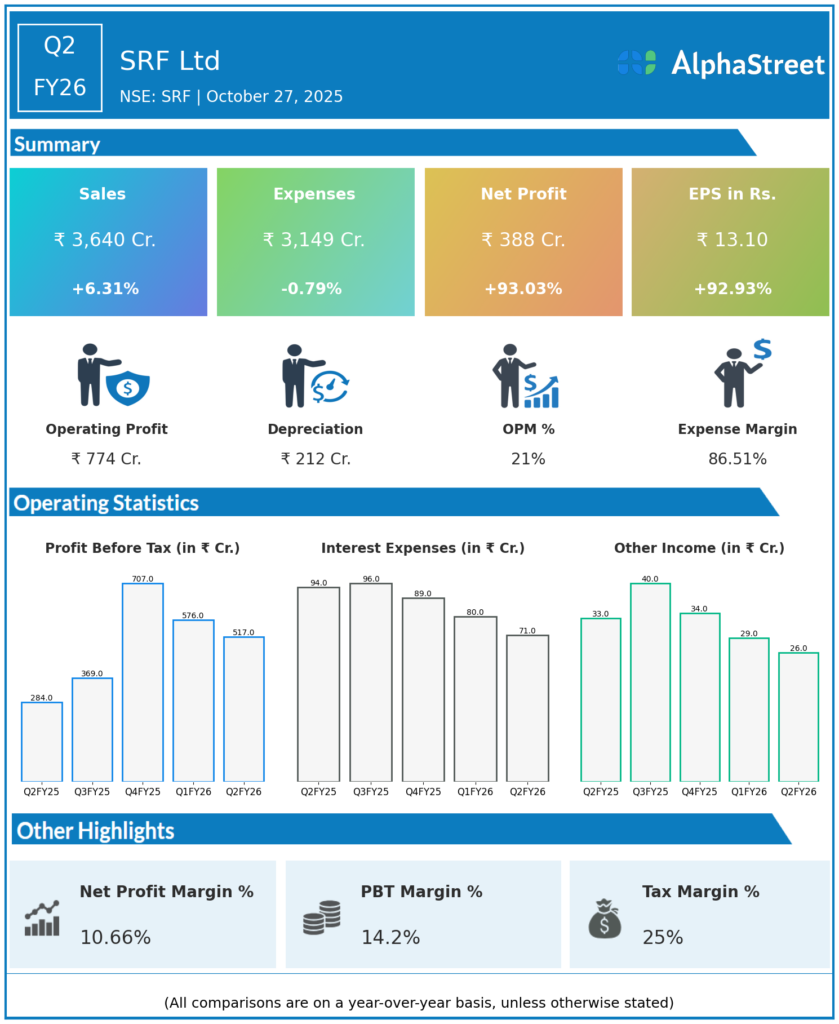

Revenue from Operations: ₹3,640 crore, up 6.4% YoY from ₹3,420 crore in Q2 FY25.

EBITDA: ₹774 crore, up 42% YoY from ₹544 crore; EBITDA margin rose to 21.3% versus 15.7% YoY.

Profit Before Tax (PBT): Not explicitly stated, but Net Profit (PAT) nearly doubled.

Profit After Tax (PAT): ₹388 crore, up 93% YoY from ₹201 crore.

Chemicals Business: Revenue grew 23% YoY, Operating Profit (segmental EBIT) surged 96%.

Technical Textiles: Revenue and profit declined, reflecting ongoing segmental challenges.

Capital Expenditure: Approved increase from ₹595 crore to ₹745 crore for current expansion projects.

CFO Transition: Rahul Jain (current CFO) set to step down in December 2025.

Management Commentary & Strategic Actions

-

SRF’s management highlighted strong margin expansion, led by robust export growth and improved product mix in the Chemicals segment.

-

The company has commenced a strategic collaboration with The Chemours Company for fluoropolymers and fluoroelastomers, aiming to accelerate plant automation and high-value exports.

-

Technical textiles continue to be affected by global weakness in tire cord and pricing pressure from Chinese imports.

-

Ongoing capex across specialty chemical and packaging film units will support capacity ramp-up for high-margin verticals.

-

Management remains optimistic about Chemical business momentum, with targeted market diversification and leadership continuity despite the upcoming CFO transition.

-

Board reaffirms focus on disciplined capital allocation, R&D, and maintaining industry-leading profitability and shareholder returns.

Q1 FY26 Earnings Results

Revenue from Operations: ₹3,818.6 crore, up 10.2% YoY from ₹3,464.1 crore in Q1 FY25.

EBITDA: ₹858.96 crore, up 36.6% YoY; margin improved to 22.5%.

Profit After Tax (PAT): ₹432.3 crore, up 71.4% YoY from ₹252.2 crore.

Chemicals Business: Contributed ₹1,838.95 crore revenue.

Performance Films & Foil: Revenue ₹1,418 crore, EBIT up 62%.

Technical Textiles: Revenue ₹467 crore, EBIT down 44%.

Capex Announcements: ₹250 crore for agrochemical intermediates, ₹490 crore for BOPP film plant.

Interim Dividend: ₹4/share announced

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.