Sona BLW Precision Forgings is an India-based automotive technology company. The company is engaged in designing, manufacturing and supplying engineered automotive systems and components such as differential assemblies, gears, conventional and micro-hybrid motors, BSG systems and EV Traction motors across all vehicle categories. The company develops mechanical and electrical hardware systems, components as well as base and application software solutions. Presenting below are its Q2 FY26 earnings results.

Q2 FY26 Earnings Results

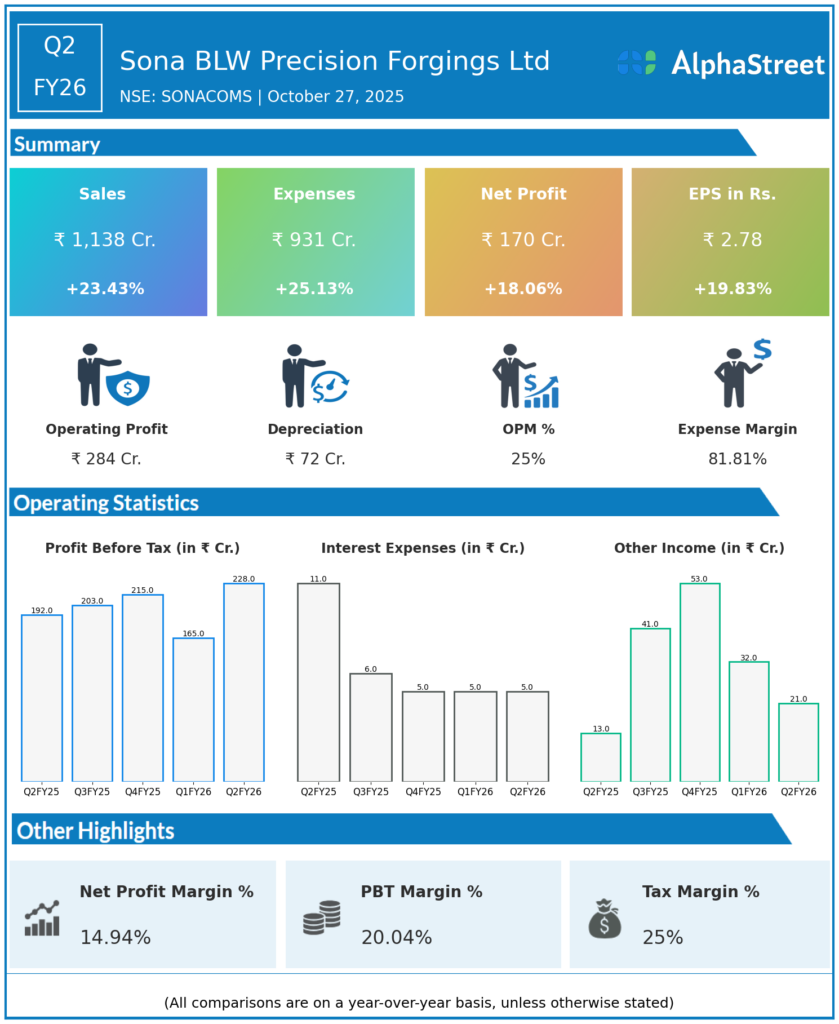

Revenue from Operations: ₹1,138 crore, up 23% YoY and up 33% QoQ (highest quarterly revenue on record).

EBITDA: ₹289 crore, up 13% YoY; EBITDA margin 25.3%.

Profit After Tax (PAT): ₹170 crore, up 18% YoY and up 39% QoQ; PAT margin 14.9%.

Net Order Book: ₹23,600 crore.

BEV Segment: Revenue ₹365 crore, comprised 32% of total; declined 17% YoY.

Stock Options: 630,000 granted to employees in Q2.

Strategic Decisions: Suspended China JV with Jinnaite Machinery.

Executive Appointment: Pratik Sachan named Head of Strategy & M&A.

Management Commentary & Strategic Directions

-

Management reported “the highest-ever revenue, EBITDA, and net profit in a single quarter,” driven by record demand across global automotive programs and continued product portfolio expansion.

-

The quarter also saw successful development and validation of rare-earth free motors for EV applications, positioning Sona Comstar as a leader in sustainable mobility tech.

-

Despite YoY pressure in BEV revenues due to global inventory destocking, ICE and hybrid program wins enabled robust total growth. Export and rail segment outperformed.

-

Focus remains on prudent capital allocation, order book diversification, and technology innovation. The China JV suspension was described as a risk-management and alignment move.

-

The company reiterated guidance for double-digit annual growth, continued productivity improvement, and advancing its electrification and global customer base.

-

Margins were supported by operational leverage, though inflation in input costs and currency impact persist as watch areas.

Q1 FY26 Earnings Results

Revenue from Operations: ₹851 crore, down 5% YoY.

EBITDA: ₹203 crore, down 19% YoY; margin 23.8%.

Profit After Tax (PAT): ₹124.7 crore, down 12% YoY.

BEV Segment: Revenue ₹202 crore, down 25% YoY; comprised 28% of total.

Order Book: All-time high at ₹26,200 crore as of June 2025.

Operational Highlights: Secured large North American OEM order, with new EV programs contributing to 75% of net order book.

Strategic Notes: Four temporary adverse factors impacted Q1 profits, expected to normalize through H2 FY26

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.