Somany Ceramics Ltd is engaged in manufacturing and trading of complete decor solutions, its products include ceramic wall and floor tiles, polished vitrified tiles, glazed vitrified tiles, sanitary-ware, bath fittings and allied products.

Q2 FY26 Earnings Results

-

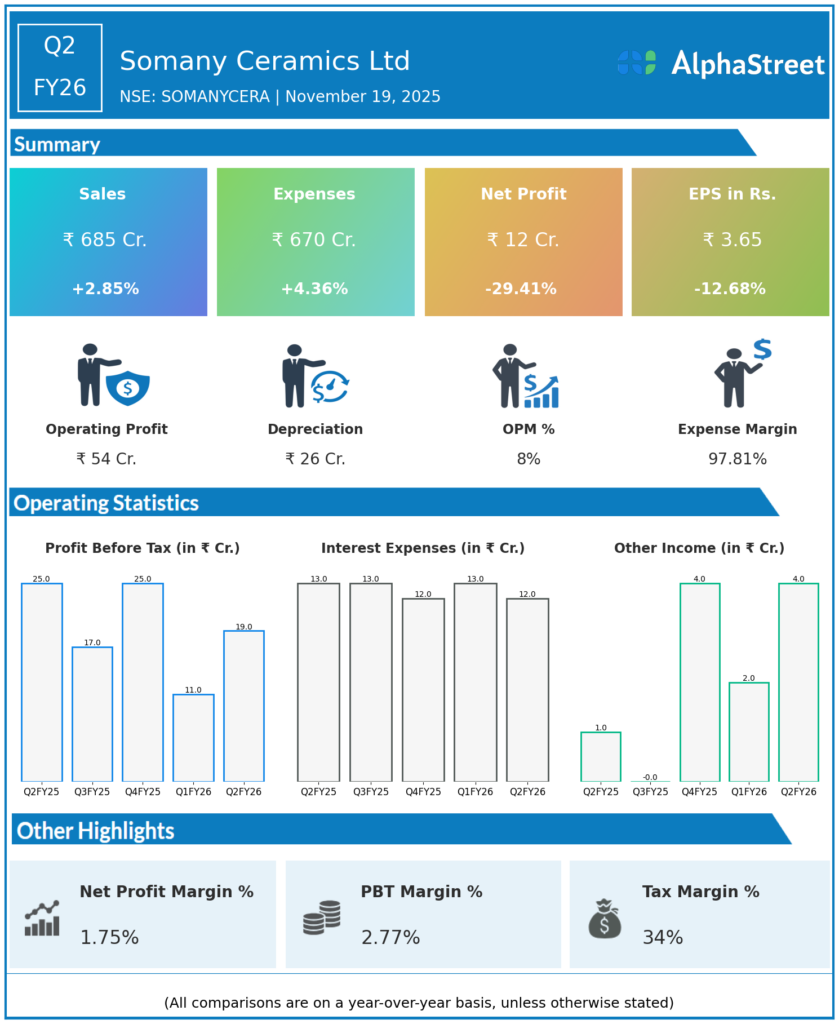

Consolidated Revenue: ₹685 crore, up 13.6% QoQ from ₹606.34 crore in Q1 FY26 and a 2.8% increase YoY from ₹667.65 crore in Q2 FY25.

-

Profit Before Tax (PBT): ₹18.58 crore, up 63.1% QoQ but down 24.7% YoY from ₹24.68 crore in Q2 FY25.

-

Profit After Tax (PAT): ₹12.31 crore, a 67.5% increase QoQ from ₹7.35 crore in Q1 FY26 but down 29% YoY from ₹17.34 crore in Q2 FY25.

-

Earnings Per Share (EPS): ₹3.65, up 44.8% QoQ and down 12.7% YoY.

-

Tile volumes remained flat YoY at 17.8 million square meters.

-

EBITDA margins were under pressure due to a combination of muted volumes, cost inflation, and a one-off impact, but management projects margin recovery in H2 FY26.

-

Key developments include approval of a draft scheme of amalgamation merging Somany Bathware, Somany Excel Vitrified, and SR Continental with Somany Ceramics, and acquisition of 51% stake in Dura Build Care.

Management Commentary & Strategic Insights

-

The management highlighted steady revenue growth despite challenging market conditions, including disruptions from weather and softer retail demand.

-

Emphasis on operational efficiencies and cost-optimization initiatives to stabilize margins.

-

Export markets from the Morbi cluster are showing signs of recovery, aiding overall volume recovery and pricing discipline.

-

The amalgamation plan aims to create operational synergies and unlock value across subsidiaries.

-

Management expects EBITDA margin improvement of about 150 basis points in H2 FY26 as utilization rises and favorable operating environment continues.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹606.34 crore, up 4.4% YoY, down 18% QoQ from ₹739.11 crore in Q4 FY25.

-

Profit After Tax (PAT): ₹7.35 crore, down about 40% YoY and 78% QoQ from ₹33.88 crore in Q4 FY25.

-

EBITDA margin was around 8%, under pressure from increased operating expenses.

-

Tile volumes steady but realizations dipped slightly impacting topline.

-

EPS was ₹2.52 showing decline from prior periods.

-

Management focused on cost control and navigating challenging macroeconomic and weather-related headwinds

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.