Solara Active Pharma Sciences Ltd is engaged in business of manufacturing, production, processing, formulating, sale, import, export, merchandising, distributing, trading of APIs.

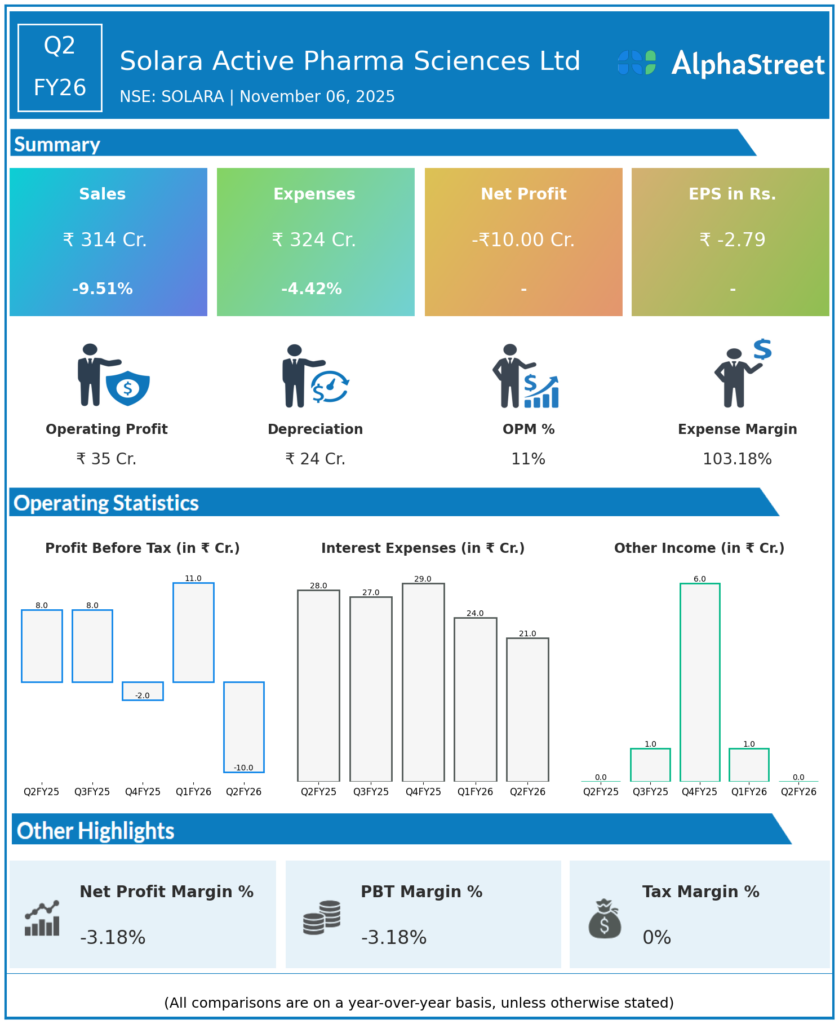

Q2 FY26 Earnings Results:

-

Revenue from Operations: ₹314 crore, down 9.6% YoY and 1.9% QoQ from ₹320 crore in Q1 FY26.

-

Net Loss: ₹10.1 crore, reversing from a profit of ₹7.9 crore in Q2 FY25 and ₹10.5 crore profit in Q1 FY26.

-

EBITDA: ₹35.2 crore, down 42.8% YoY and 38.8% QoQ; EBITDA margin contracted to 11.3% from 17.7% in Q2 FY25.

-

Gross Margin: 51.0%, modestly up 50 bps YoY but down 310 bps QoQ.

-

Operating costs increased by 8% YoY and 10% QoQ due to one-time additional operating expenses and a temporary shutdown at Mangalore facility.

-

Net debt reduced to ₹623 crore, down ₹153 crore from FY25 end.

-

Focus areas on deleveraging, cost optimization, and maintaining product mix in regulated markets (~75% of revenue).

Management Commentary & Strategic Insights:

-

MD & CEO Sandeep Rao stated that operational disruptions in Mangalore facility were temporary and expected to normalize soon.

-

Strategic focus remains on profitable revenue growth driven by regulated markets and high-margin products.

-

Emphasis on cost control and deleveraging for sustainable performance.

-

The long-term outlook remains positive with ongoing investment in R&D and capacity expansion.

Q1 FY26 Earnings Results:

-

Revenue: ₹320.13 crore, up 6.3% QoQ, down 12.1% YoY.

-

PAT: ₹10.52 crore, recovered from loss the previous quarter.

-

EBITDA: ₹57.5 crore, margin at 18%, up from 11.6% a year ago.

-

Improved profitability attributed to gross margin expansion and better cost control.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.