Solar Industries is one of the largest domestic manufacturers of bulk and cartridge explosives, detonators, detonating cords and components which find applications in the mining, infrastructure and construction industries. Company manufactures high-energy explosives, delivery systems, ammunition filling and pyros fuses for the defence sector.

Q2 FY26 Earnings Results

-

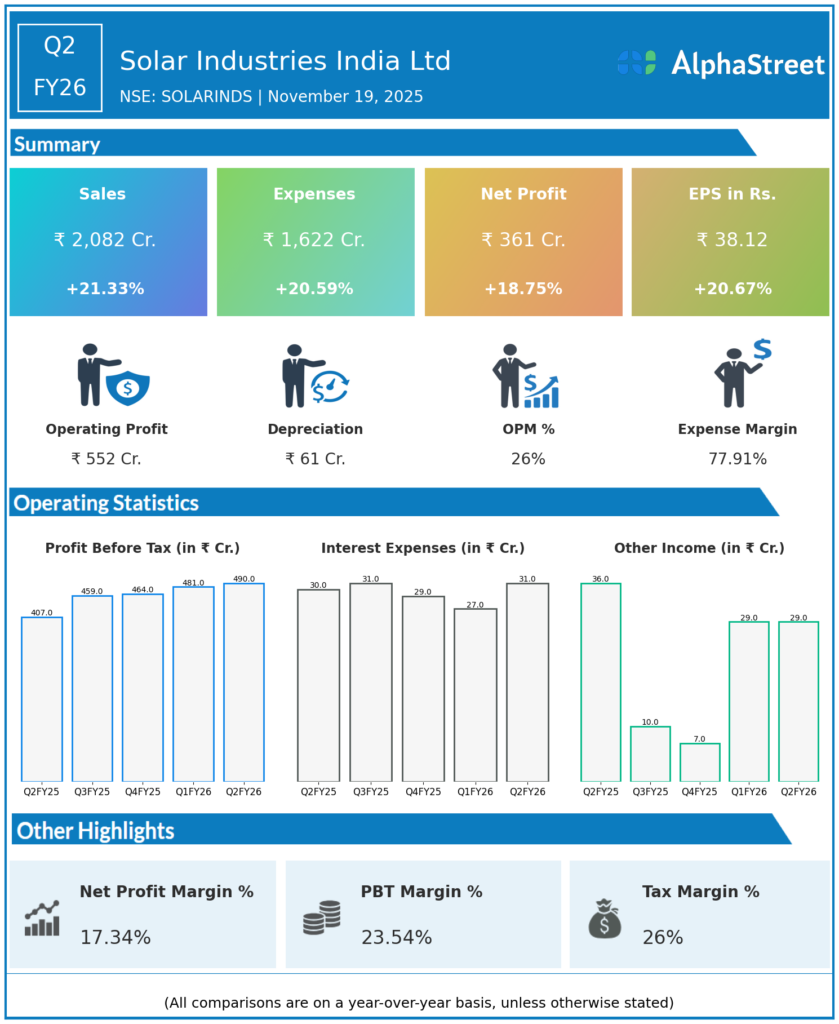

Revenue from Operations: ₹2,082 crore, up 21.3% YoY but down 3.3% QoQ from ₹2,183.71 crore in Q1 FY26.

-

EBITDA: ₹582 crore, highest-ever quarterly EBITDA, up significantly YoY with margin expansion to 26.55% from 25.92% YoY despite inflationary raw material pressures.

-

Profit After Tax (PAT): ₹361.45 crore, up 19.0% YoY and 2.5% QoQ with PAT margin at approximately 17.1%.

-

Defense revenue surged 57% YoY to ₹500 crore, contributing significantly to growth.

-

Total Income for H1 FY26 was ₹4,237 crore with EBITDA at ₹1,146 crore, demonstrating strong half-year performance and growth momentum.

-

EPS: ₹38.12, up 20.7% YoY and 1.8% QoQ.

-

Employee costs rose 34.56% YoY to ₹194.7 crore, reflecting strategic hiring and wage inflation but stable as a percentage of sales at 9.35%.

Management Commentary & Strategic Insights

-

Managing Director & CEO Manish Nuwal highlighted the company’s operational excellence and significant growth despite challenges in domestic markets and inflationary pressures.

-

Management reaffirmed FY26 guidance targeting INR 3,000 crore revenue from defense business, emphasizing capital efficiency with ROCE of 43.31% and strong cash flows.

-

The company is focused on scaling defense operations, maintaining margin leadership, and executing capacity expansion plans.

-

Strategic emphasis on international market expansion supported by global manufacturing presence in nine countries and distribution across 90+ countries.

-

Management is optimistic about maintaining the growth trajectory while navigating sectoral volatility and valuation headwinds.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹2,183.71 crore, up 27.0% YoY from ₹1,719.07 crore in Q1 FY25.

-

EBITDA: ₹564 crore, up 19% YoY with a margin of 26.18%.

-

Profit After Tax (PAT): ₹352.62 crore, up 17.3% YoY and 45.3% QoQ from ₹242.71 crore.

-

Defense revenue grew sharply in Q1FY26, contributing ₹418 crore with a 115% YoY increase.

-

The company recorded robust international sales reaching ₹826 crore in the quarter, up 43% YoY.

-

Sustained growth driven by operational leverage, product portfolio expansion, and strategic capital allocation.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.