Solar Industries India Limited (NSE:SOLARINDS), a significant player in the industrial explosives and defense sectors, reported a robust financial performance for the third quarter ended December 31, 2025 (Q3FY26).

Under its “Power to Propel” philosophy, the company provides specialized solutions for mining, infrastructure, and national security. Its customer base is diversified across institutional segments, including Coal India Limited (CIL), Singareni Collieries Company Limited (SCCL), and various international markets.

Latest Q3 & 9M FY26 Results

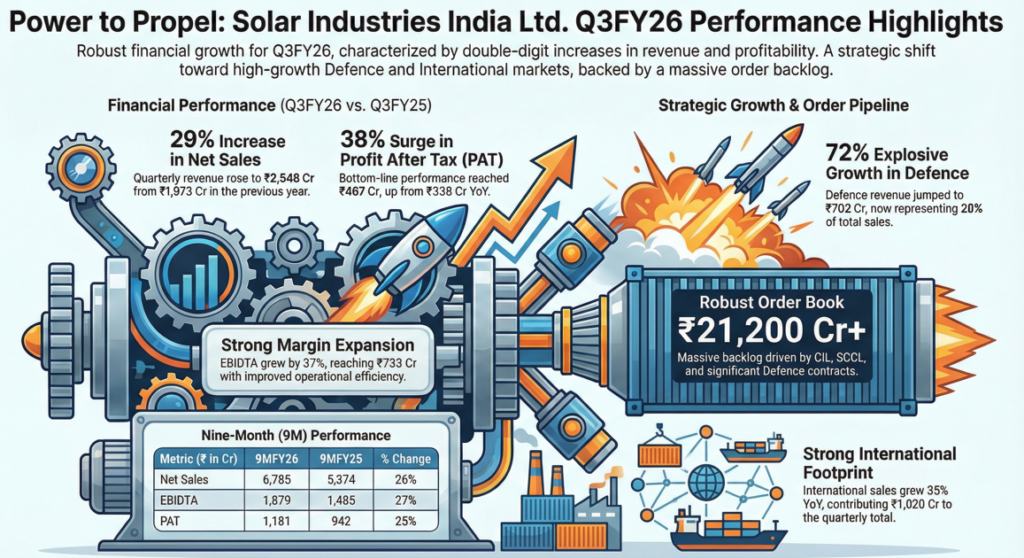

For the third quarter ended December 31, 2025:

- Net sales reached Rs 2,548 crore, marking a 29% increase from Rs 1,973 crore in the same period last year.

- Profit After Tax (PAT) saw a significant surge of 38% year-on-year, rising to Rs 467 crore from Rs 338 crore.

- EBITDA for the quarter stood at Rs 733 crore, representing a 37% growth with a margin of 28.77%.

For the nine-month period (9MFY26), the growth trajectory remained consistent.

- Sales grew by 26% to Rs 6,785 crore.

- PAT increased by 25% to reach Rs 1,181 crore.

- The company maintained healthy margins despite an increase in employee costs, which rose 42% in Q3 compared to the previous year.

Segment Performance

- The Defense segment emerged as a primary growth engine, with quarterly revenue jumping 72% year-on-year to Rs 702 crore, now accounting for 28% of total sales. On a nine-month basis, Defense revenue grew by 76%.

- The International and Overseas segment remains the largest contributor, representing 40% of quarterly sales at Rs 1,020 crore, a 35% increase from Q3FY25.

- Meanwhile, domestic segments like CIL and Housing & Infrastructure showed stable or moderate growth, contributing 10% each to the quarterly revenue mix.

Business & Operations Update

- Solar Industries is backed by a massive order book exceeding Rs 21,200 crore, primarily driven by long-term contracts with CIL, SCCL, and the Defense sector. This substantial backlog provides strong revenue visibility for upcoming quarters.

- Operationally, the company has managed to optimize material consumption costs, which dropped as a percentage of net sales from 53.50% in Q3FY25 to 48.71% in Q3FY26.

Investor Sentiment & Shareholding

- Investor confidence remains high, characterized by a stable and high promoter holding of 73.15% as of December 31, 2025. The company has attracted significant institutional interest, with Mutual Funds and AIFs holding a 12.16% stake.

- Key institutional shareholders include SBI Mutual Fund (3.40%), Kotak Fund (3.03%), and international entities such as Vanguard and iShares. Foreign Institutional Investors (FII/FPI) collectively hold 6.74% of the company.

General Assessment

Solar Industries India Limited has demonstrated exceptional financial resilience and growth in the 2025-26 fiscal year. The strategic pivot toward high-value Defense contracts and the continued expansion of its international footprint have successfully offset localized fluctuations in domestic mining and infrastructure. With a record order book and improving operational efficiencies, the company appears well-positioned to maintain its momentum in the explosives and defense manufacturing landscape.