Sobha Limited, incorporated in 1995, is a real estate developer engaged in construction to operations of townships, housing projects, commercial premises, and other related activities. The company is also engaged in manufacturing activities related to interiors, glazing and metal works, and concrete products.

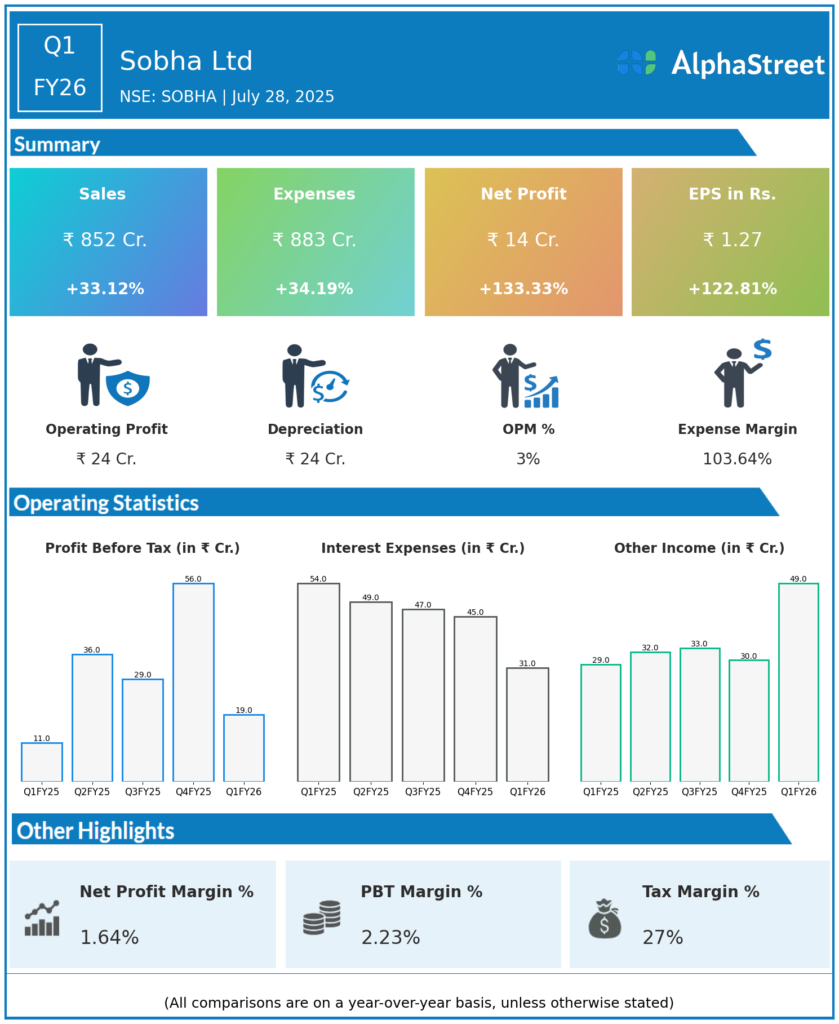

Q1 FY26 Earnings Summary (Apr–Jun 2025)

-

Total Income: ₹852 crore, up 33% YoY.

-

Profit After Tax (PAT): ₹13.6 crore, more than doubling (126.7% YoY) from ₹6 crore in Q1 FY25 but down roughly 66% QoQ from Q4 FY25.

-

Quarterly Real Estate Sales Value: ₹2,079 crore, an 11% YoY increase and the first time crossing ₹2,000 crore in a quarter.

-

New Area Sold: 1.44 million square feet, up 23% YoY.

-

Average Price Realization: ₹14,395 per square foot, slightly lower than previous year’s ₹15,941 per square foot.

-

Total Collections: ₹1,778 crore, up 15% YoY.

-

Net Debt: Further improved to negative ₹687 crore, with Net Debt-to-Equity ratio of -0.15.

-

EBITDA Margin: Declined to 2.8% from 7.3% YoY due to higher expenses.

Key Management & Strategic Decisions

-

Record Sales Achievement: Sobha achieved its highest-ever quarterly sales value in Q1 FY26 crossing ₹2,000 crore, driven by strong demand across cities and especially new launch success in Greater Noida and Kochi regions.

-

Geographical Expansion: Entered NCR region successfully, adding to growth momentum.

-

Backward Integrated Delivery Model: Continued investments in operational excellence to maintain quality and delivery standards.

-

Financial Discipline: Maintained strong balance sheet with reduced net debt and improved cash inflows.

-

Growth Pipeline: Planned launches with a pipeline valuing ₹16,500 crore, targeting sustained top-line growth.

-

Focus on Quality and Customer Value: Management emphasized delivery quality, reliability, and transparency as competitive edges.

Q4 FY25 Earnings Summary (Jan–Mar 2025)

-

Total Income: ₹1,270 crore (₹12.7 billion), up 61% YoY from ₹790 crore in Q4 FY24.

-

Profit After Tax (PAT): ₹40.85 crore, a 482% increase YoY.

-

Collections: ₹1,785 crore in Q4 FY25, up 21% QoQ and 7% YoY.

-

Quarterly Sales Value: ₹1,836 crore, increased 32% QoQ.

-

New Area Sold: 1.56 million square feet, up 53% QoQ.

-

Average Price Realization: ₹13,412 per square foot, up 23% YoY.

-

Financial Strength: Reduced net debt significantly to negative ₹630 crore (Net Debt-to-Equity ratio of -0.14).

Summary

-

Q4 FY25 exhibited robust revenue and profit growth with strong sales and collections.

-

Q1 FY26 posted record quarterly sales and revenue growth, strong cash collections, and improved financial health, despite a dip in PAT versus the prior quarter.

-

Sobha is positioned for continued growth through strategic launches, geographic expansion, and operational excellence.