Skipper Ltd is engaged in manufacturing and selling of Transmission & Distribution Structures and Pipes & Fittings. It also undertakes EPC projects in the infrastructure segment.

Q2 FY26 Earnings Results

-

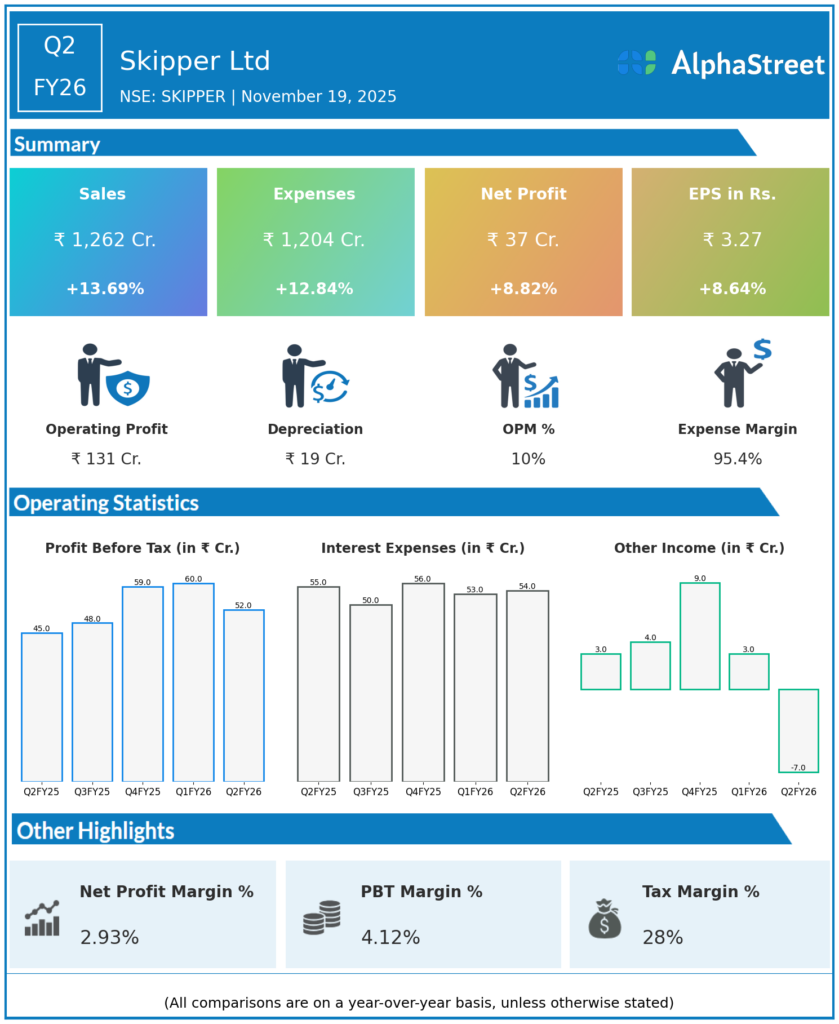

Revenue from Operations: ₹1,261.79 crore, a modest sequential growth of 0.63% from ₹1,253.86 crore in Q1 FY26, and up 13.7% YoY from ₹1,109.74 crore in Q2 FY25. This marked the company’s highest-ever quarterly revenue.

-

EBITDA: ₹130.69 crore, up 16.23% YoY and up 2.77% QoQ, translating to a margin improvement to 10.36%, highest in the trailing seven quarters.

-

Profit After Tax (PAT): ₹37.03 crore, down 18.18% QoQ from ₹45.26 crore in Q1 FY26, but positive YoY performance.

-

PAT margin compressed to 2.93% from 3.61% QoQ, impacted by elevated interest and tax expenses.

-

Interest expenses remained high at ₹53.56 crore; effective tax rate increased to 28.31% from 25.05% QoQ.

-

Export revenue grew 27% YoY, supporting topline growth.

-

New orders worth ₹1,977.5 crores booked in H1 FY26, pushing order book to record ₹8,820 crore, reflecting demand momentum in engineering and polymer segments.

-

ROCE for H1 FY26 stood at 21.28%, indicating improved capital efficiency.

Management Commentary & Strategic Insights

-

Management highlighted ongoing strong revenue growth driven by order execution and new contract wins amidst challenging raw material cost and inflationary pressures.

-

Efforts on cost optimization and better product mix helped margin expansion despite rising input costs.

-

Focus continues on capacity expansion, enhancing production efficiency, and broadening geographic export footprint.

-

Emphasis on sustaining positive earnings trajectory, deleveraging, and maintaining robust order pipeline to fuel growth going forward.

-

Management expects continued strong second-half performance, potentially delivering 25% revenue growth for FY26.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹1,253.86 crore, increased 15% YoY.

-

EBITDA: ₹127.16 crore, with 10.14% margin.

-

PAT: ₹45.26 crore, up 39.6% YoY, reflecting strong operational execution and cost discipline.

-

EPS: ₹3.96.

-

Order book strength and capacity commissioning supported performance.

-

Management expressed confidence in sustaining growth momentum with robust demand environment.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.