SKF India Ltd is a leading supplier of products, solutions & services within rolling bearing, seals, mechatronics, and lubrication systems.

Q2 FY26 Earnings Results

-

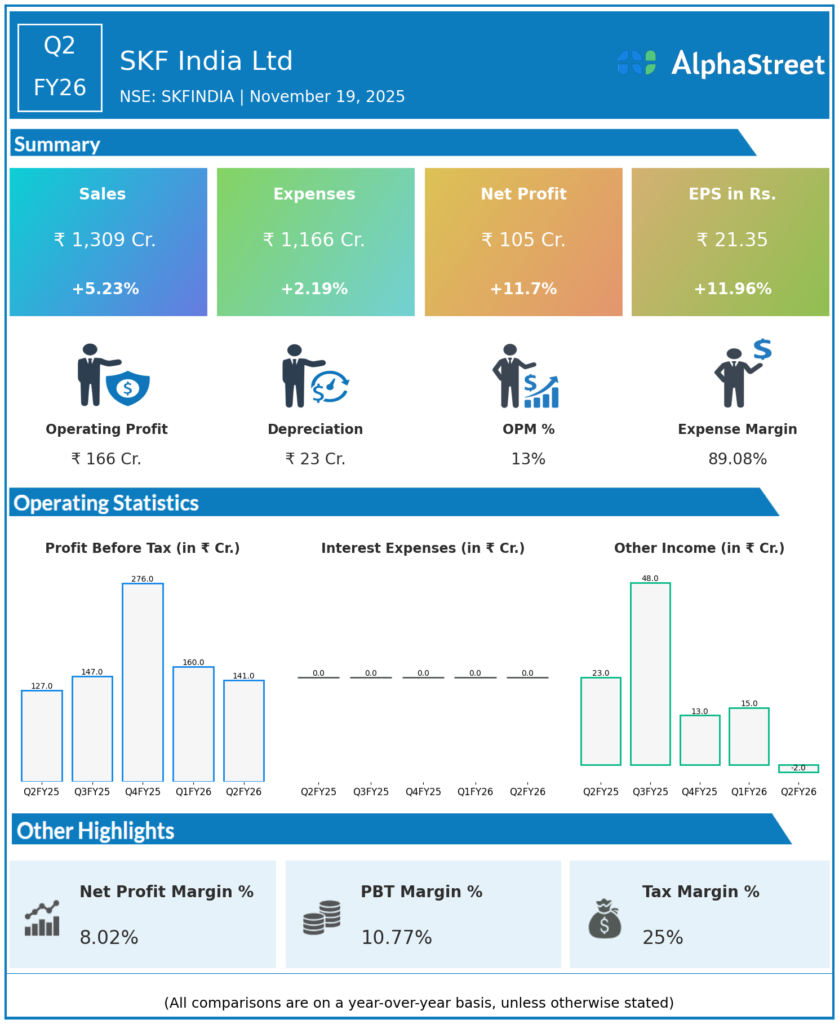

Revenue from Operations: ₹1,309.06 crore, up 2.02% QoQ and 5.21% YoY, marking the highest quarterly revenue on record for SKF India.

-

Net Profit (PAT): ₹105.49 crore, up 11.99% YoY but down 10.76% QoQ due to margin pressures.

-

Profit Before Tax (PBT): ₹140.62 crore, up 10.89% YoY.

-

Operating Margin contracted to 12.66% from 13.04% QoQ, and sharply down from 23.45% in Q4 FY25 due to cost pressures including raw materials and employee expenses, which rose 20.53% and 19.96% YoY respectively.

-

Cash flow concerns noted with operating cash flow dropping sharply in FY25 to ₹203 crore from ₹624 crore in FY24.

-

Debtors turnover ratio declined, indicating longer collection cycles and stretched credit terms.

-

Management approved demerger plan for industrial unit to unlock value and improve agility.

Management Commentary & Strategic Insights

-

Management expressed confidence in revenue growth despite margin headwinds, attributing margin pressure primarily to global raw material inflation and rising employee costs.

-

Emphasis on reversing margin compression through cost controls, operational efficiencies, and leveraging the demerger to create focused business units.

-

Long-term strategy revolves around capitalizing on industrial capex recovery and automotive sector momentum for growth acceleration.

-

Operating cash flow improvement and sustainable margin recovery remain key focus areas to assure earnings quality and investor confidence.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹1,283.15 crore, an increase of 6.38% YoY.

-

Profit After Tax (PAT): ₹118.21 crore, down 25.62% YoY due to margin contraction.

-

Operating margin stood at 13.04% in Q1 FY26, indicating better margin situation than Q2 FY26.

-

Higher material costs and employee expenses impacted profits despite improved revenues.

-

The company reported consistent revenue growth amid challenging industrial conditions.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.