SJVN (Satluj Jal Vidyut Nigam) is engaged in the business of Electricity generation. The company is also engaged in the business of providing consultancy for hydro-power projects. SJVN was declared Navaratna status in Aug,24.

Q2 FY26 Earnings Results

-

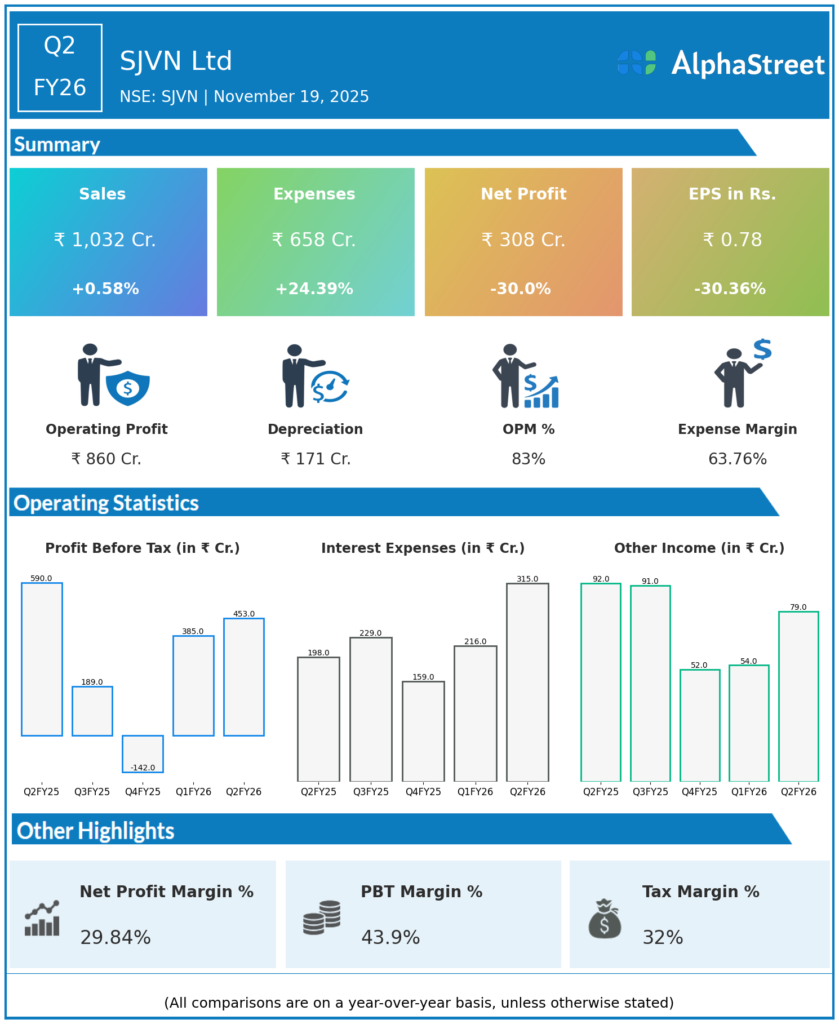

Consolidated Revenue: ₹1,032.40 crore, up 0.6% YoY and 13% QoQ.

-

Standalone Revenue: ₹942.03 crore, down from ₹994.51 crore in Q2 FY25.

-

Consolidated Profit After Tax (PAT): ₹307.91 crore, down 30.2% YoY from ₹441.14 crore in Q2 FY25.

-

Standalone PAT: ₹341.50 crore, down from ₹463.94 crore in Q2 FY25.

-

Operating Profit (excluding other income): ₹742.33 crore, with operating margin of 80.91% up from 76.69% in Q2 FY25.

-

Interest Expense: ₹215.97 crore, up 51.43% YoY due to debt-funded capacity expansion.

-

Net profit margin compressed to 27.67% from 43.46% a year ago.

-

Depreciation increased to ₹160.40 crore from ₹130.89 crore YoY.

-

Total debt rose to ₹26,220 crore as of March 2025 from ₹19,689.54 crore a year earlier.

-

Capital expenditure outlook for FY26 is approximately ₹7,500 crore including around ₹3,600 crore by September 2025.

-

Employee costs controlled at ₹74.83 crore, down from ₹80.16 crore YoY.

Management Commentary & Strategic Insights

-

Management emphasized operational excellence and strong hydroelectric generation during monsoon season driving robust operating margins.

-

The sharp decline in net profit is attributed mainly to rising finance costs and depreciation from aggressive capacity expansion.

-

Capacity additions have been slower to translate into EBITDA growth due to large capital base and debt burden.

-

Management highlighted the importance of commissioning new projects and improving returns to address capital inefficiency.

-

The company is confident about future profitability recovery as new projects come online and debt servicing costs stabilize.

-

Continuous monitoring and measures are underway to control costs and improve capital efficiency.

Q1 FY26 Earnings Results

-

Consolidated Revenue: ₹917.45 crore, up 5.4% YoY from ₹870.37 crore in Q1 FY25.

-

PAT: ₹227.77 crore, down 36.21% YoY from ₹357.09 crore.

-

Operating Profit: ₹667.49 crore with improved margin of 80.9% from 76.7% YoY.

-

Profit decline linked to higher deferred tax and other expenses.

-

Company maintained strong generation volumes and effective cost control but faced financial headwinds.

-

Management remains focused on reducing costs, expanding capacity, and managing debt.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.