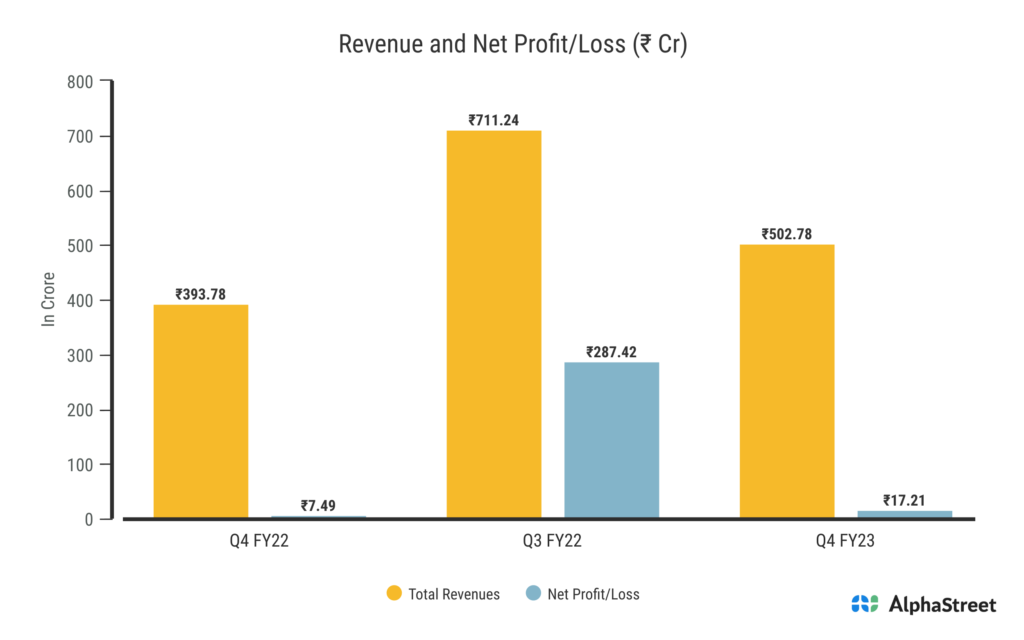

“In the months of April and till now also, the discharge and generation is as low as 50% to 55% as compared to last year. So, during the quarter, the revenue as total income increased by what, 50% but the per profit after tax, there is a marginal increase. Last year it was negative but this year it is only 13.61 crores rupees so far as this Q4 is concerned. Similarly, there is a decrease in the generation also. Generation decreased by 7%. Last year it was 886 million units, this year only 824 million units generation during the Q4 also. So, these are the figures for the Q4 and FY23 accounts.”

– N. L. Sharma, Chairman & Managing Director

Stock Data

| Ticker | SJVN |

| Industry | Energy |

| Exchange | NSE & BSE |

Share Price

| Last 1 Month | 15.5% |

| Last 6 Months | 19.6% |

| Last 12 Months | 53.3% |

Business Basics

Satluj Jal Vidyut Nigam Limited (SJVN) is a Mini Ratna and a joint venture of the Governments of India and Himachal Pradesh. GoI owns a 59.92% equity stake in SJVN, while GoHP owns a 26.85% interest. The company’s main line of business is the production and sale of electricity. The company has projects in Sikkim, Himachal Pradesh, Uttarakhand, and Arunachal Pradesh. SJVN Limited specializes in the development, construction, and operation of hydroelectric power projects. The company has a diverse portfolio of power projects across various states in India, with a focus on the Himalayan region. It has successfully commissioned several large-scale hydroelectric projects, harnessing the potential of rivers and water resources to generate clean and renewable energy.

The core business of SJVN Limited revolves around the generation and sale of electricity. The company’s power projects have a combined installed capacity of over 2,000 megawatts (MW), with additional projects under development. SJVN Limited also engages in the trading of power through power exchanges and bilateral agreements. In addition to hydroelectric power, SJVN Limited has diversified its operations into other renewable energy sources such as solar and wind power. The company has ventured into solar power projects and is actively exploring opportunities in the wind energy sector as well. This diversification strategy aligns with the company’s vision of becoming a leading renewable energy player in India.

Q4 FY23 Financial Performance

SJVN Limited reported Total revenue for Q4 FY23 of ₹502.78 Crore, up from ₹393.87 Crore year on year depicting a growth of 27.6%. Consolidated Net Profit of ₹17.21 Crore, up 129.8% from ₹7.49 Crore in the same quarter of the previous year. The Earnings per Share is ₹0.04 in this quarter.

SJVN’s Power Generation Portfolio

SJVN Limited is primarily engaged in the generation of power through various sources, including thermal power, hydro power, wind power, and solar power. Here is a breakdown of the different power generation segments of SJVN Limited:

Thermal Power: Although SJVN Limited’s primary focus is on renewable energy sources, the company also has a presence in thermal power generation. It operates a thermal power plant in Buxar, Bihar, with an installed capacity of 1,320 megawatts (MW). The thermal power plant utilizes coal as the primary fuel to generate electricity.

Hydro Power: SJVN Limited is renowned for its expertise in hydro power generation. The company has developed and operates several hydroelectric power projects with installed capacity of 1,500 MW across various locations in India. These projects harness the energy potential of rivers and water bodies to generate clean and renewable electricity. Some of the prominent hydro power projects of SJVN Limited include the Nathpa Jhakri Hydro Power Station, which is one of the largest hydroelectric power projects in India, and the Rampur Hydro Power Project.

Wind Power: SJVN Limited has diversified into wind power generation as part of its renewable energy portfolio. The company has identified wind-rich areas and is exploring opportunities to develop wind power projects. By harnessing the kinetic energy of wind, SJVN Limited aims to further expand its renewable energy capacity and contribute to India’s clean energy goals.

Solar Power: SJVN Limited has ventured into solar power generation, recognizing the immense potential of solar energy in India. The company has undertaken solar power projects to harness the abundant sunlight available in different regions of the country. These projects involve the installation of solar panels and the conversion of sunlight into electricity through photovoltaic technology. SJVN Limited aims to increase its solar power capacity and contribute to the growth of India’s solar energy sector.

SJVN’s Operations & Project Under Development

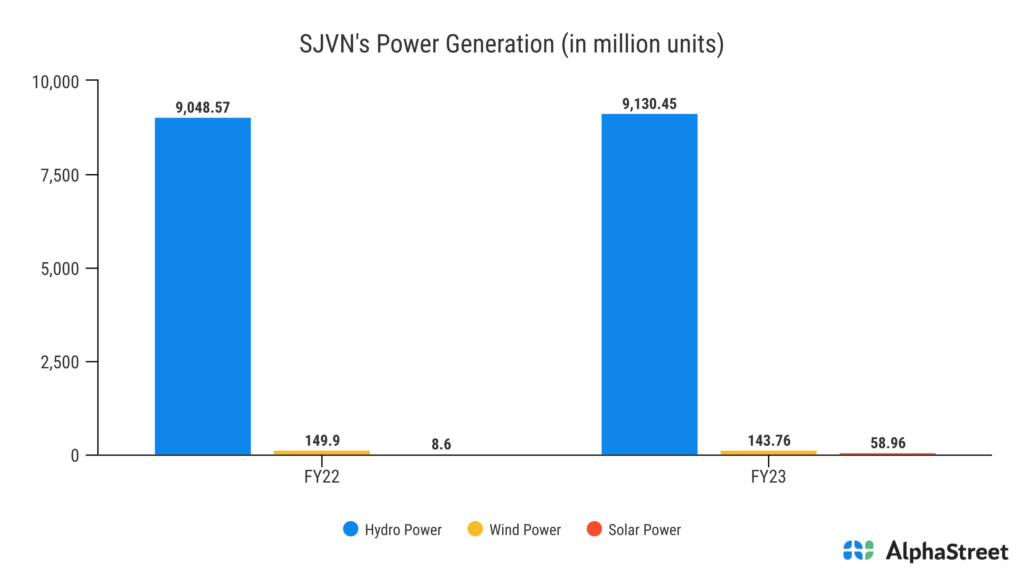

The company currently has eight active projects, including one gearbox project and seven generation projects. The highest capital expenditure that SJVN has ever incurred is related to the 16 projects that are currently under construction. It was ₹8,240 crores against the target set by Government of India of ₹8,000 crores. In the previous six years, the capex was ₹407 crores in FY18 and increased to ₹8,240 crores annually. In the same time frame, SJVN experienced compound growth at a rate of 70%. Additionally, generation went up by over 1% last year. SJVN generated 9,335 million units against 9,208 million units last year from all of its subsidiaries’ and main projects’ projects.

SJVN’s Other Businesses

In addition to power generation, SJVN Limited is also involved in other business segments that complement its core operations. Here are the details of these segments:

Power Transmission: SJVN Limited is engaged in the transmission of electricity through its power transmission business. The company is responsible for the efficient and reliable transmission of power generated from its own projects as well as from other power producers. This involves the construction, operation, and maintenance of transmission lines, substations, and related infrastructure to ensure the smooth transfer of electricity from generation centers to distribution networks.

Power Trading: SJVN Limited participates in power trading activities as part of its business diversification strategy. The company engages in the buying and selling of electricity to optimize its power portfolio and maximize revenue generation. Power trading allows SJVN Limited to take advantage of market opportunities, balance the supply-demand dynamics, and enhance its competitiveness in the power sector.

Consultancy: SJVN Limited offers consultancy services in the power sector. The company leverages its expertise, experience, and technical know-how to provide consultancy and advisory services to other entities involved in power generation, transmission, and related areas. These services may include project planning, feasibility studies, engineering, procurement, and construction management, as well as operation and maintenance support. By offering consultancy services, SJVN Limited contributes to the growth and development of the power sector by sharing its industry knowledge and best practices.

Risks That May Impact SJVN

Companies operating in the power generation sector like SJVN are subject to regulatory and policy changes by government bodies. Changes in environmental regulations, tax policies, tariffs, or licensing requirements can impact the operations and profitability of power generation companies. The power generation industry is influenced by market conditions and demand for electricity. Fluctuations in electricity prices, changes in energy consumption patterns, or economic downturns can affect the demand and revenue generation of power generation companies.

Power generation involves complex operations and infrastructure management. Operational risks include equipment failures, unplanned outages, maintenance challenges, or accidents that can disrupt power generation and impact the company’s financial performance. The projects often require significant investments in infrastructure and equipment. Companies may face risks related to securing financing, managing debt levels, interest rate fluctuations, or access to capital markets, which can impact their financial stability and growth plans. Power generation companies are under increasing pressure to adopt environmentally sustainable practices and address social concerns. Failure to meet environmental standards, mitigate environmental impact, or address community concerns can lead to reputational damage and regulatory penalties.