Security & Intelligence Serv.(India) is directly and indirectly engaged in rendering security and related services consisting of manned guarding, training, and indirectly engaged in paramedic and emergency response services; loss prevention, asset protection and mobile patrols; facility management services consisting of cleaning, housekeeping and pest control management services in the areas of facility management; cash logistics services consisting of cash-in-transit, ATM cash replenishment activities and secure transportation of precious items and bullion; and alarm monitoring and response services consisting of trading and installation of electronic security devices and systems through its subsidiaries, joint ventures and associates.

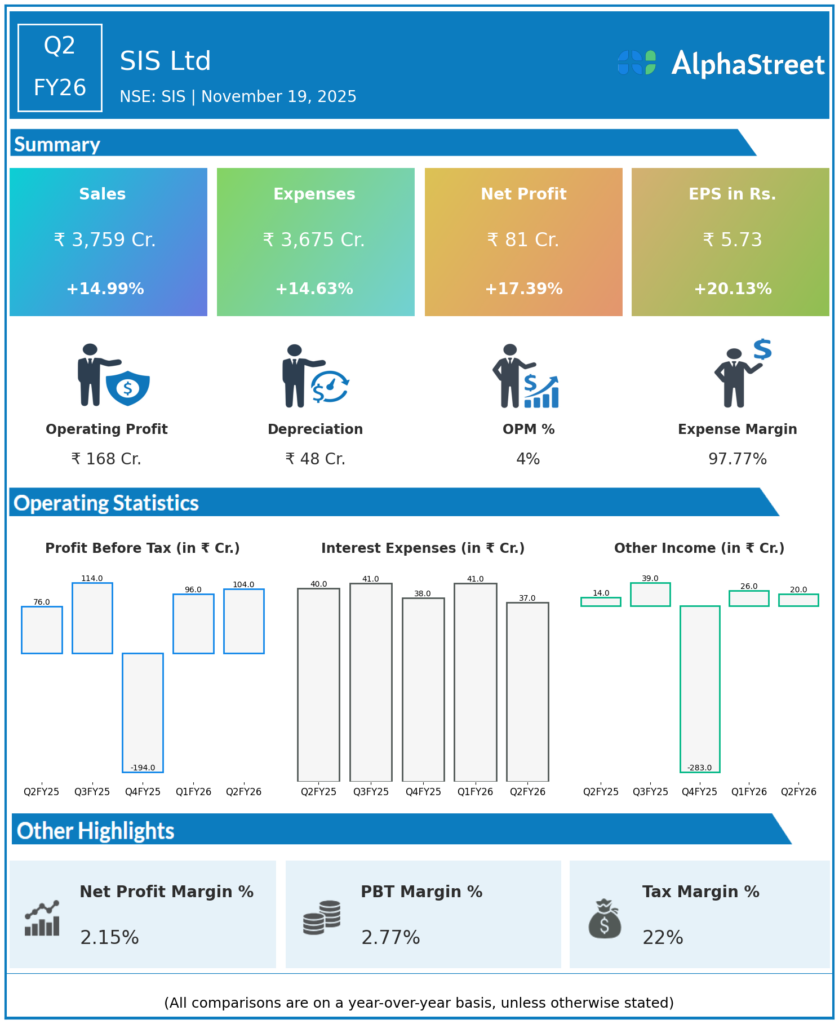

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹3,758.5 crore, up 15% YoY and 5.9% QoQ (highest-ever quarterly revenue).

-

EBITDA: ₹168.3 crore, up 16.2% YoY and 10.7% sequentially; margin improved to 4.5%.

-

Profit After Tax (PAT): ₹81 crore, up 17.3% YoY.

-

PAT margin: 2.15%, down from 2.62% in Q1 FY26, reflecting ongoing cost pressures.

-

EPS: ₹5.7 for the quarter.

-

Segment highlights:

-

India Security revenue: ₹1,543.6 crore (11.5% YoY growth), EBITDA margin 5.3%.

-

International Security revenue: ₹1,607.2 crore (19.3% YoY growth), EBITDA margin 3.3%.

-

Facility Management revenue: ₹629.2 crore (13.7% YoY growth), EBITDA margin improved to 5.2%.

-

-

SIS completed acquisition of 51% of AP Securitas and invested in Installco Wify Technology.

-

Record monthly run rate: ₹1,300 crore (all-time high).

Management Commentary & Strategic Insights

-

Group MD Rituraj Kishore Sinha called Q2 FY26 a “milestone quarter” with record revenue, highest ever EBITDA, and enhanced segment leadership across Security and Facility Management.

-

Management flagged ongoing margin compression due to cost pressures, especially wage inflation and competitive pricing in facility management.

-

Capital efficiency concerns rose, with ROE and ROCE deteriorating to 0.49% and 4.67% from historical averages.

-

Focus remains on strengthening market leadership, driving operational efficiency, and leveraging technology investments for sustainable growth.

-

Strong cash generation supported ₹199 crore closing cash position (up from negative ₹52 crore prior year).

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹3,549 crore, up 13.4% YoY; sequentially up 3.5% from Q4 FY25.

-

EBITDA: ₹152 crore, margin at 4.3%.

-

PAT: ₹92.95 crore, up 44.7% YoY and reflecting recovery from a loss of ₹11.67 crore in Q4 FY25.

-

EPS: ₹6.4 in Q1.

-

All segments saw growth, especially India Security (+9.2% YoY) and Facility Management.

-

Management cited robust demand and steady client acquisitions driving segment results.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.