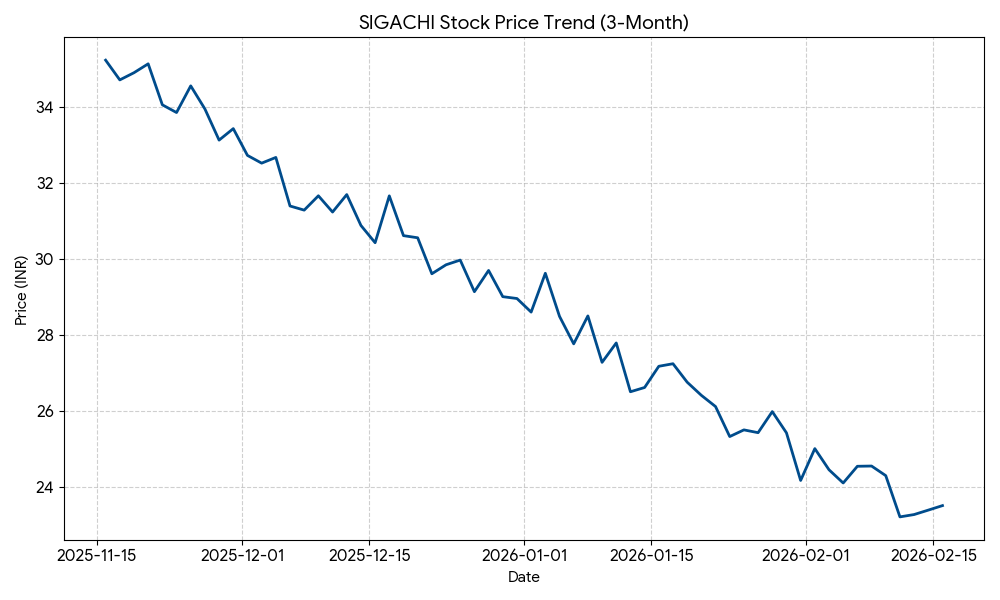

Sigachi Industries Ltd (NSE: SIGACHI, BSE: 543389) shares closed at 23.01 INR on Monday, February 16, 2026, representing an intraday decline of 4.21%. The stock traded between a high of 24.00 INR and a low of 22.86 INR during the session following the board’s approval of the third-quarter financial results on February 14.

Market Capitalization

As of the market close on February 16, 2026, the market capitalization of Sigachi Industries Ltd stands at approximately 879.25 crore INR.

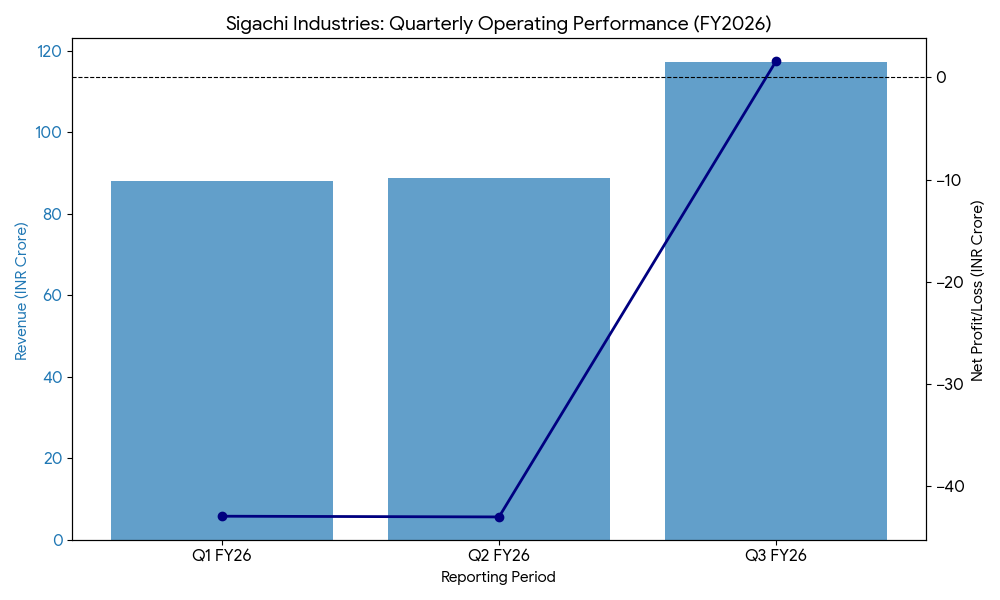

Latest Quarterly Results

For the quarter ended December 31, 2025 (Q3 FY2026), Sigachi Industries reported consolidated revenue from operations of 117.21 crore INR, a decrease from 139.42 crore INR in the corresponding quarter of the previous year. Consolidated net profit for the period fell to 1.62 crore INR, compared to 20.60 crore INR in Q3 FY2025.

Segment Highlights

- Microcrystalline Cellulose (MCC): Revenue in the primary manufacturing segment was impacted by the continued suspension of operations at the Pashamylaram facility.

- Operations & Management (O&M): The segment maintained steady contributions, though overall margins were pressured by increased operational costs.

- Active Pharmaceutical Ingredients (API): The company continues to utilize allocated IPO proceeds for expansion, though revenue contribution remains a smaller portion of the consolidated total.

FINANCIAL TRENDS

Nine-Month Overview

The cumulative nine-month performance for the period ended December 31, 2025, reflects a contraction in profitability. The company reported a consolidated net loss of 84.45 crore INR for 9M FY2026, compared to a net profit of 40.69 crore INR in 9M FY2025. Total income for the nine-month period stood at 293.85 crore INR, trending lower than the 312.60 crore INR reported in the previous year.

Business & Operations Update

Operational performance during the quarter was influenced by the June 2025 fire incident at the Pashamylaram factory. The facility, which accounts for approximately 29% of the company’s total installed capacity, remains under temporary shutdown. Management has relocated interim production to the Dahej and Jhagadia units. The company has also advanced its R&D pipeline with the development of new Cystic Fibrosis (CF) API combinations, targeting a revenue potential of 250 crore INR commencing from Q4 FY2027.

M&A or Strategic Moves

Sigachi Industries has entered into a Memorandum of Understanding (MOU) with Group SRO to deploy Respalon’s proprietary nanofiber technology for drug delivery systems. Additionally, the company is exploring strategic collaborations with formulation innovators for the commercial supply of its specialty APIs.

Q&A Focal Points

During the earnings discussion, management addressed the 5.8 crore INR disbursed in compensation related to the Pashamylaram incident. A significant point of inquiry was the 68.63 crore INR shortfall from warrant holders and a 56.77 crore INR shortfall in promoter investment commitments. Executives noted that while internal accruals were used to meet immediate objectives, the shortfall and the fire impact have delayed planned capital expenditure and expansion timelines.

Guidance & Outlook

The company is currently managing the regulatory process for the reconstruction of the Hyderabad plant, which may require fresh environmental and statutory approvals. Market participants are monitoring the timeline for the resumption of full capacity at Pashamylaram and the progress of insurance claim settlements related to the 117.07 crore INR asset loss.

Performance Summary

Sigachi Industries shares ended today down 4.21% at 23.01 INR. The Q3 FY2026 results show a significant year-over-year decline in net profit to 1.62 crore INR on revenue of 117.21 crore INR. Segment signals indicate capacity constraints in the MCC business, while the API segment remains the focus for long-term diversification.