Siemens Limited offers products, integrated solutions for industrial applications for manufacturing industries, drives for process industries, intelligent infrastructure and buildings, efficient and clean power generation from fossil fuels and oil & gas applications, transmission and distribution of electrical energy for passenger and freight transportation, including rail vehicles, rail automation and rail electrification systems. Presenting below are its Q1 FY26 earnings results.

Q1 FY26 Earnings Results

-

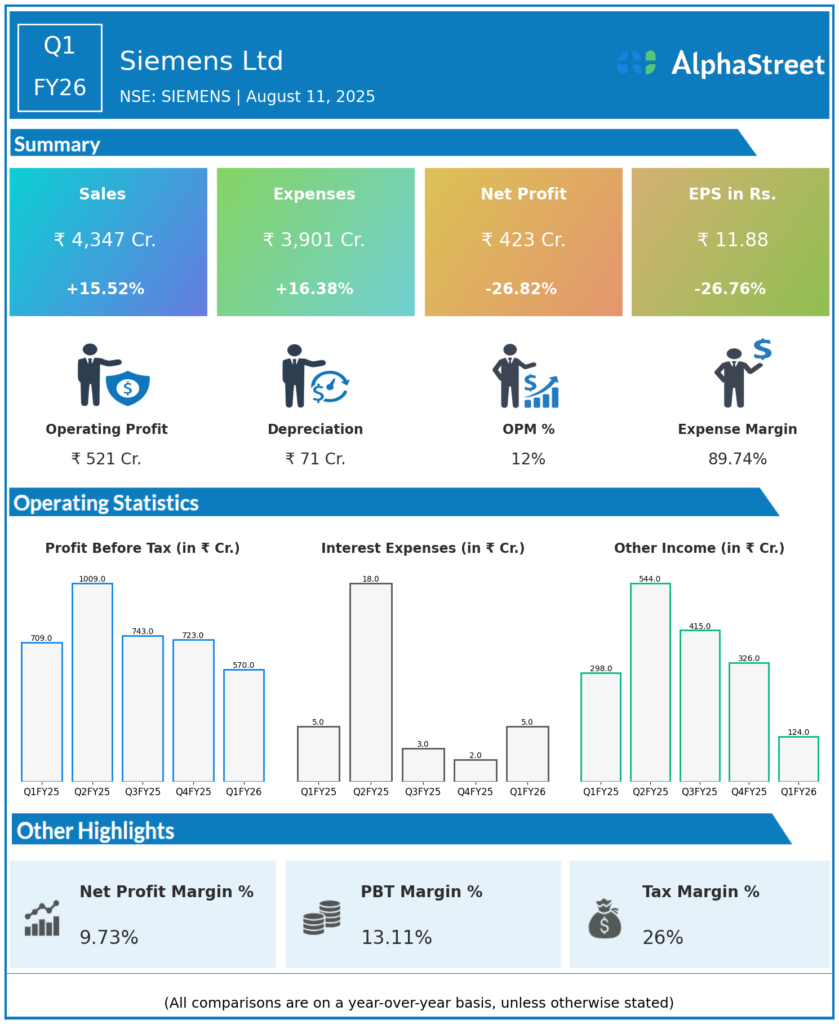

Revenue: ₹4,347 crore, up 15.5% year-over-year (YoY) from approximately ₹3,763 crore in Q1 FY25.

-

Net Profit (PAT): ₹423 crore, down 26.8% YoY from around ₹578 crore in Q1 FY25, reflecting strong bottom-line improvement despite a moderate revenue dip.

-

Operating Margin: Approximately 9.3%, indicating stable profitability and cost efficiency.

-

Earnings Per Share (EPS): ₹11.88, down 26.7% on the YoY basis.

-

Order Book and New Orders: The company reported a robust order inflow and backlog, supporting revenue visibility in future quarters.

-

Key Business Drivers: Growth was led by strong execution in smart infrastructure and digitalization projects, along with mobility solutions contributing to order inflows.

Key Management Commentary & Strategic Highlights

-

Siemens India has completed a leaner business structure following the energy division spin-off, focusing on core verticals like smart infrastructure, digital industries, and mobility.

-

Management highlighted disciplined cost control and operational efficiency leading to improved profit margins.

-

The outlook remains constructive with expectations of recovery in order inflows and margin improvement, especially in mobility and digital sectors.

-

Siemens continues to leverage government capex and infrastructure projects, with a strong emphasis on sustainability and digital transformation.

-

The robust order book (approx. ₹42,800 crore) and a 13% rise in new orders provide a solid foundation for medium-term growth.

-

The company is adapting to sector-specific challenges, including margin pressures, through innovation and strategic investments.

Q4 FY25 Earnings Results

-

Revenue: Similar level to Q1 FY26, indicating flat sequential growth.

-

Net Profit (PAT): Lower than Q1 FY26, supporting the YoY profit rise in Q1.

-

Margins: Margins were stable but slightly lower than Q1 FY26, indicating margin improvement quarter-on-quarter.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.