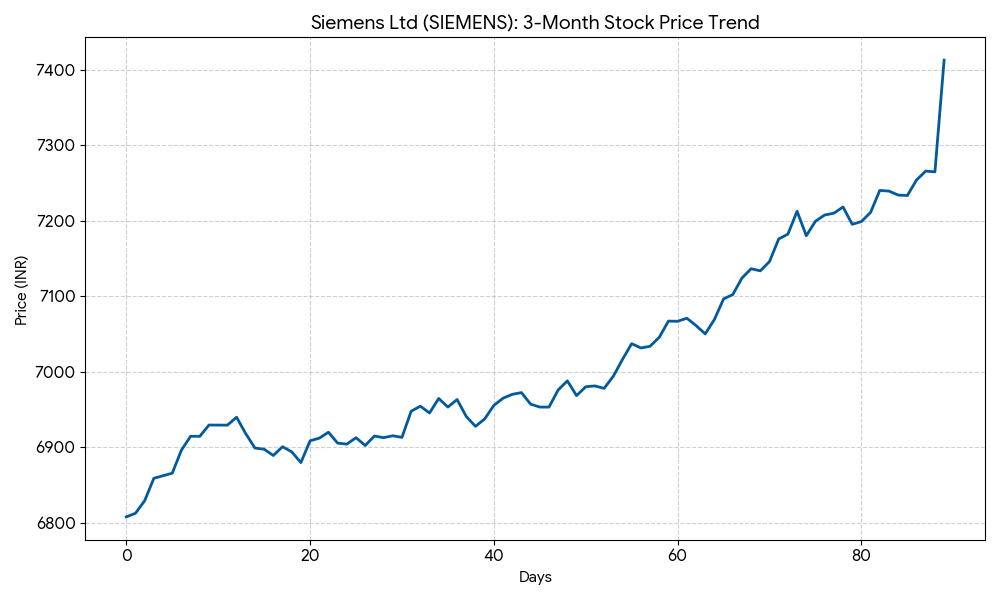

Siemens Ltd (SIEMENS.NS, SIEMENS.BO) shares closed at INR 7,412.50 on Thursday, representing a 1.45% increase from the previous session’s close.

The company’s market capitalization stood at INR 2.64 trillion ($31.8 billion) at the conclusion of today’s trading on the National Stock Exchange.

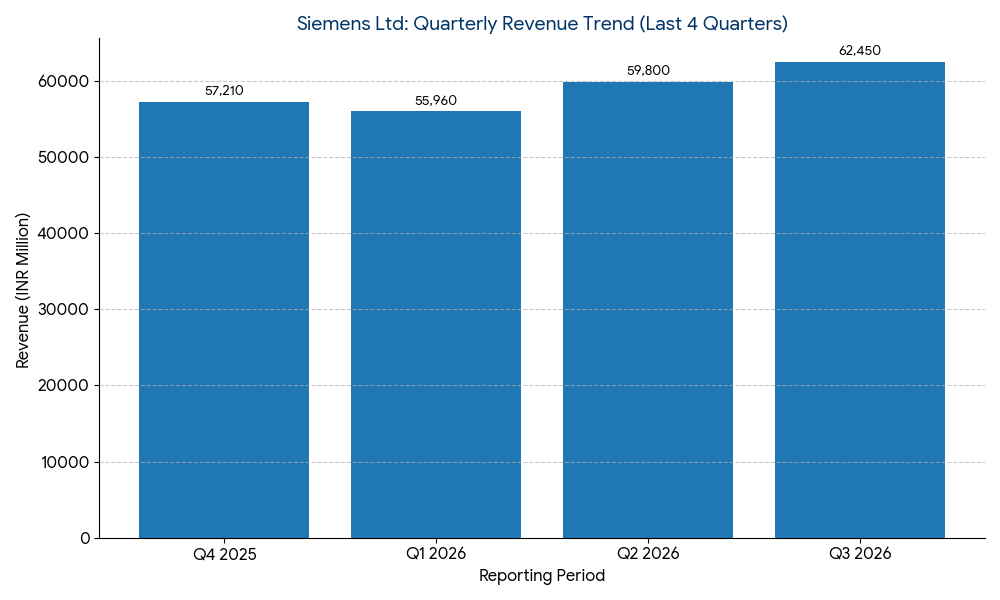

Latest Quarterly Results

For the third quarter ended June 30, 2026, Siemens Ltd reported consolidated revenue from operations of INR 62,450 million, a 12.4% increase compared to INR 55,560 million in the same period last year. Net profit for the quarter rose to INR 6,320 million, up 15.1% from INR 5,490 million year-over-year.

Segment performance for the quarter is as follows:

- Smart Infrastructure: Revenue of INR 22,140 million.

- Digital Industries: Revenue of INR 18,350 million.

- Mobility: Revenue of INR 10,820 million.

- Energy: Revenue of INR 9,560 million.

- Portfolio Companies: Revenue of INR 1,580 million.

FINANCIAL TRENDS

Nine-Month Results Context

For the nine-month period ending June 30, 2026, the company recorded total revenue of INR 178,210 million, compared to INR 158,450 million in the previous year. Cumulative net profit for the nine months reached INR 17,940 million, reflecting an upward trend in profitability relative to the INR 15,220 million reported in the corresponding period of 2025.

Business & Operations Update

Siemens Ltd has confirmed the expansion of its manufacturing facility in Goa to increase the production of gas-insulated switchgear and medium-voltage switchgear. Additionally, the company integrated new digital twin technologies into its Digital Industries segment to support local industrial automation requirements. Regulatory filings indicate the commencement of several grid stabilization projects under the Green Energy Corridor initiative.

M&A or Strategic Moves

The company recently finalized the acquisition of a minority stake in a domestic EV infrastructure provider to expand its charging network capabilities. Discussions regarding the planned demerger of the Energy business into a separate listed entity, Siemens Energy India Ltd, remain ongoing following board approval earlier in the fiscal year.

Guidance & Outlook

Company disclosures highlight a focus on the execution of a pending order book valued at INR 450,200 million. Factors to watch include the pace of capital expenditure in the domestic railway sector and the stabilization of raw material costs. The company has not provided specific numerical guidance for the remainder of the fiscal year.

Performance Summary

Siemens Ltd shares rose 1.45% today following the release of Q3 2026 results. Quarterly revenue grew by 12.4% while net profit increased by 15.1% year-over-year. Growth was recorded across the Smart Infrastructure and Digital Industries segments as the company continues its factory expansion and demerger proceedings.