Shyam Metalics is primarily engaged in the manufacturing of steel and allied products including pellets, sponge iron, TMT and long products, ferro alloys and generation of power.

Q2 FY26 Earnings Results

-

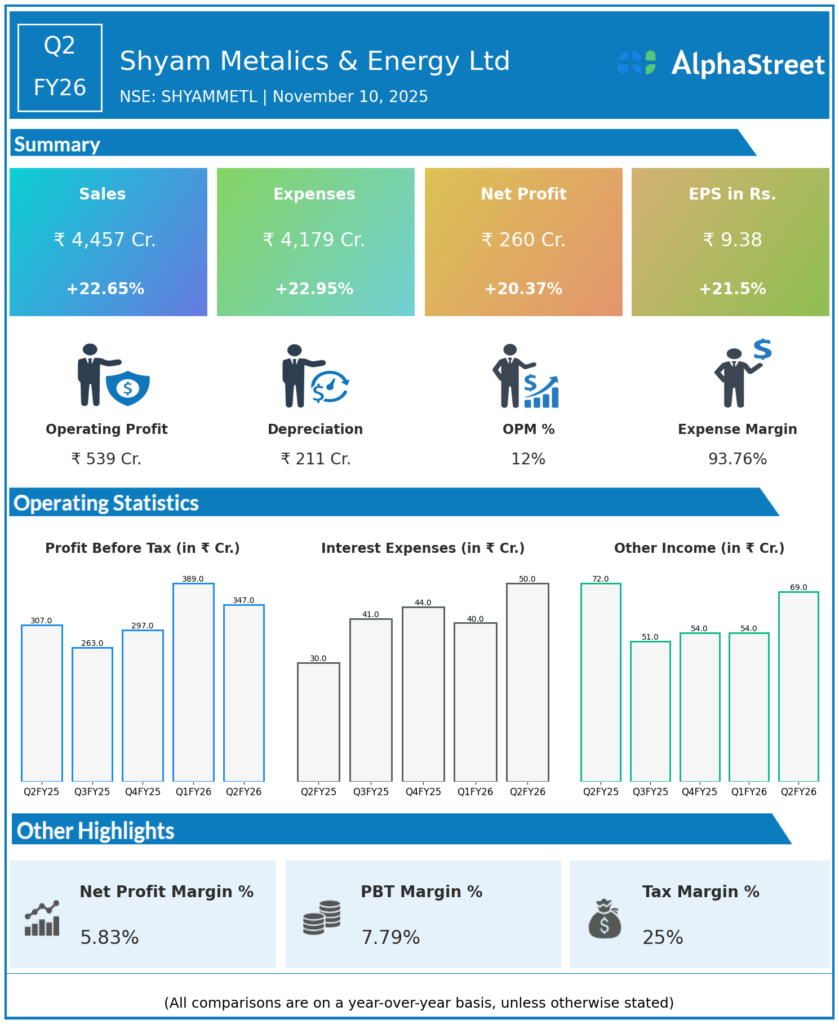

Revenue from Operations: ₹4,457 crore, up 22.65% YoY and 6.75% QoQ

-

Operating Profit (PBDIT excluding other income): ₹579.62 crore, highest quarterly figure on record, operating margin improved to 13.12% from 12.45% QoQ

-

Net Profit (PAT): ₹260 crore, up 33.55% QoQ and 20.3% YoY

-

EBITDA margin: 13.43% (including other income), reflecting effective cost management amid raw material price volatility

-

Employee costs: ₹123 crore, up 13.85% YoY

-

Effective tax rate: 25.27%

-

Debt-to-equity ratio for H1 FY26 rose to 0.54, indicating elevated short-term borrowings, though overall net cash position remains strong

-

Trade payables increased 23.15% YoY, suggesting extended supplier payment cycles

-

Current ratio slightly compressed due to faster growth in current liabilities (25.37%) relative to current assets (8.68%)

Management Commentary & Strategic Insights

-

Strong revenue momentum driven by ferro alloys and sponge iron segments with volume growth of 24% YoY

-

Sequential expansion in operating margin and continued working capital optimization efforts

-

Focus on capacity utilisation, value-added product growth, and deleveraging balance sheet to improve ROCE

-

CRISIL upgraded credit rating from AA(Positive) to AA+(Stable), reflecting financial strength

-

Management cautions on sustained margin pressure due to cost inflation but optimistic about long-term growth thanks to operational efficiencies and market demand

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹4,139.36 crore, up 10.31% QoQ

-

Net Profit (PAT): ₹218.75 crore, up 10.64% QoQ

-

Operating margin: 12.45%

-

Continued volume growth and operational leverage contributed to profitability improvement.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.