Incorporated in 1995, Shree Renuka Sugars Ltd does manufacturing and refining of sugar, ethyl alcohol, ethanol, generation and sale of power.

Q2 FY26 Earnings Results:

-

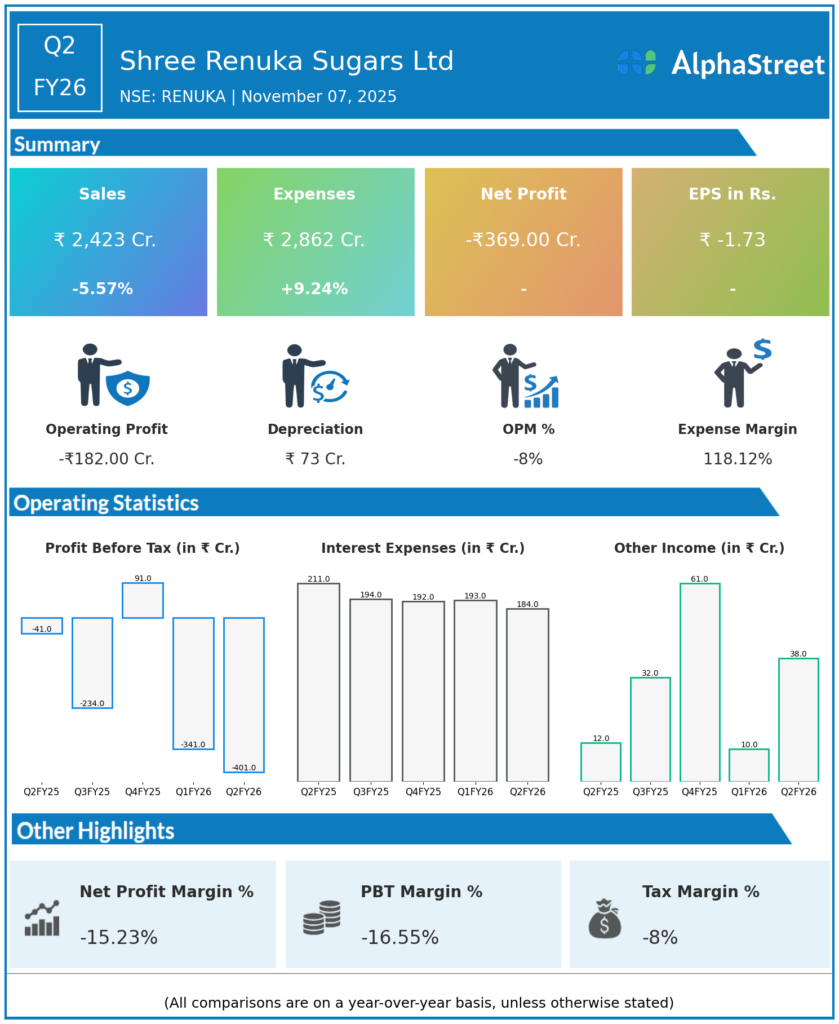

Revenue from Operations: ₹2,422.80 crore, up 20.53% QoQ, down 5.59% YoY from ₹2,566.20 crore in Q2 FY25.

-

Operating profit (PBDIT excluding other income): Loss of ₹182.20 crore compared to a profit of ₹227.40 crore in Q2 FY25.

-

Profit Before Tax (PBT): Loss of ₹401.30 crore, worsening from ₹-22.30 crore in Q2 FY25.

-

Profit After Tax (PAT): Net loss of ₹368.60 crore, a sharp deterioration of 1552.91% YoY from a minor loss of ₹22.30 crore in Q2 FY25.

-

PAT margin: -15.21%, compared to -0.87% in Q2 FY25.

-

Segment revenues (Standalone Q2 FY26):

-

Sugar Refinery: ₹1,667.2 crore (Loss of ₹35.6 crore PBT vs profit of ₹300.8 crore YoY).

-

Sugar Milling: ₹299.6 crore (Loss of ₹68.7 crore PBT).

-

Distillery: ₹285.8 crore (Profit of ₹1.4 crore PBT).

-

Co-generation: ₹8.2 crore (Loss of ₹29.1 crore PBT).

-

Trading: ₹82.1 crore (Profit of ₹5 crore PBT).

-

-

Total expenses increased to ₹2,861.6 crore from ₹2,619.4 crore in Q2 FY25, driven by higher operational costs and interest expenses.

-

Interest expense: ₹183.60 crore, slightly down from ₹192.90 crore in Q1 FY26.

Management Commentary & Strategic Decisions:

-

Management cited challenging market conditions marked by seasonality and tough sugar sector dynamics.

-

Highlighted structural issues beyond normal industry cyclicality, impacting sales and profitability.

-

Emphasized efforts on cost control despite fixed cost pressures and high interest burden.

-

Confident about the company’s going concern status and ongoing strategic initiatives to improve financial health.

-

Focus remains on operational restructuring, debt management, and exploring growth opportunities within and beyond core sugar business.

Q1 FY26 Earnings Results:

-

Revenue from Operations: ₹2,010.20 crore, down 34.18% YoY from ₹3,030.3 crore in Q1 FY25.

-

Operating Profit Margin (OPM): -4.29%, reflecting an operating loss due to adverse pricing and higher costs (compared to +2.76% in Q1 FY25).

-

Profit Before Tax (PBT): Loss of ₹341.4 crore, a significant increase from a loss of ₹178.1 crore in Q1 FY25.

-

Profit After Tax (PAT): Net loss of ₹264 crore, worsening compared to a loss of ₹165.5 crore in Q1 FY25.

-

Highlighted steep sales decline as the main driver of increased losses.

-

Continued pressure on pricing and volume in sugar and allied segments.

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.