Shree Cement is engaged in manufacturing and selling of cement and cement related products and is one of the lowest cost producers in the country. It is the 3rd largest cement producer in India with an installed capacity of 46.4 MTPA.

Q2 FY26 Earnings Results

-

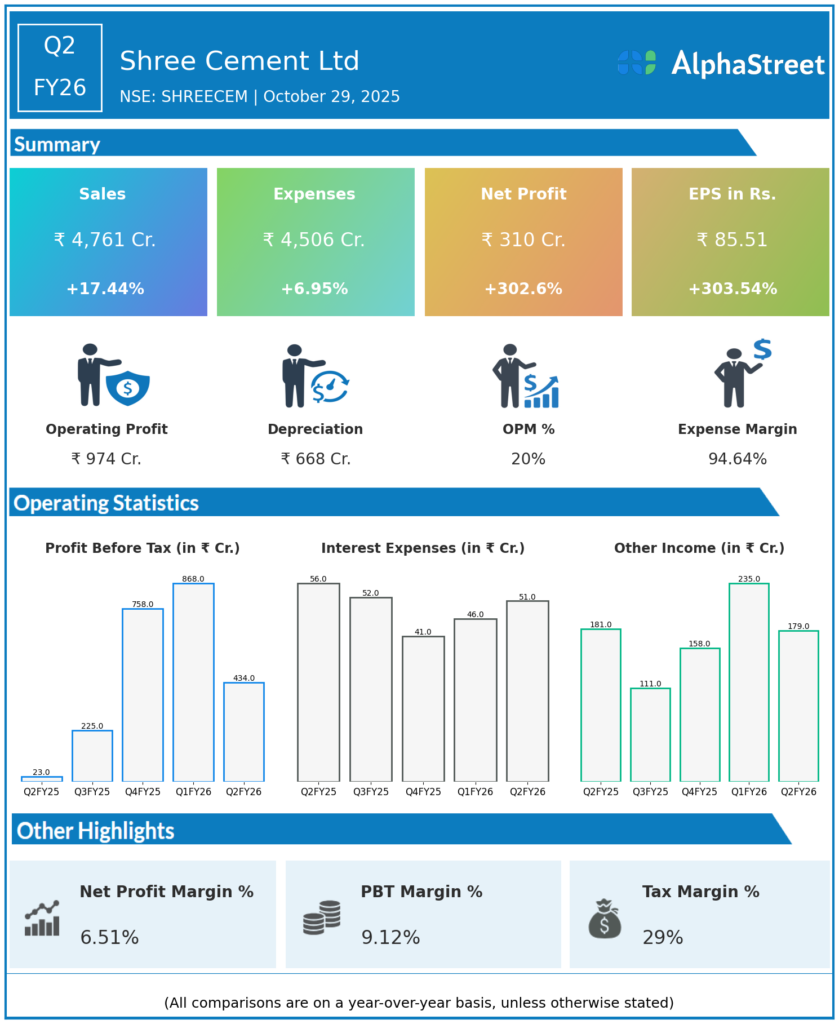

Revenue from Operations: ₹4,761.07 crore, up 17.4% YoY from ₹4,054.17 crore.

-

EBITDA: ₹1,152.88 crore, up 45% YoY from ₹795 crore, margin improved to 24.21%.

-

Profit After Tax (PAT): ₹309.82 crore, up 302% YoY from ₹77 crore.

-

Interim Dividend: ₹80 per equity share declared, record date November 3, 2025.

-

Cash Profit: ₹891 crore.

-

Net Debt to Equity: 0.08 (conservative leverage).

-

Current Ratio: 2.11, indicating strong liquidity.

-

Key Growth Drivers: Volume gains, premiumization, value-over-volume strategy, operational efficiencies.

Management Commentary & Strategic Initiatives

-

Neeraj Akhoury, Managing Director highlighted the resilience and strategic focus on premiumisation, cost management, and value creation despite challenging macroeconomic conditions.

-

Management cited policy support including GST rationalization and benign inflation as facilitate economic momentum for demand growth in the cement industry.

-

Emphasis on sustainable and consistent results delivery operating margins supported by disciplined cost control.

-

The company aims to achieve approximately 39 million metric tonnes of cement sales in FY26 with sustainable growth trajectories.

Q1 FY26 Earnings Results

-

Revenue from Operations: ₹5,280.88 crore, up 3.1% YoY from ₹5,123.96 crore.

-

PAT: ₹642.67 crore, up 130.7% YoY from ₹278.61 crore.

-

EBITDA: ₹1,566.83 crore, up 34% YoY.

-

Growth Drivers: Pricing discipline, operational efficiency, green power generation capacity (586 MW).

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.