The rollout of the E-20 ethanol blending policy has set off one of the most heated debates in India’s auto and energy ecosystem. On paper, it looks like a forward looking environmental move where you are just blending 20% ethanol with 80% petrol to cut oil imports, support farmers, and reduce pollution. In practice, however, the transition has been anything but smooth.

Car owners across the country are reporting mileage drops, engine problems, and confusion over warranties and insurance. Social media has amplified the frustration, with one user bluntly stating: “There should be a choice.”

With the help of Alphastreet’s research desk, lets dive in this article and explore explores the core of the controversy. What E-20 actually means for consumers, why the backlash is growing, and whether India may have rushed the transition.

Understanding E-20: A Quick Primer

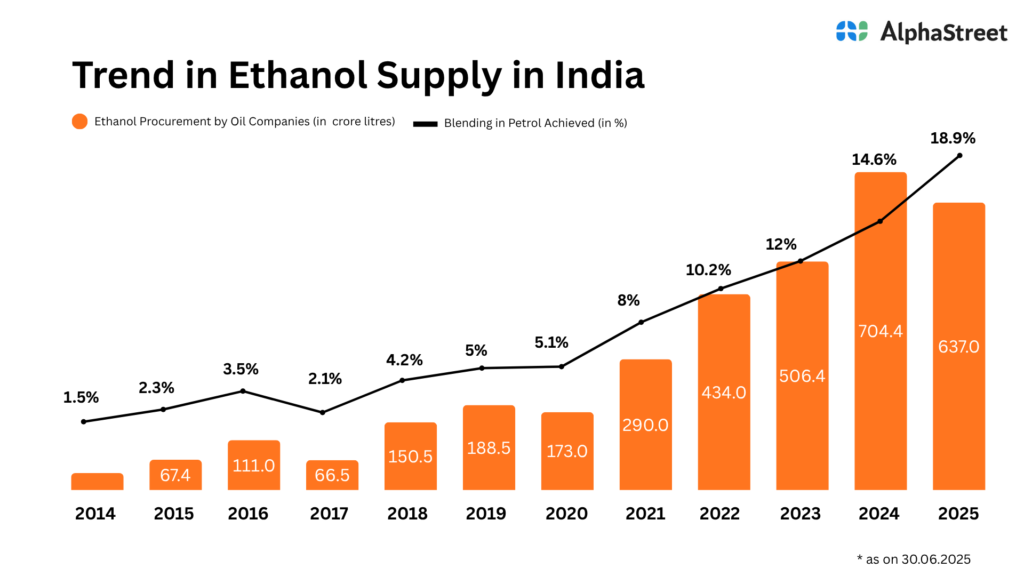

Ethanol is an alcohol produced by fermenting sugarcane, maize, or even surplus rice. India’s first blending efforts began in 2003 with a modest 5% target (E-5). However, the government failed to achieve this target and ethanol blending was achieved at 1.5%.

However, the big shift came in 2014, when blending became a flagship priority. By February 2023, Prime Minister Modi formally launched E-20 fuel in 11 states and union territories. By 2025, E-20 had replaced earlier variants like E-5 and E-10 across nearly 100,000 petrol pumps.

What was presented as a clean energy milestone, however, quickly turned into a consumer trust problem. Owners of both cars and two-wheelers began reporting issues ranging from 2–2.5 km/l drops in mileage to fears of long-term engine corrosion. Let’s dig a little deeper and understand what these issues are:

Issue 1: The Engine Damage Risk (Material Compliance)

Perhaps the scariest worry for drivers is whether E-20 is slowly destroying their vehicles. At the heart of this is material compliance. In simple terms it means, whether the rubber, plastic, and metal parts in a fuel system can withstand ethanol’s properties.

Why Ethanol Can Damage Engines

- Hygroscopic Nature: Ethanol absorbs moisture from the air. If vehicles sit unused, water accumulates inside the tank and mixes with ethanol, corroding the metal parts of your automobile.

- Solvent Properties: Ethanol dissolves old fuel deposits, which then travel through the fuel line and clog filters or sensors, thus, degrading performance of your vehicle.

However, this risk is highest for idle vehicles. A problem in Indian cities where cars and two-wheelers often sit unused for days.

Who Should Worry the Most?

- Two-Wheelers: Small engines are more vulnerable. Auto experts warn performance could drop so significantly that some bikes may become “difficult to use.”

- Cars: Post-2009 models are generally safer, but even manufacturers like Toyota and Honda have stopped short of issuing guarantees.

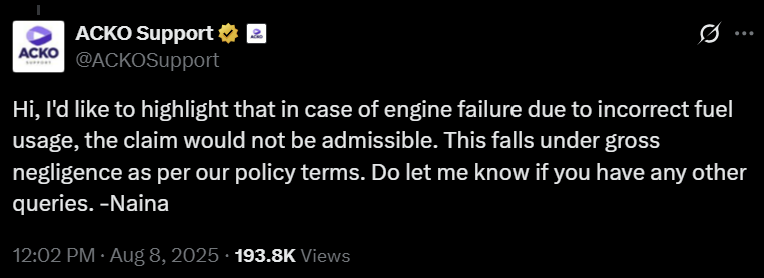

- Warranties & Insurance: Several insurers, including ACKO, have stated that owners will be liable for damage if their vehicle wasn’t certified for ethanol use.

Mitigation Measures

- Keep Driving: Avoid leaving tanks full for weeks. If parking long-term, drain or reduce fuel levels.

- Upgrade Parts: Replace vulnerable hoses and gaskets with ethanol-resistant ones. For two-wheelers, this conversion can cost around ₹5,000–6,000.

Issue 2: Mileage Drops (Tuning Compliance)

The second pain point and one felt daily is a drop in mileage. Let’s understand that how:

The Science of Lower Efficiency

Petrol provides ~42 MJ/kg of energy, while ethanol provides only ~26 MJ/kg. Naturally, a 20% blend lowers the overall energy content of the fuel. Engines need more volume of fuel to produce the same power.

- Official Estimates: NITI Aayog (2021) suggested mileage losses between 1% and 7% for E-10 and E-20.

- Consumer Reports: Many drivers claim mileage has fallen by 2–2.5 km/l, though experts caution some of this could be due to unrelated issues like tyre pressure.

The High-Octane Trade-off

Ethanol does bring one advantage: higher octane levels, which allow newer E-20–ready engines to perform better under load. But older vehicles don’t benefit, so for most, it’s a net loss.

Lack of Choice and Price Transparency

A major source of anger is not just the performance drop but the lack of alternatives.

- In Brazil, petrol and ethanol have coexisted for 30+ years. Consumers can choose based on price and performance.

- In India, E-5 and E-10 have been largely removed. The only ethanol-free option is premium 100-octane petrol (e.g., Indian Oil XP100) but this costs nearly double normal petrol.

Adding to the frustration, NITI Aayog had recommended that ethanol blends be priced lower than petrol to offset efficiency loss. Instead, the government has kept prices roughly the same.

Why the Government is Pushing So Hard

Despite consumer resistance, there are strong policy drivers:

- Foreign Exchange Savings: India imports 85% of its crude oil. Ethanol blending has already saved ₹1.5 lakh crore since 2014.

- Farmer Income: Ethanol production creates a new revenue stream for sugarcane and maize growers, adding ₹40,000 crore in rural income in states like UP and Maharashtra.

- Pollution Reduction: Blends emit fewer greenhouse gases compared to pure petrol.

The Conflict of Interest Question

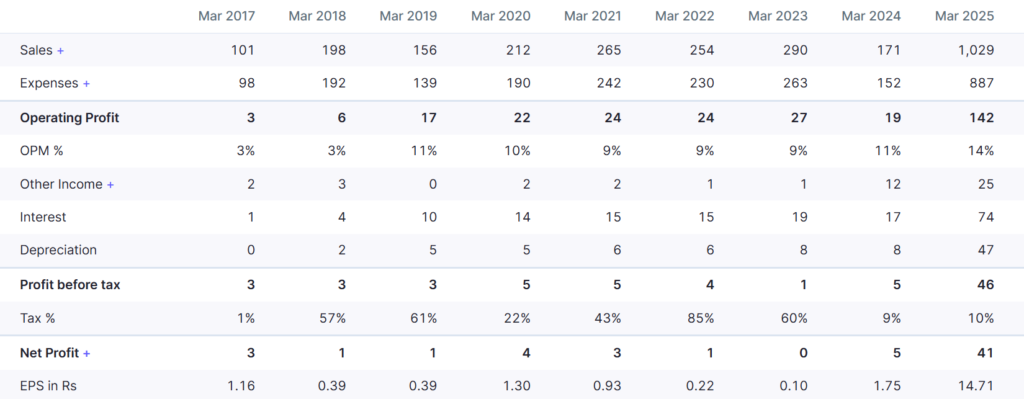

Public distrust has also been fueled by allegations of conflict of interest. The Transport Minister’s son is the MD of Cian Agro Industries, an ethanol-linked company whose revenues surged from ₹17 crore in Q1 FY25 to ₹511 crore in Q1 FY26.

While it is not clear if this was entirely ethanol-driven, the optics have raised questions about transparency and fairness.

Conclusion: Good Intentions, Poor Transition

Ethanol blending is not a bad idea in itself. It’s a reasonable transition policy, especially for a country dependent on oil imports. But the real future lies with EVs, which are 4x more energy-efficient than petrol engines.

The anger around E-20 is not because people reject cleaner fuels. It’s because:

- The rollout felt too sudden.

- Alternatives (like E-5 or E-10) were removed.

- Communication about risks, warranties, and costs has been confusing at best.

In short, India is witnessing a policy that’s visionary on paper but clumsy in execution. Drivers feel trapped between supporting national goals and protecting their wallets and for now, most are leaning toward frustration.