Shoppers Stop Ltd. is the nation’s leading premier retailer of fashion and beauty brands established in 1991. It has 800+ Brands under its portfolio and 271 Stores spread across 50 cities in India as of 31st Dec 2022. Presenting below are its Q2 FY26 earnings results.

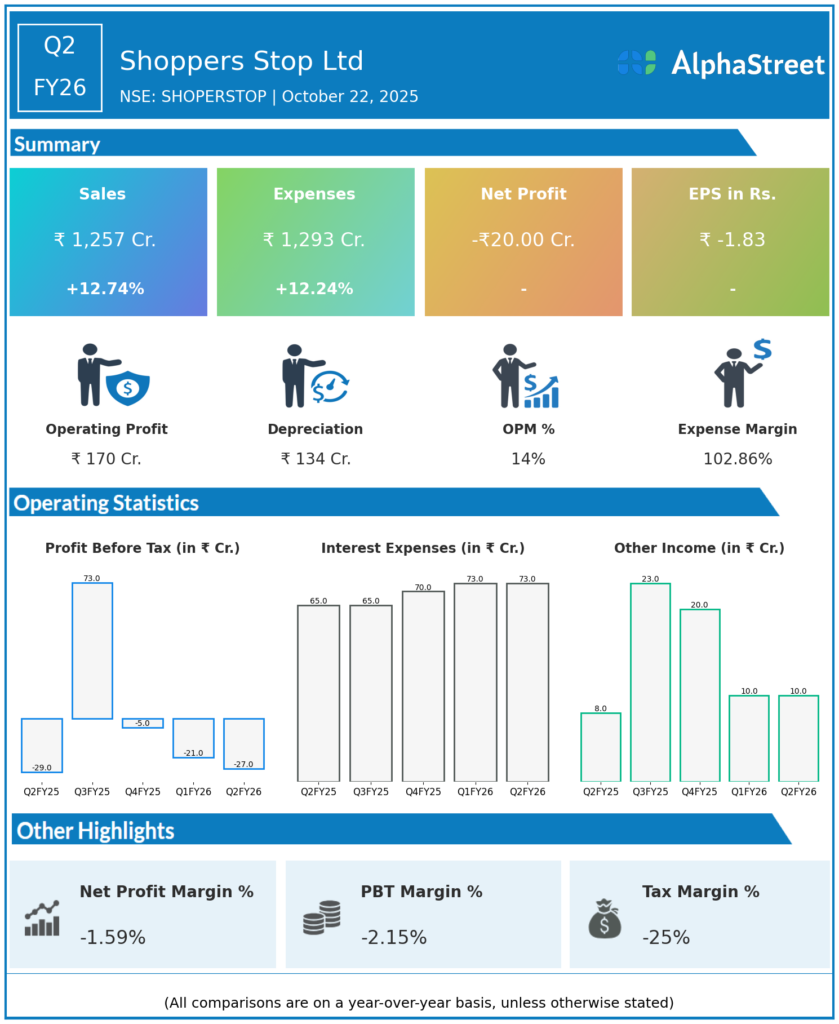

Q2 FY26 Earnings Results

-

Revenue from Operations: ₹1,175.3 crore, up 10.04% YoY from ₹1,067 crore in Q2 FY25, driven by strong performance in beauty and premium fashion categories.

-

Total Income: ₹1,256 crore, marking a 13% YoY increase, reflecting improved core retail performance and higher customer entry growth of 6% YoY.

-

EBITDA (GAAP): ₹173 crore, up 10% YoY from ₹157 crore, while Non-GAAP EBITDA stood at ₹23 crore, up 7% YoY.

-

EBITDA Margin: 14.7%, largely stable YoY with improved operational efficiencies despite margin pressures in the apparel segment.

-

Net Profit / (Loss): ₹(20) crore (loss), compared to ₹(22.0) crore in Q2 FY25 — a marginal widening of losses due to higher operating expenses and store expansion costs.

-

Pre-tax Loss: ₹30.21 crore vs ₹30.68 crore last year, essentially stable.

-

Gross Margin: 39.2%, slightly down from 39.9% YoY, due to higher promotional expenditure in mid-season sales.

-

Average Transaction Value (ATV): ₹5,109, up 8% YoY, reflecting successful premiumization initiatives.

-

Private Brand Revenue: ₹161 crore (13% of total revenue; 17% of apparel revenue), indicating growing traction in high-margin proprietary labels.

-

Beauty Distribution Business: ₹106 crore, up 103% YoY, led by the addition of three new beauty stores.

-

Capex: ₹34 crore during the quarter, largely for new store openings and refurbishment projects.

Management Commentary & Strategic Insights

Kavindra Mishra, MD & CEO, Shoppers Stop Ltd:

“Despite continued softness in discretionary spending, we delivered a consistent performance with improved operational efficiencies and Like-for-Like growth. Our focus on premiumization, personalized campaigns, and an expanding beauty distribution business continues to yield promising results. We are optimistic for Q3 FY26 with the festive and wedding season expected to drive a strong rebound in demand.”.

-

Premiumisation Strategy: Continued focus on higher-value assortment, driving an 8% YoY increase in average transaction value.

-

Beauty Expansion: Opened three beauty stores (including Armani & NARS), diversifying offerings under the EuroItalia partnership for global fragrances and cosmetics.

-

Store Network Growth: Opened seven new stores (one department + three beauty + three Intune stores) during Q2.

-

Customer Engagement: 83% of total sales came from First Citizen loyalty members (69% from repeat customers, 14% from new members), reflecting high brand loyalty.

-

Festive Outlook: Management expects festive spending and premium apparel to significantly improve in Q3 due to positive macro trends and tax policy tailwinds.

Q1 FY26 Earnings Results

-

Revenue: ₹1,092 crore, up 4% YoY but seasonally softer due to subdued consumer demand.

-

Net Profit / (Loss): ₹(21.6) crore, reflecting similar levels of loss control as last quarter.

-

EBITDA (GAAP): ₹162 crore, with EBITDA margin at 14.8%, broadly in line with Q1 FY25 levels.

-

Operating Highlights:

-

Focus on digital integration and omni-channel fulfillment.

-

Renewal of brand partnerships and expansion in digital-first brands under “Intune” format.

-

Enhancement in in-store experience to drive higher conversion across key metros.

-

To view the company’s previous earnings and latest concall transcripts, click here to visit the Alphastreet India news channel.